Discover

.cwp-coin-chart svg path {

stroke-width: 0.65 !essential;

}

Worth

Quantity in 24h

<!–

?

–>

Worth 7d

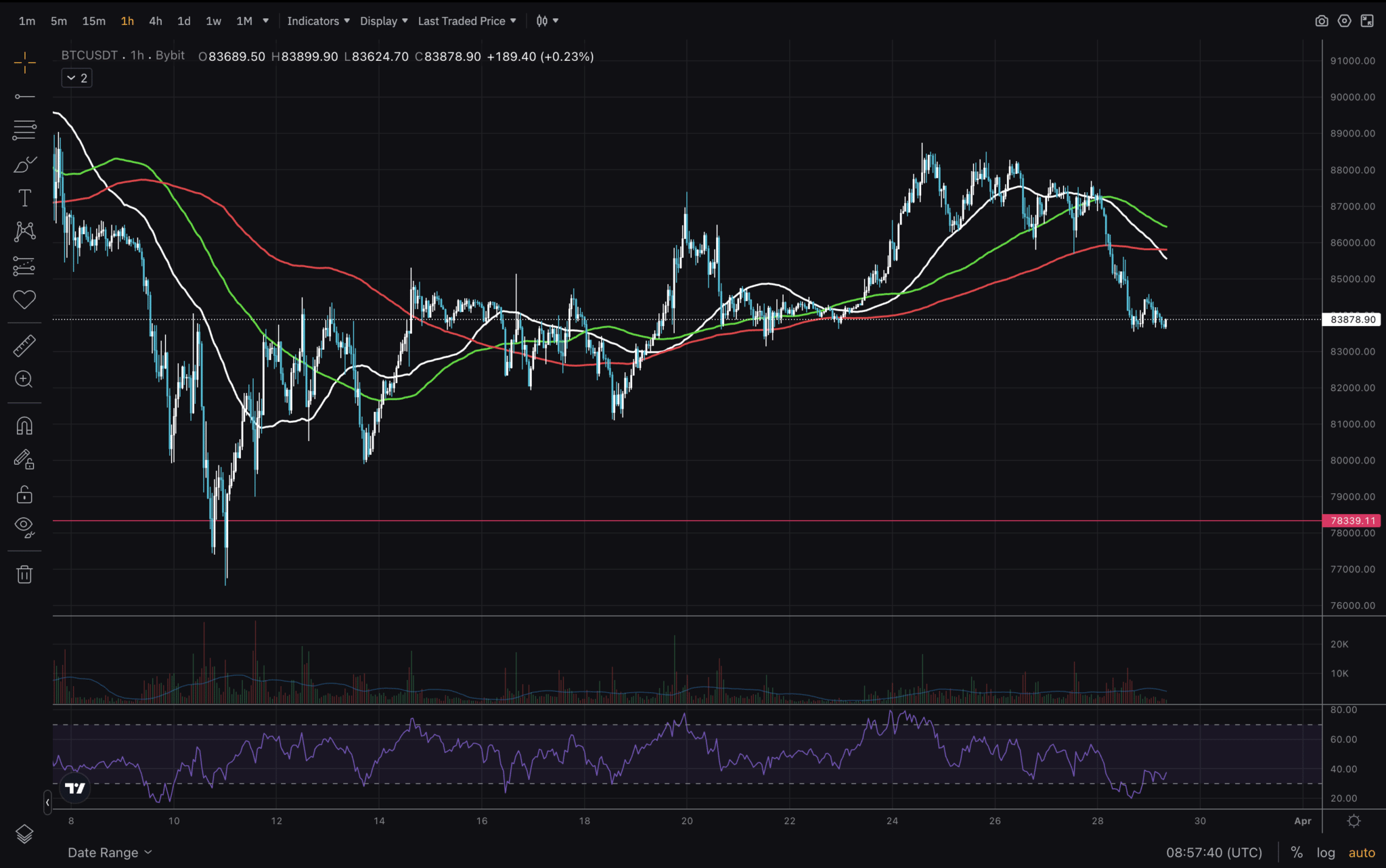

current value motion by way of in-depth Bitcoin technical evaluation. This text dives into key Bitcoin chart patterns, help and resistance ranges, and buying and selling indicators driving cryptocurrency market development. With search curiosity peaking in late March 2025, we uncover what technical indicators like RSI, transferring averages, and quantity counsel about Bitcoin subsequent transfer. Whether or not you’re a seasoned dealer or crypto fanatic, acquire actionable insights into the forces shaping BTC value volatility and crypto buying and selling indicators.

$BTC provide hits 8 12 months low as demand from whales intensifies pic.twitter.com/Q8BiVK8K3M

— The Crypto Professor (@TheCryptoProfes) March 29, 2025

The Bitcoin provide is nice to take a look at because the provide / demand dynamics apply for it as effectively. The extra curiosity there may be, the upper the worth will develop. Similar to the housing market in the previous couple of years. Please seek advice from final week’s article right here for extra context.

Bitcoin Technical Evaluation for Finish of March

(BTCUSDT)

Bitcoin technical evaluation continues the cryptocurrency market development – upwards. We’re wanting the 4H timeframe and the BTC value volatility has printed one in every of buyers favorite Bitcoin chart patterns. Specifically, increased highs and better lows. What we’re seeing now could be regular – a retrace to check one of many earlier lows. And we actually don’t need value to go under $78,000.

DISCOVER: High 20 Crypto to Purchase in March 2025

(BTCUSDT)

Staying on the 4H timeframe, I would like us to present a fast look at RSI and the Shifting averages as effectively since these present crypto buying and selling indicators. Worth is hovering across the 50, 100 and 200 MAs and RSI has dropped to the extent it was once we noticed a dip under $78,000. This might counsel that we will count on a reversal to the upside someday within the subsequent few days. Ideally, we’d proceed ranging and hop above and under the MAs with a view to kind a backside.

DISCOVER: Greatest New Cryptocurrencies to Spend money on 2025

(BTCUSDT)

Final, we’ll discover the 1H timeframe. A low timeframe that might give us early crypto buying and selling indicators. That’s as a result of the Bitcoin chart patterns are nonetheless legitimate and there may be sufficient BTC value volatility to decode. Worth has damaged under all of the MAs on this timeframe as effectively and RSI seems bottomed. Really there’s a bullish divergence seen on the RSI chart. Being at a earlier low stage, this may very well be a superb place for value to bounce off of. Preserve a detailed eye on how value reacts when it reaches earlier lows and commerce with good threat administration.

That’s all for right this moment. Keep secure on the market!

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Bitcoin Worth Motion: Technical Insights from Current Developments

BTC value hovering round 4H and 1H MAs

RSI bullish divergence on 1H

We wish to see value keep round present ranges for a backside to kind

The submit Bitcoin Worth Motion: Technical Insights from Current Developments appeared first on 99Bitcoins.