Bitcoin is holding agency above the $110,000 stage as traders await readability on the US Federal Reserve’s financial coverage. The subsequent Fed assembly has turn out to be a central focus, with hypothesis mounting that an rate of interest minimize could possibly be introduced, probably reshaping threat urge for food throughout world markets. For now, BTC is consolidating inside a good vary, reflecting the market’s cautious stance forward of this key macroeconomic occasion.

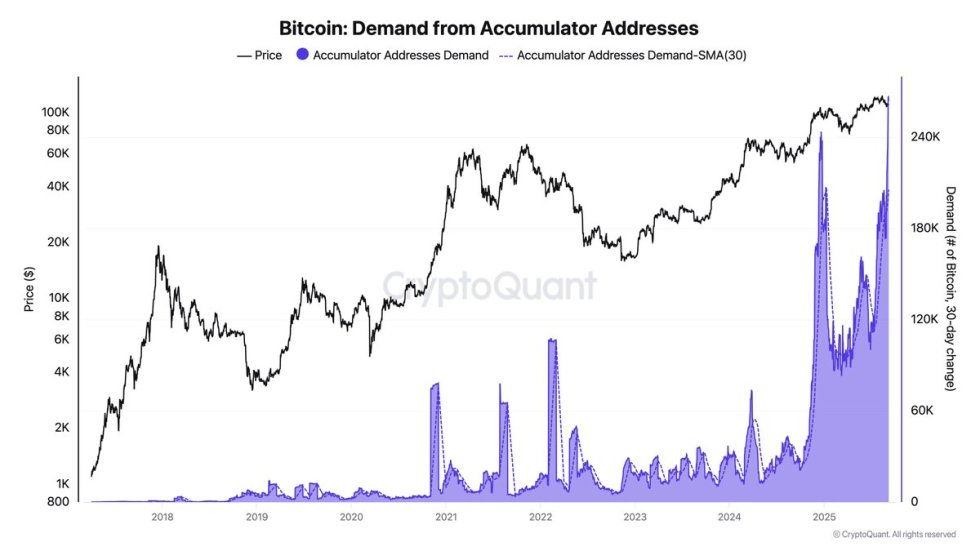

On the similar time, recent onchain knowledge highlights an encouraging pattern for long-term confidence. In response to analyst Darkfost, demand from Bitcoin accumulator addresses is skyrocketing, reaching a brand new document. These particular wallets are characterised by regular BTC purchases with out promoting exercise, successfully signaling conviction amongst holders with long-term horizons. As of early September, these addresses have continued to soak up provide, reflecting a type of “silent accumulation” beneath the floor of short-term volatility.

This dynamic underscores a divergence between macro-driven uncertainty and structural demand inside the Bitcoin community. Whilst short-term merchants react to coverage hypothesis and worth swings, long-term individuals proceed to strengthen their positions. If this sample persists, it may present the spine for BTC to carry present ranges—and probably stage a breakout—as soon as financial readability arrives.

Bitcoin Traders Sign Lengthy-Time period Conviction

In response to Darkfost, as of September 5, greater than 266,000 BTC have been recorded as gathered by accumulator addresses, marking a recent all-time excessive for any such holding conduct. These addresses are distinctive of their definition—they will need to have executed at the least two incoming transactions of Bitcoin above a minimal threshold whereas by no means recording a single outgoing transaction. In easy phrases, as soon as BTC enters these wallets, it has but to go away.

This classification locations accumulator addresses firmly within the class of long-term holder (LTH) conduct. Not like short-term merchants or speculative individuals, these entities show a constant technique: purchase and maintain with out succumbing to short-term volatility. Such conduct is especially vital given the present backdrop of heightened uncertainty in world monetary markets and Bitcoin’s personal consolidation section.

The implications of this pattern prolong past particular person pockets exercise. In an period marked by the rise of company treasuries, institutional adoption, and Bitcoin’s rising recognition as a world retailer of worth, the surge in accumulator exercise suggests sturdy conviction that transcends day-to-day worth motion.

By persistently including to their positions and refraining from promoting, these wallets illustrate a strong structural demand that helps Bitcoin’s long-term trajectory. This charted conduct highlights how BTC is more and more considered not simply as a speculative asset however as a strategic holding.

In some ways, these accumulators are shaping the muse for the subsequent section of Bitcoin’s market cycle, demonstrating that the spine of this market lies with these getting ready for the lengthy haul fairly than chasing short-term good points.

Value Motion Particulars: Key Resistance Above

Bitcoin is exhibiting indicators of energy because it pushes again towards the $113K stage, making an attempt to get better from its latest lows close to $110K. The chart reveals that BTC is approaching the 100-day shifting common (inexperienced line) round $114K, which now stands as an instantaneous resistance. A decisive shut above this stage would open the door for a retest of the $117K–$118K area, the place the 200-day shifting common (pink line) presently sits.

On the draw back, the $111K stage is performing as near-term assist, with the $110K space remaining the important thing ground to look at. Dropping this zone may set off renewed promoting stress, probably sending BTC again towards $107K. Nevertheless, the present worth motion suggests patrons are stepping in at decrease ranges, preserving the market comparatively secure regardless of the latest volatility.

Momentum indicators level to cautious optimism. The rejection of deeper lows under $110K alerts resilience from bulls, although BTC should overcome a number of resistance layers earlier than regaining clear bullish momentum. A breakout above $114K would doubtless gasoline a push towards the $120K vary, whereas failure to reclaim these ranges may hold Bitcoin caught in consolidation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.