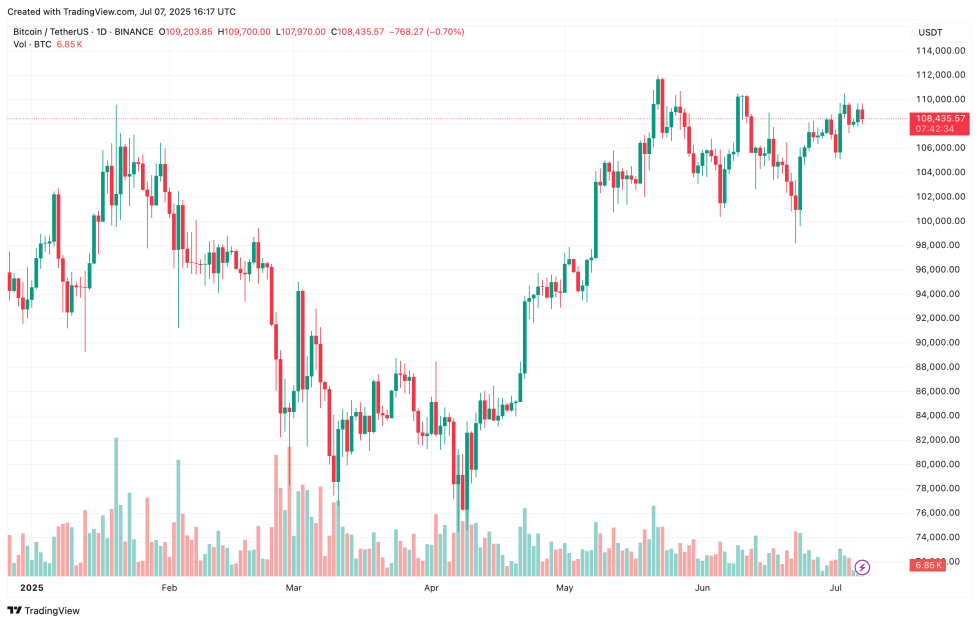

After a brief weekend dip, Bitcoin (BTC) is again on observe, persevering with to comply with each the rise in M2 world cash provide and the Wyckoff Accumulation sample. Whereas some analysts predict BTC could attain a brand new all-time excessive of $120,000 within the coming weeks, declining funding charges are elevating some warning.

Bitcoin To Hit $120,000 Quickly?

In an X publish revealed at present, seasoned crypto market commentator Ted Pillows famous that Bitcoin stays in sync with the Wyckoff Accumulation sample and is monitoring the expansion in world M2 cash provide.

For the uninitiated, The M2 world cash provide refers back to the complete amount of cash in circulation worldwide, together with money, checking deposits, and simply convertible near-money like financial savings deposits. It’s a key indicator of worldwide liquidity and central financial institution financial coverage, typically used to evaluate inflation danger and financial development potential.

The analyst shared the next chart, displaying M2 cash provide development (in white) main Bitcoin’s worth motion (in blue). Based mostly on the chart, BTC could climb to $120,000 within the coming weeks and doubtlessly as excessive as $153,000 by October 2025.

Fellow crypto dealer Merlijn The Dealer echoed Ted’s view, stating that BTC is “taking part in out the traditional Wyckoff script.” Following April 2025’s false breakdown that noticed BTC tumble to $75,600, the digital asset is now getting into the “liftoff” part, which usually options robust upward worth motion.

BTC Funding Charges Decline On Binance

Whereas the Wyckoff sample suggests additional positive aspects for BTC, trade information reveals a special story. Particularly, funding charges on Binance point out rising quick curiosity amongst merchants.

In accordance with a CryptoQuant Quicktake publish by contributor BorisVest, a major variety of merchants are betting towards the rally. Nonetheless, if BTC’s worth continues to climb, these merchants could also be vulnerable to liquidation.

The analyst famous {that a} mismatch between funding charges and worth motion typically triggers compelled quick liquidations or margin calls. Each outcomes can amplify upward momentum in worth.

Since Binance is the most important crypto trade by buying and selling quantity, its funding charges typically function a proxy for broader market sentiment. BorisVest defined:

As Bitcoin continues to rise, these shorts face rising stress and are steadily compelled out of the market – both by liquidations or margin calls. This course of accelerates the bullish momentum, making a suggestions loop that pushes costs even larger.

That stated, the robust June 2025 US employment information confirmed no indicators of financial weak point, lowering the probability of a near-term charge lower from the Federal Reserve, which may weigh on risk-on belongings like Bitcoin. At press time, BTC trades at $108,435, down 0.4% previously 24 hours.

Featured picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.