BlackRock is among the 4 horsemen of the US economic system, together with funding giants Vanguard, Constancy and State Avenue. And now there’s a Moody’s recession prediction terrifying all of those establishments.

All of those funding establishments are lugubrious on the US economic system - right here’s why.

Moody’s Recession Prediction: Two Extra Weeks

Recession dangers are rising, in keeping with Moody’s Analytics chief economist Mark Zandi. In a latest put up on X, he warned that U.S. progress is faltering beneath mounting coverage pressures.

Zandi later clarified that he doesn’t imagine the economic system is in a proper recession but, however stated sure sectors have already slipped into one.

In an interview with Enterprise Insider, Zandi pointed to tariffs, immigration restrictions, and Federal Reserve coverage as the principle headwinds. Collectively, he stated, they’ve created unusually excessive uncertainty, stalling funding and hiring.

BREAKING: Moody's Rankings warns US economic system nears recession, citing 3 key components:

— Payroll employment— Employment ranges— Constant job declines

Q: When will voters study? pic.twitter.com/P9wvPQurBr

— Dr. MemeNstein votes

BLUE

(@Coste1Costello) August 12, 2025

All of this has BlackRock, which manages over $12.5 trillion in property beneath administration, about 40% of the USA’s GDP, nervous and already promoting its holdings.

September is at all times a nasty month for shares. Traditionally, September has been the graveyard for the S&P 500, with a mean lack of 1.1% relationship again to 1928. Two extra weeks might be the beginning of it.

To not point out, in a latest report, BlackRock cited these financial considerations:

Getting old scarcity: Developed international locations have record-low start charges (Google “sperm depend 2045”). This may occasionally end in excessive inflation over time and a shift in demand towards industries catering to seniors, comparable to healthcare, actual property, and leisure.

A fragmenting world: In line with BlackRock, “We predict the Ukraine battle and fraught U.S.-China relations have ushered in a brand new period of worldwide fragmentation and competing protection and financial blocs.” BlackRock believes international financial progress might be extra risky, however opens prospects in rising markets.

DISCOVER: 9+ Greatest Excessive-Danger, Excessive-Reward Crypto to Purchase in July 2025

Jackson Gap: Crash the Economic system With No Survivors

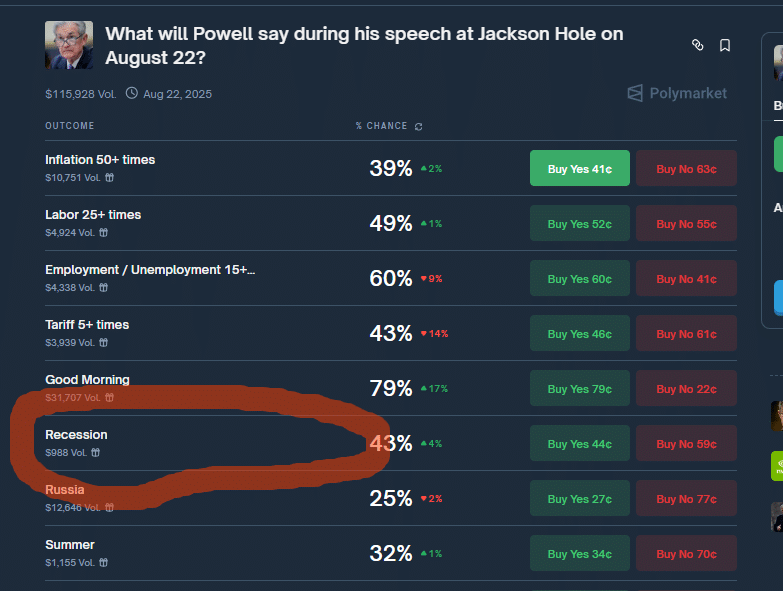

The final bit of stories terrifying buyers is the Fed’s assembly right this moment in Jackson Gap, Wyoming.

Wall Avenue largely expects charge cuts from the Federal Reserve this fall, pointing to September because the most probably begin. But, undercutting these hopes are Tariffs launched by President Donald Trump, which have added financial pressure, and the administration has leaned onerous on the Fed to shift coverage.

In contrast to previous Jackson Gap conferences, many consultants imagine Powell is unlikely to supply sturdy clues.

Inflation stays sticky above goal and has been pushed larger by tariffs, muddying the case for cuts. Some analysts argue the central financial institution will need extra proof earlier than shifting.

In actuality, the U.S. economic system feels a pinprick away from one thing dangerous:

Scholar mortgage debt is reaching an alarming $2 trillion, whereas bank card debt is surging.

Banks are tightening on client credit score. When this occurs, client spending, which has stayed sturdy however shifted to credit score, will get shafted.

DISCOVER: Subsequent 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Are Issues That Dangerous?

The hour attracts close to now. The bell has tolled for thee, America, in the end. Meals might be a luxurious by early 2026. Is that how issues will pan out?

No. Whereas issues aren’t that dangerous, all alerts level to a slowing, if not crashing, economic system after another run-up for shares and crypto that many see coming in This fall from charge cuts. However stay calm. Issues will get higher. Drink copious quantities of Chivas Regal. Kidding. Partially.

Hold on to your long-term investments with strong foundations, promote what you have to for instant money, and belief that all the pieces will finally prove all proper. Get some contemporary air, contact grass.

EXPLORE: Tether CEO Paolo Ardoino Hopes For Internet Constructive From US Elections, Says Bitcoin Strategic Reserve Is A Nice Thought: 99Bitcoins Unique

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Key Takeaways

BlackRock is among the 4 horsemen of the US economic system, together with funding giants Vanguard, Constancy and State Avenue – and now they’re all terrified.

All eyes are on Powell right this moment at Jackson Gap. As inflation lingers and labor metrics soften.

The put up BlackRock and Wall St. Exit US Markets, Bracing for Recession appeared first on 99Bitcoins.