Bitcoin is exhibiting exceptional power because it continues its upward momentum, having surged previous its all-time excessive to succeed in the $112,000 mark yesterday. The value is at present holding firmly above $110K, a important stage that now serves as assist as bulls intention to increase the rally. This breakout confirms a robust bullish construction, with market sentiment leaning more and more optimistic. Nonetheless, regardless of the passion, warning is creeping in as analysts spotlight the rising potential for a near-term pullback.

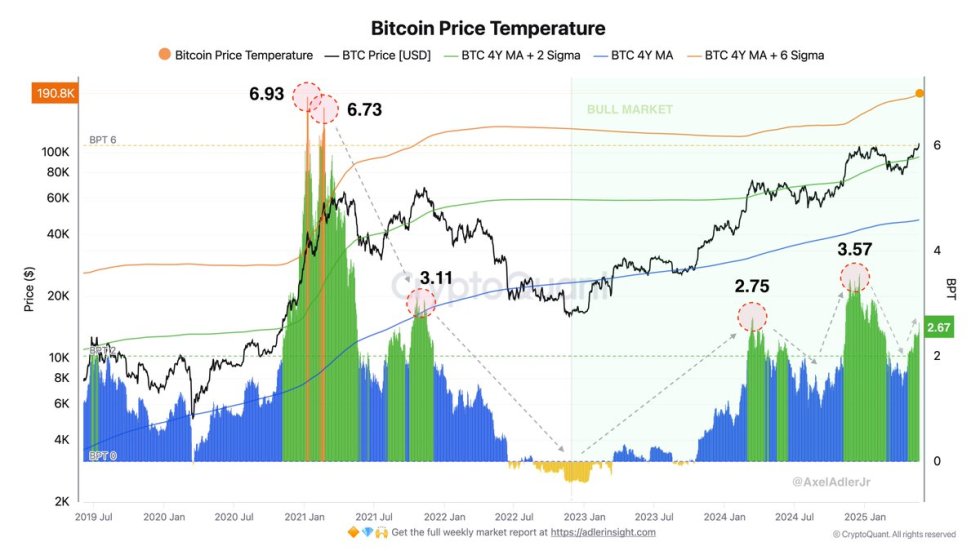

In response to recent knowledge from CryptoQuant, the Bitcoin Worth Temperature (BPT) metric—a gauge used to measure market overheating—has climbed to 2.67 factors. For context, the final two cycle peaks recorded BPT values of two.75 and three.57, with a median cycle peak close to 3.14. Whereas Bitcoin nonetheless has room earlier than hitting this historic common, the rising BPT signifies mounting stress and a market that could be approaching overheated situations.

With momentum nonetheless sturdy however warning indicators rising, all eyes at the moment are on whether or not Bitcoin can preserve its present trajectory, or if promoting stress will set off the following cooldown section in what has been a strong bull market. Will BTC defy historical past and push by with recent legs?

Bitcoin Pushes Larger As International Dangers Mount

As US Treasury yields rise and recession issues intensify, international markets are navigating a fragile macroeconomic atmosphere. Curiously, Bitcoin seems to be thriving on this context. After breaching its all-time excessive, BTC has remained sturdy above the $110,000 mark, exhibiting resilience whilst conventional belongings falter.

This power has ignited optimism amongst bulls, with many anticipating a continued rally. Nonetheless, analysts warn that the $115K stage have to be cleared to substantiate the beginning of a brand new bullish section. Failing to carry present ranges may result in a pointy correction, particularly with broader financial uncertainty in play.

Prime analyst Axel Adler lately highlighted an vital sign of market warmth: the Bitcoin Worth Temperature (BPT). In response to Adler, the BPT has now reached 2.67 factors. For context, the final two cycle peaks noticed BPTs of two.75 and three.57, with the common peak sitting at 3.14. This leaves a remaining hole of simply 0.47 BPT earlier than matching the historic common.

Whereas this doesn’t assure a direct prime, it alerts that BTC could also be approaching overheated situations. With this in thoughts, merchants are watching intently. Will Bitcoin’s power persist, or is that this the calm earlier than a mandatory cooldown?

BTC Each day Chart Evaluation: Bulls Maintain Management However Key Ranges Forward

Bitcoin is holding regular close to $111,000 after breaking to new all-time highs, signaling sturdy bullish momentum. The every day chart reveals that BTC efficiently flipped the $103,600 resistance zone into assist, marking a big technical milestone. Worth is nicely above the 34 EMA at $100,246, which has now turned upward, indicating short-term development power. In the meantime, the 50, 100, and 200 SMAs proceed to slope positively, including confidence to the medium and long-term development.

Quantity has barely decreased in comparison with the breakout days, suggesting a interval of consolidation might observe. Nonetheless, BTC stays inside a robust bullish construction, and a sustained shut above $112,000 may set off the following impulsive leg towards $115,000 or larger.

Nonetheless, if bulls fail to push previous that zone, we might even see a wholesome retracement towards $103,600 and even the $100,000 psychological stage—each of which ought to now act as sturdy assist. RSI and momentum indicators on decrease timeframes present indicators of cooling, according to the present consolidation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.