Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

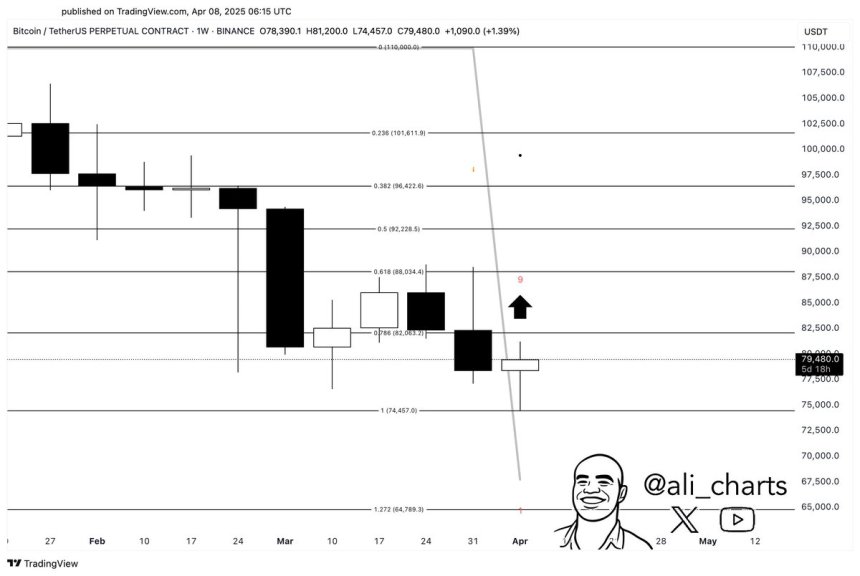

In an X put up shared earlier at the moment, crypto analyst Ali Martinez famous that Bitcoin (BTC) is flashing a purchase sign. One other analyst, Titan Of Crypto, highlighted that BTC is at the moment buying and selling in a reversal zone – suggesting that the main cryptocurrency might quickly expertise a shift in value momentum.

Bitcoin Flashes Purchase Sign Amid Market Pullback

In comparison with the worth motion seen final 12 months, Q1 2025 has been comparatively sluggish for digital property. On a year-to-date (YTD) foundation, BTC is down practically 30%, dropping from round $97,600 on January 1 to roughly $78,000 on the time of writing.

Associated Studying

Following yesterday’s tariff-induced crypto market pullback – which wiped over $140 billion from the whole crypto market cap – BTC is now starting to indicate early indicators of power. Martinez emphasised that Bitcoin is flashing a weekly TD Sequential purchase sign.

For the uninitiated, the weekly TD Sequential purchase sign is a technical indicator that implies a possible pattern reversal or shopping for alternative after a chronic downtrend. It usually seems when a selected 9-count sample completes, signalling that promoting stress could also be exhausted and a value rebound could possibly be close to.

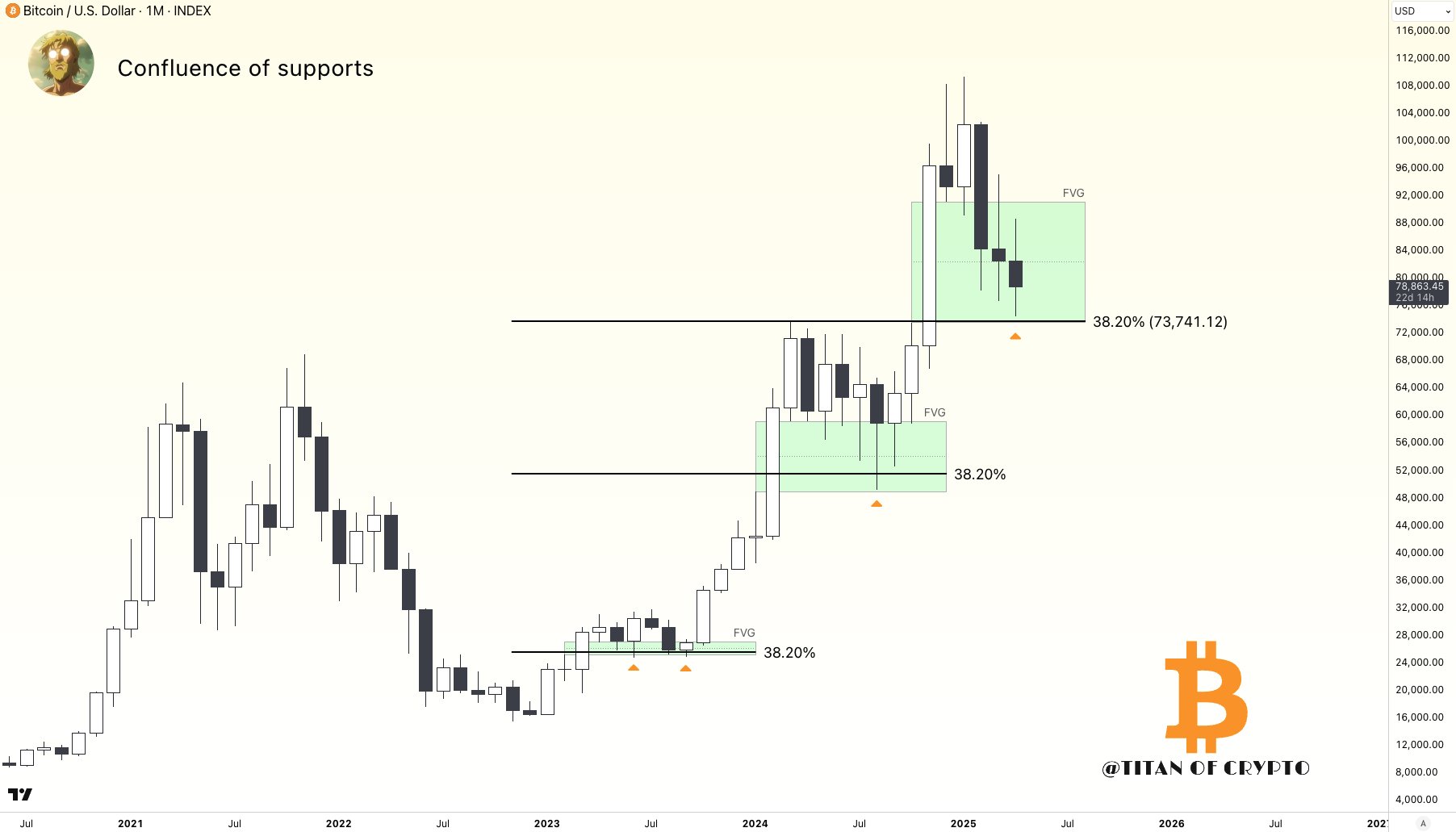

In the meantime, fellow crypto analyst Titan Of Crypto identified that BTC is buying and selling inside a possible reversal zone. He famous that so long as BTC stays above the 38.2% Fibonacci retracement degree, the broader uptrend would stay intact.

Moreover, Titan highlighted that BTC’s Honest Worth Hole (FVG) at $80,000 has now been stuffed – a improvement that additional boosts the case for a possible pattern reversal or vital value motion at present ranges.

To clarify, an FVG is a value imbalance on a chart, usually created by a powerful transfer in a single course, the place little to no buying and selling occurred. It signifies a possible space the place value might return to “fill the hole” earlier than persevering with its pattern.

Latest BTC Worth Drop Not Out Of The Unusual

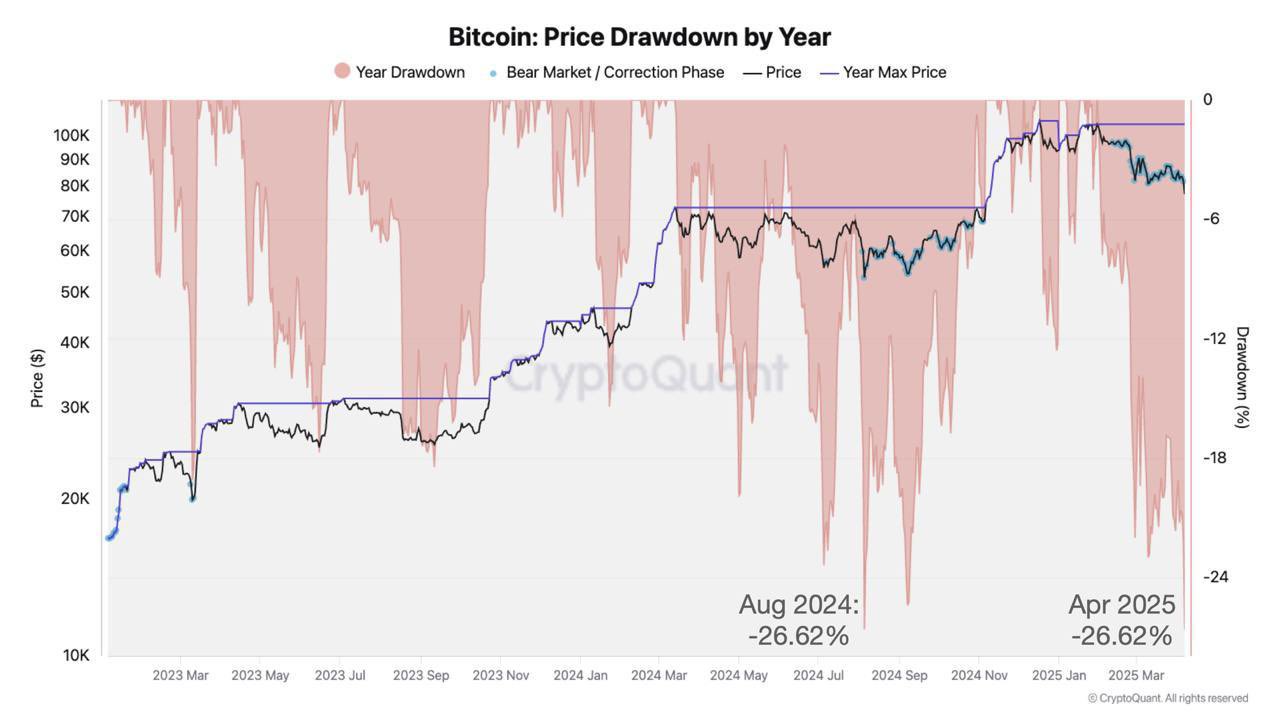

One other crypto analyst, Grasp Of Crypto, remarked that though the latest BTC value decline might have alarmed some traders, it’s effectively throughout the bounds of historic norms. The analyst identified that BTC is at the moment buying and selling about 26.6% beneath its all-time excessive (ATH) of $109,500.

Associated Studying

Nonetheless, this decline continues to be much less extreme than earlier market cycle drawdowns, equivalent to 83% in 2018 and 73% in 2022. The analyst added that apart from the worth pullback, BTC’s weekly Relative Energy Index (RSI) has additionally been trending down for 5 weeks.

That mentioned, technical indicators counsel that it might take extra time earlier than BTC sees a significant shift in value momentum. As an illustration, the highest cryptocurrency just lately flashed a demise cross, a bearish sample that might sign additional short-term draw back. At press time, BTC trades at $78,543, down 0.3% previously 24 hours.

Featured picture from Unsplash, Charts from X, and TradingView.com