An analyst has defined how Bitcoin might face vital waves of promoting stress from the short-term holders round these worth ranges.

Bitcoin Quick-Time period Holder MVRV May Flag These Ranges As Vital

In a brand new put up on X, CryptoQuant creator Axel Adler Jr has talked concerning the pattern within the Market Worth to Realized Worth (MVRV) Ratio of the Bitcoin short-term holders.

The MVRV Ratio is an indicator that retains monitor of the ratio between the Bitcoin Market Cap and Realized Cap. The previous represents the worth at the moment held by the traders as a complete, whereas the latter that originally invested by them. As such, this ratio tells us concerning the profit-loss scenario of the community.

When the worth of this metric is bigger than 1, it means the common investor on the chain is holding a web unrealized revenue. Alternatively, it being beneath the brink implies the dominance of loss among the many holders.

Within the context of the present subject, the MVRV Ratio of solely a selected a part of the market is of curiosity: the short-term holders (STHs). The STHs consult with the Bitcoin traders who bought their cash throughout the previous 155 days.

The members of this cohort have a tendency to not be too resolute, so that they usually react to market happenings. Specifically, at any time when the revenue held by them will get too excessive, a mass selloff from them can grow to be possible, as they give the impression of being to understand their features.

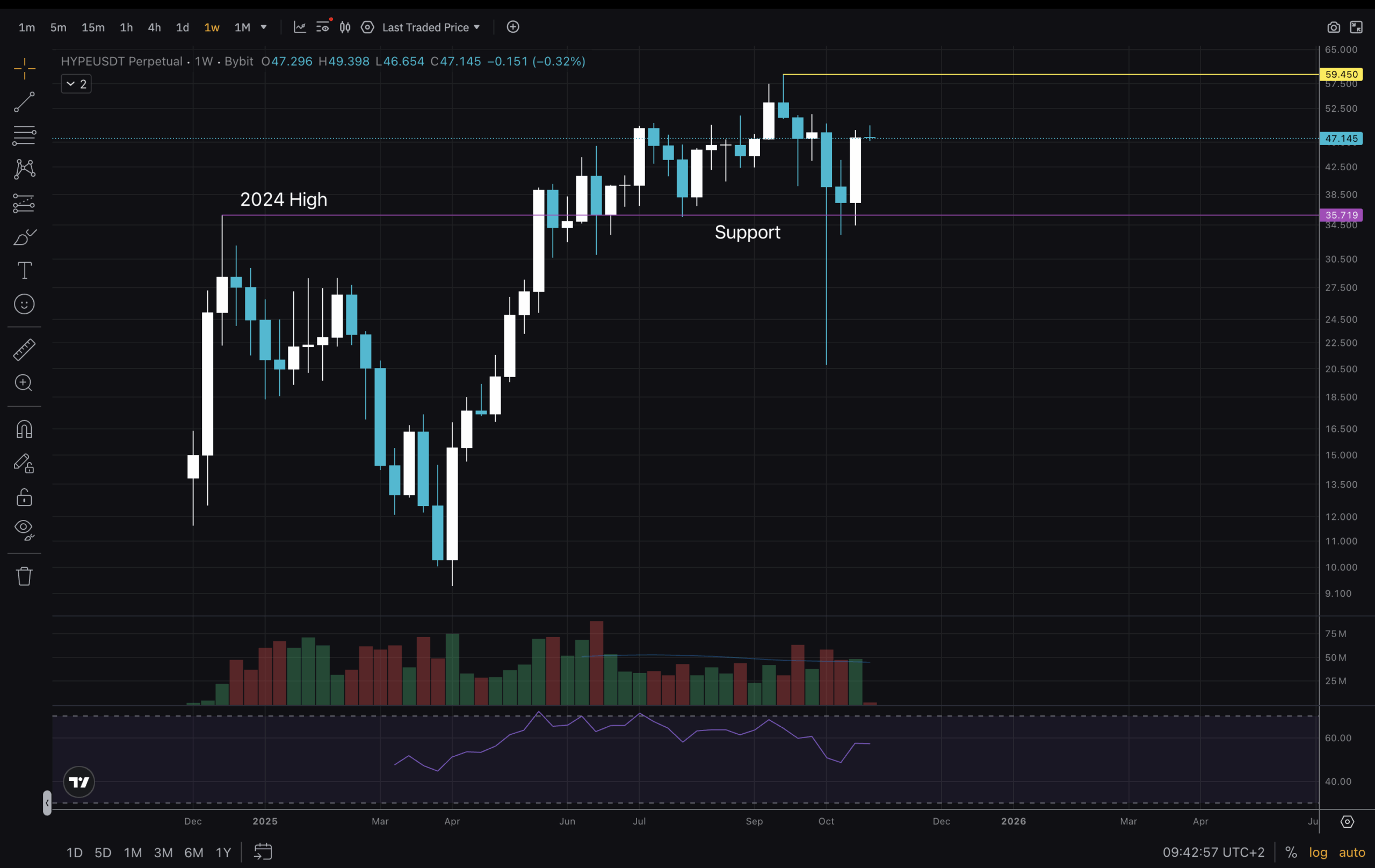

Now, right here is the chart shared by the analyst that reveals the pattern within the Bitcoin STH MVRV Ratio over the previous couple of years:

As is seen within the above graph, the Bitcoin STH MVRV Ratio fell beneath the 1 mark earlier within the 12 months because the asset’s worth declined under the common value foundation of the group.

With the most recent restoration rally, the cryptocurrency has managed to interrupt again above the road, placing STHs again into features. Up to now, the MVRV Ratio has solely reached the 1.09 mark, which isn’t too excessive when in comparison with previous rallies. As such, it’s potential that the STHs will not be tempted to understand earnings en masse simply but.

Within the chart, Adler Jr has highlighted two ranges the place profitability is excessive sufficient that vital promoting stress can certainly grow to be more likely to come up from this cohort: the 1.25 and 1.35 STH MVRV Ratios. At current, the previous is located at $118,000 and the latter at $128,000.

It now stays to be seen whether or not Bitcoin will rally excessive sufficient to retest these ranges—and if it does, whether or not the STH selloff will act as resistance.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $103,200, up over 2% within the final seven days.