Fast Take

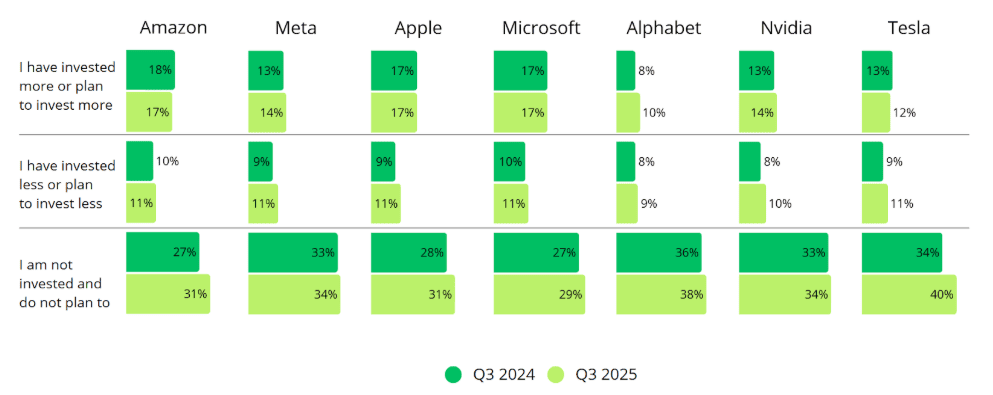

Because the choices expiry for Bitcoin (BTC) approaches on Aug. 30, important market exercise is anticipated, particularly with a big quantity of choices set to run out.

For Bitcoin, roughly $3.6 billion of notional worth is ready to run out, with a complete open curiosity of 60,316 BTC. The put-to-call ratio stands at 0.61, indicating a considerably bullish sentiment. Particularly, there may be 37,477 BTC in name open curiosity in comparison with 22,839 BTC in put open curiosity, with the max ache worth positioned at $61,000. This worth degree, near Bitcoin’s present buying and selling worth of round $60,000, means that many merchants are positioning for stability or a slight upward motion within the quick time period.

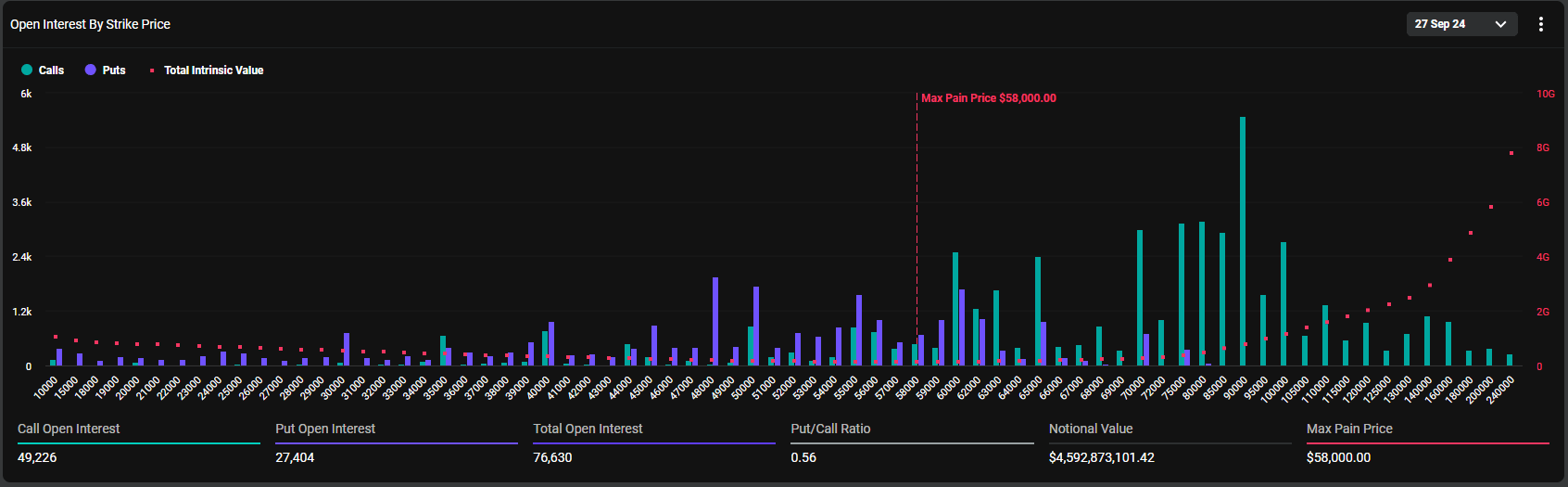

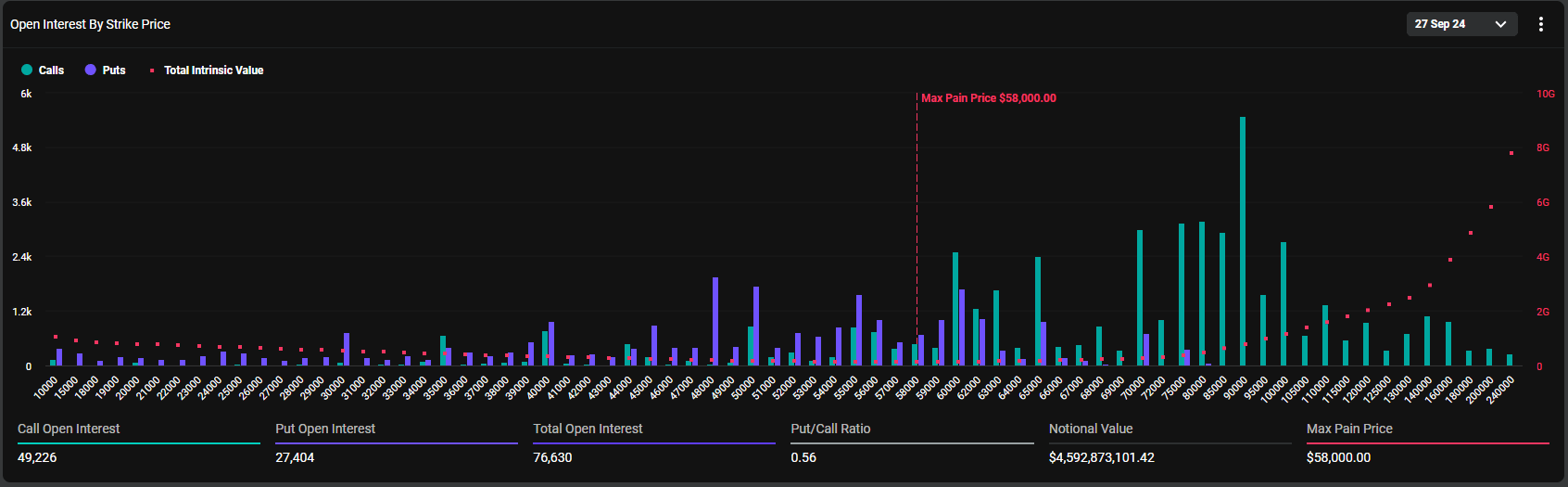

Looking forward to the Sep. 27, expiry, the information reveals an much more bullish sentiment. The full open curiosity will increase to 76,630 BTC, with a decrease put-to-call ratio of 0.56. A putting characteristic of this expiry is the numerous focus of name open curiosity on the $90,000 strike worth, totaling 49,226 BTC. This means {that a} substantial portion of the market is betting on Bitcoin, probably reaching or exceeding $90,000 by late September.

The max ache worth for this expiry is $58,000, beneath the present buying and selling degree, additional hinting at expectations for a major upward worth motion within the coming month.

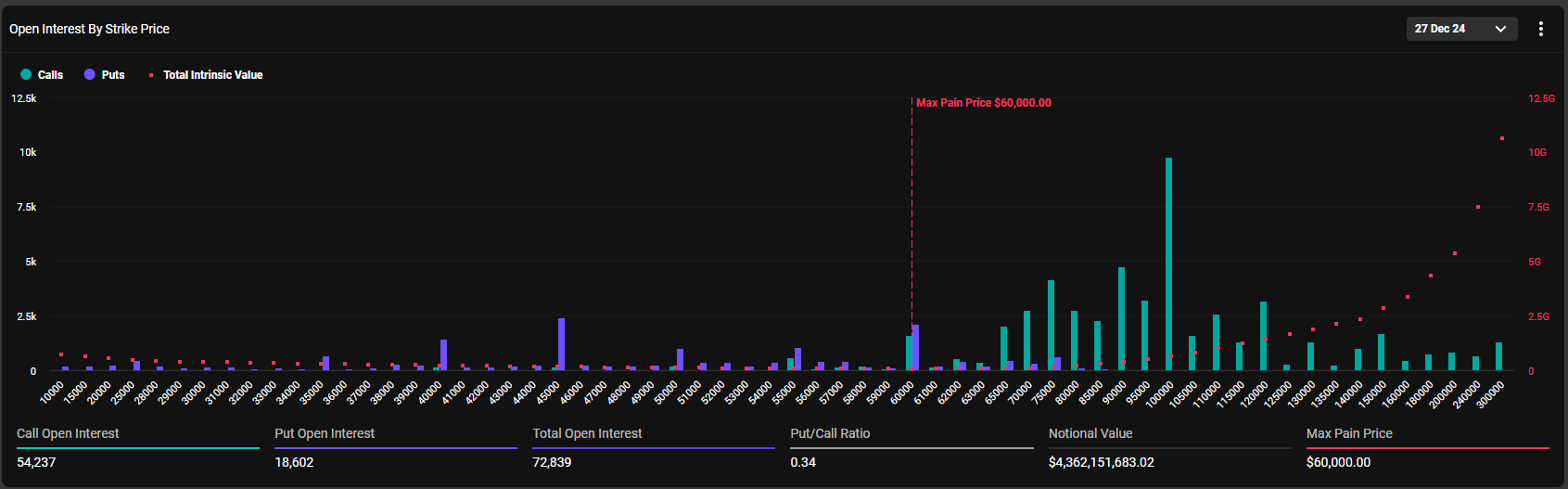

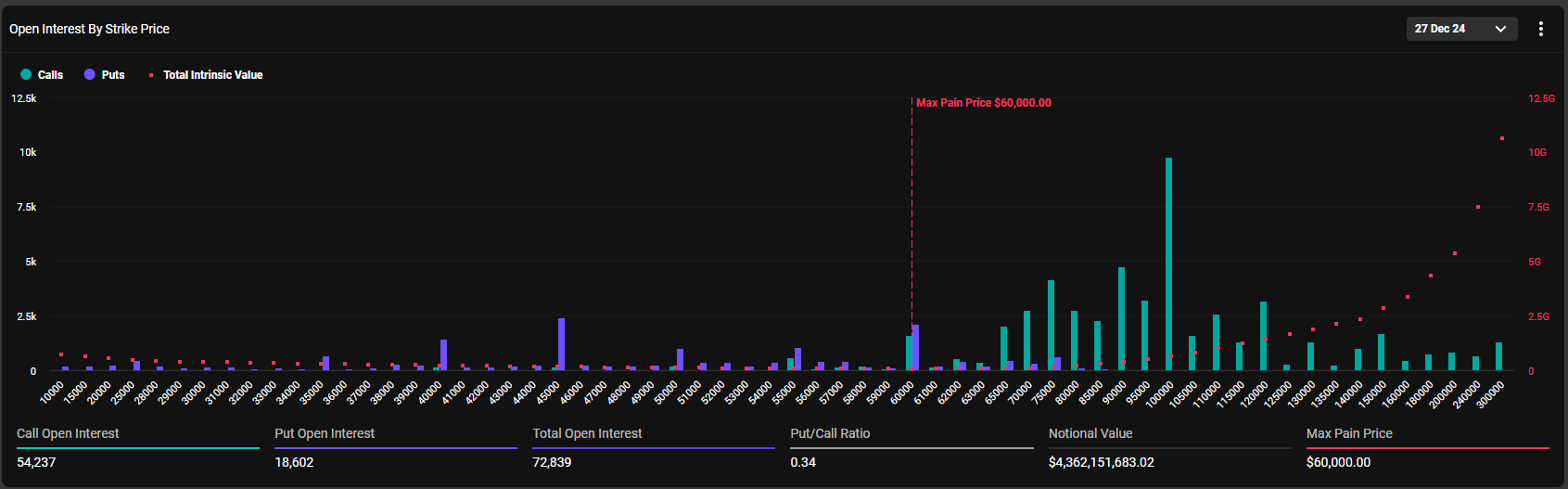

Additional out, the Dec. 27 expiry additionally displays sturdy bullish sentiment, with a complete open curiosity of 72,839 BTC and a notably low put-to-call ratio of 0.34. There’s a important name open curiosity at larger strike costs, particularly on the $100,000 degree, which might counsel that merchants predict Bitcoin to expertise substantial worth features by the top of the 12 months.

The max ache worth for this expiry is ready at $60,000, much like the present buying and selling vary, however the clustering of open curiosity at a lot larger strike costs signifies a long-term bullish outlook.

In abstract, whereas the Aug. 30 expiry reveals fast positioning across the $61,000 degree, the September and December expiries counsel rising optimism, with merchants probably anticipating important upward motion in Bitcoin’s worth in the direction of the top of the 12 months. The concentrate on larger strike costs in these later expiries highlights the market’s rising confidence in Bitcoin’s bullish This autumn.