Bitcoin’s current worth motion has been a rollercoaster of highs and lows. Nevertheless, regardless that bitcoin has set a brand new all-time excessive and had two years of a near-constant constructive trajectory, we’re but to see a constant inflow of retail traders. The potential for a surge in retail participation and the potential of elevating the bitcoin worth to unprecedented ranges are prospects that many traders are anxiously anticipating. On this article, we will discover once we may see these retail traders dive again into the bitcoin pool and whether or not their return may certainly propel BTC to even larger heights.

Energetic Handle Progress and its Influence

To anticipate this potential retail wave, it is essential to scrutinize the pattern of lively tackle development. Knowledge sourced from Bitcoin Journal Professional suggests a downward swing within the variety of lively community members in current months. The 365-day shifting common (blue line), together with the 60-day (purple line) and 30-day averages (crimson line), inform a story of decreased community exercise. This drop takes the rely of lively customers again to ranges harking back to early 2019, following bitcoin’s bear cycle, when costs hovered between $3,500 to $4,000.

This decline in lively community customers raises eyebrows about bitcoin’s upside potential within the present cycle. Curiously, regardless of bitcoin hitting a brand new report of roughly $74,000, there was no corresponding sustained uptick in community customers, a stark departure from earlier cycles.

The Crucial Influx of New Capital

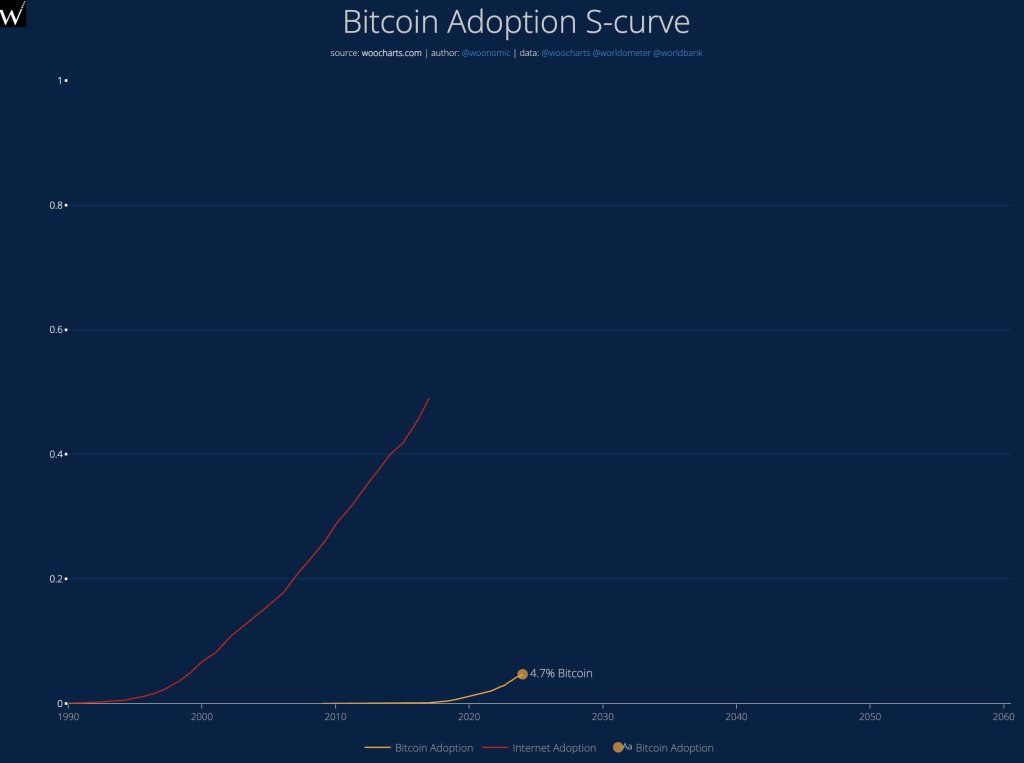

This pattern may very well be a mirrored image of Bitcoin’s evolving identification. Initially a digital peer-to-peer forex, Bitcoin is more and more seen as a retailer of worth. Because of this, fewer persons are utilizing it for on a regular basis transactions and are as an alternative pouring capital into bitcoin as a long-term asset.

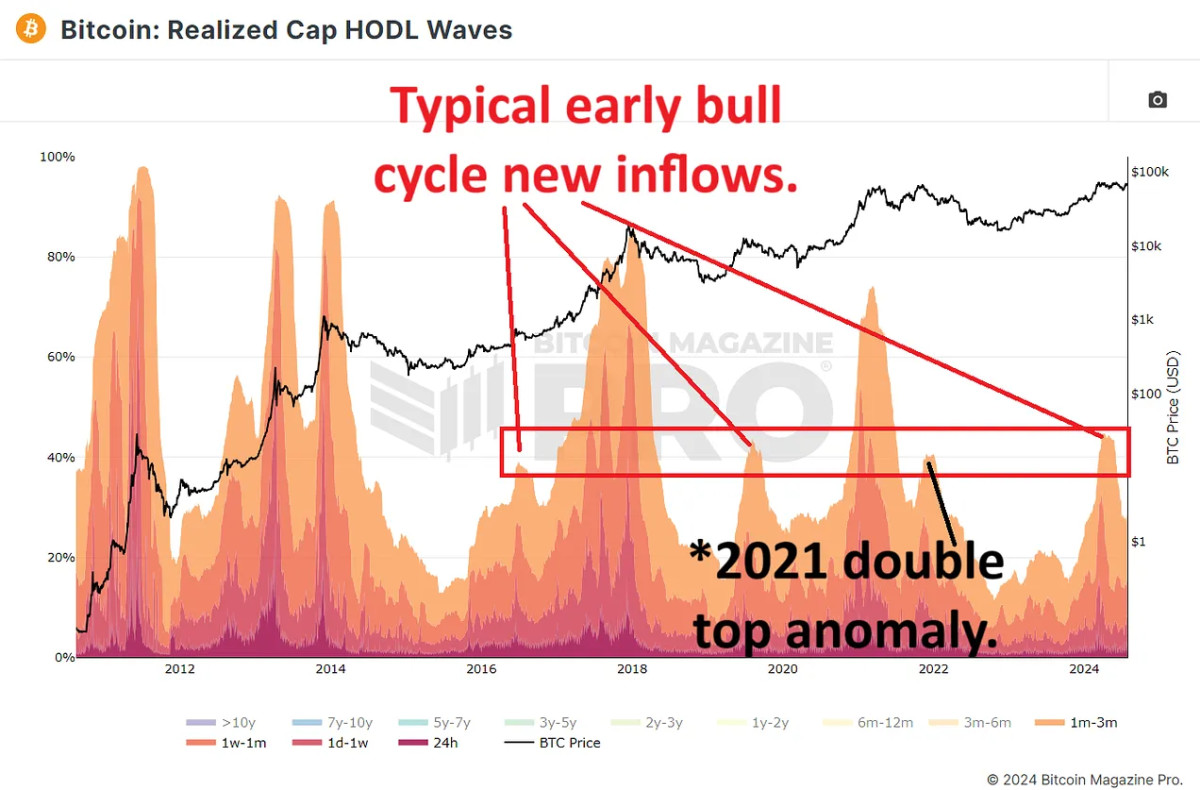

The Bitcoin HODL Waves & Realized Cap HODL Waves make clear this shift. These metrics group Bitcoin community customers primarily based on the length they’ve held their cash, in addition to exhibiting their affect on the buildup worth of BTC. Current information reveals that about 20% of bitcoin has been held for 3 months or much less, indicating that new customers are getting into the market, however as we will see from the typical lively addresses within the above information, not utilizing Bitcoin as incessantly as earlier than.

The influence of those new customers on the realized cap (the typical accumulation worth of all BTC) is appreciable, with over 40% of current affect coming from customers holding Bitcoin for 3 months or much less (indicated by the hotter crimson/orange colours within the chart under). This means that customers are getting into the market at greater costs and are behaving in a fashion in line with earlier cycles (we’re not too long ago seen the preliminary early bull cycle inflows at comparable ranges to earlier cycles, indicated by the crimson field), simply not as incessantly as now we have beforehand seen.

Understanding Market Forces and Retail Involvement

A have a look at Bitcoin’s previous cycles reveals {that a} surge in retail exercise usually precedes market peaks. For instance, within the 2017 and 2021 bull runs, retail curiosity spiked round 6 months earlier than the value peaks. The present absence of a big enhance in retail curiosity, as evidenced by Google Developments, suggests we’re experiencing a extra measured, and extra sustainable market development.

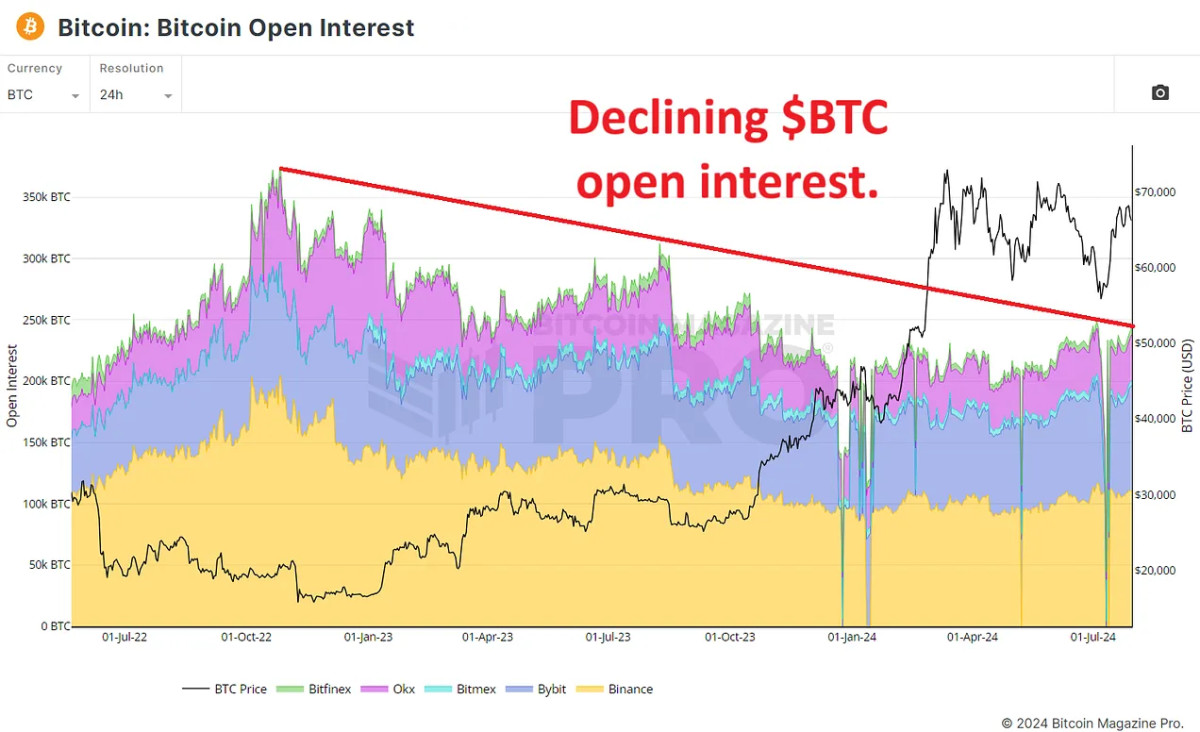

One other key consideration is the Bitcoin Open Curiosity chart, which measures the entire worth of open bitcoin futures contracts. Since late 2022, this metric hasn’t proven a big enhance; in reality, we’ve seen a gentle decline for the reason that bear cycle lows (indicated by the declining crimson line within the chart under). Revealing that traders are actually preferring to commerce precise bitcoin fairly than merely collaborating in derivatives buying and selling. This means a shift in narrative the place traders are extra all for holding bitcoin for the lengthy haul fairly than chasing short-term speculative positive aspects.

Conclusion

Given present developments, the shortage of a retail frenzy may very well be seen as a constructive signal for the market’s long-term prospects. As bitcoin approaches new report highs, maintaining a detailed eye on the arrival of retail traders shall be important. If retail traders begin getting into the market in massive numbers, will they fall again into previous habits of pure FOMO shopping for, or will they proceed to favor long-term holding?

In brief, regardless of a fall in Bitcoin’s lively person metrics, the market reveals indicators of stability and long-term funding. The absence of speedy retail curiosity might sound bearish, but it surely’s extra prone to be bullish because it signifies a extra measured and sustainable development trajectory.

For a extra in-depth look into this subject, take a look at a current YouTube video right here: