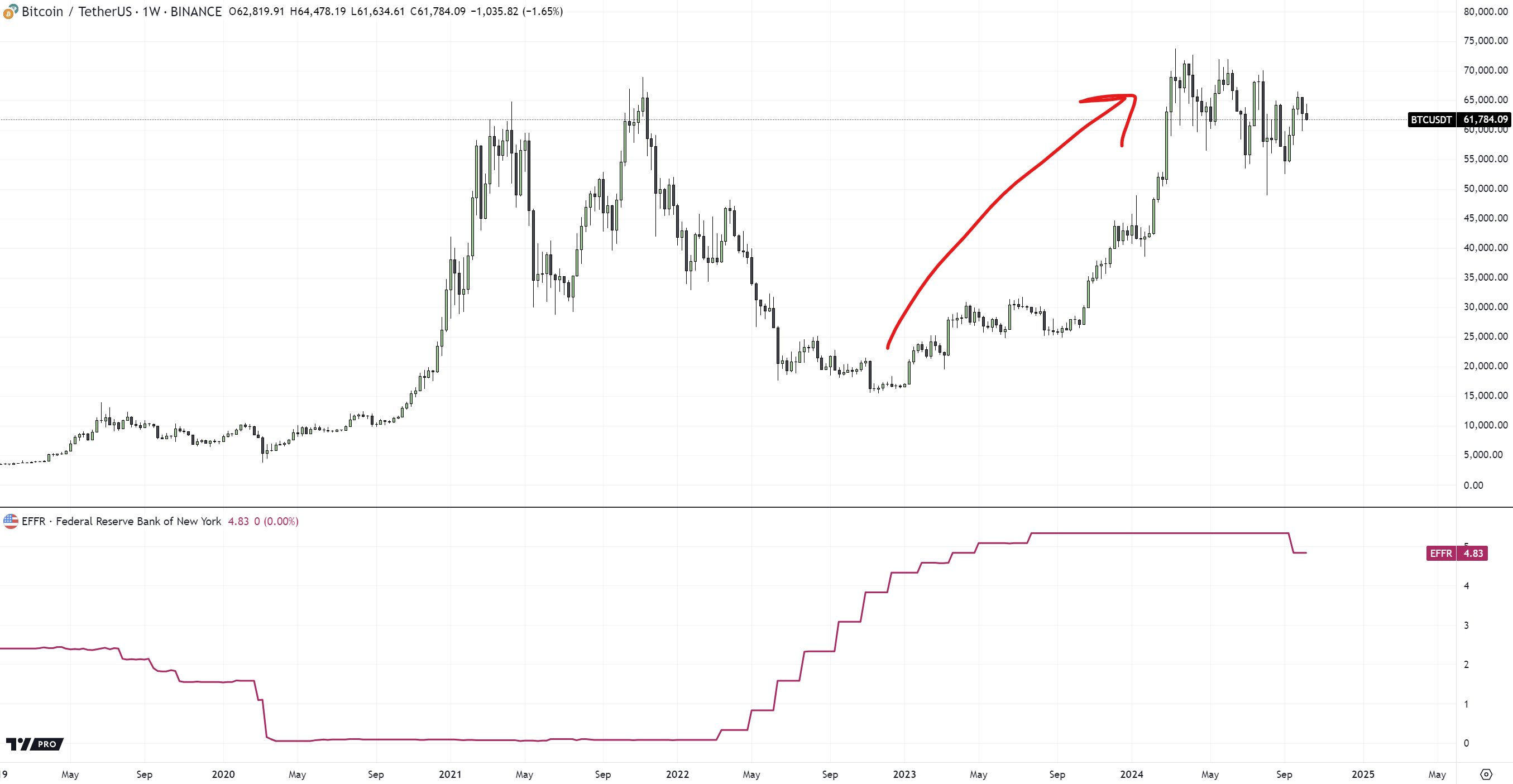

Bitcoin remained above $60,500 after US inflation information launched at this time confirmed higher-than-expected figures. The Core Inflation Price year-over-year for September rose to three.3%, surpassing the consensus estimate of three.2%. Month-to-month core inflation elevated by 0.3%, exceeding the forecasted 0.2%. Total inflation rose by 0.2% month-over-month, with an annual charge of two.4%, barely above the anticipated 2.3% however nonetheless down from final month’s 2.5%.

Preliminary jobless claims for the week ending Oct. 5 reached 258,000, larger than the anticipated 230,000, indicating potential softening within the labor market. The Client Value Index (CPI) climbed to 315.30, above the consensus of 314.86.

Bitcoin skilled a minimal 0.7% decline following the info to round $60,700. This motion mirrors earlier situations the place Bitcoin confirmed resilience amid financial information releases. In September, regardless of higher-than-expected inflation and a 50 foundation level charge lower by the Federal Reserve, Bitcoin maintained stability above $60,000.

The uptick in inflation figures could affect market expectations concerning future financial coverage. Rising core inflation could lead on the Federal Reserve to rethink the tempo of charge cuts applied earlier this 12 months. Moreover, elevated jobless claims could sign a shifting financial panorama.

Analysts are assessing how these financial indicators have an effect on Bitcoin’s position as a possible inflation hedge. The relative stability of digital property means that buyers could have anticipated modest deviations in inflation information. Ongoing demographic shifts and housing market pressures, reminiscent of rising Homeowners’ Equal Hire, proceed contributing to inflationary tendencies.