Bitcoin tumbled from $83,000 to $74,000 in a single day, triggering over $1.36 billion in liquidations throughout digital asset markets, in line with Coinglass.

The sharp correction adopted escalating commerce tensions, with U.S. President Donald Trump saying sweeping tariffs on practically all main buying and selling companions late Friday.

Greater than 441,000 merchants had been liquidated over the 24 hours, with lengthy positions accounting for $1.21 billion of the entire. Bitcoin alone noticed $401.31 million in long-side liquidations, with Ethereum contributing $341.82 million.

Probably the most vital single liquidation order, valued at $16.38 million, occurred on Bitfinex’s perpetual contract. The highest 5 property by liquidation quantity included BTC, ETH, SOL, XRP, and DOGE.

The transfer coincided with broader market turmoil. S&P 500 Futures Index ER dropped 10% over the weekend, following back-to-back every day losses exceeding 4% on Thursday and Friday, amongst one of many steepest two-day declines in index historical past.

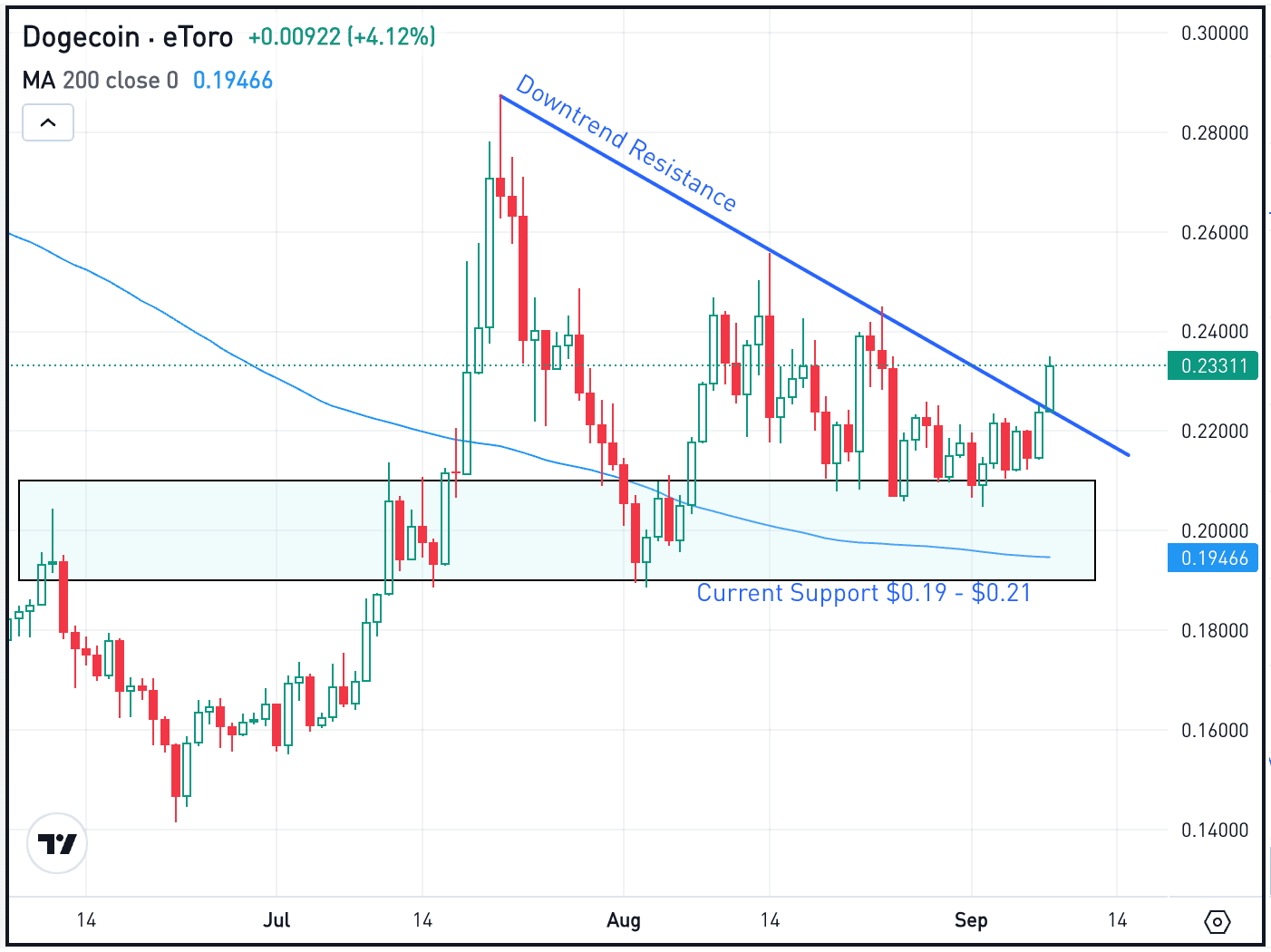

The liquidation heatmap reveals concentrated stress on Bitcoin and Ethereum, although altcoins equivalent to XRP, SOL, and DOGE additionally skilled vital drawdowns.

BTC’s 24-hour value declined 10.25%, ETH fell 19.84%, and most main altcoins posted double-digit losses. The information suggests the sell-off was long-heavy, with quick liquidations remaining comparatively minimal.

Whereas the pullback punctuates Bitcoin’s latest energy, peaking above $109,000 in January following Trump’s reelection and inauguration, it has now reversed to ranges final since below Joe Biden.

Bitcoin has a powerful resistance stage of round $73,000, which I’ve advocated for being the native backside of a sustained bull run. Nevertheless, world stress and the unprecedented tariffs have created a black swan occasion that no technical evaluation can foreshadow.

As geopolitical tensions mount, digital asset markets are actually repricing danger in tandem with conventional equities.

Talked about on this article