BlackRock’s transfer to register an iShares Ethereum Belief in Delaware signaled a possible game-changer for Ethereum as an institutional-grade funding. Ethereum (ETH) surged on the information, breaking above $2,000 for the primary time since July. Understanding the ETH/BTC ratio’s conduct is essential in dissecting the market’s response to such developments, providing an alternate perspective to the traditional ETH/USD or ETH/USDT pairs.

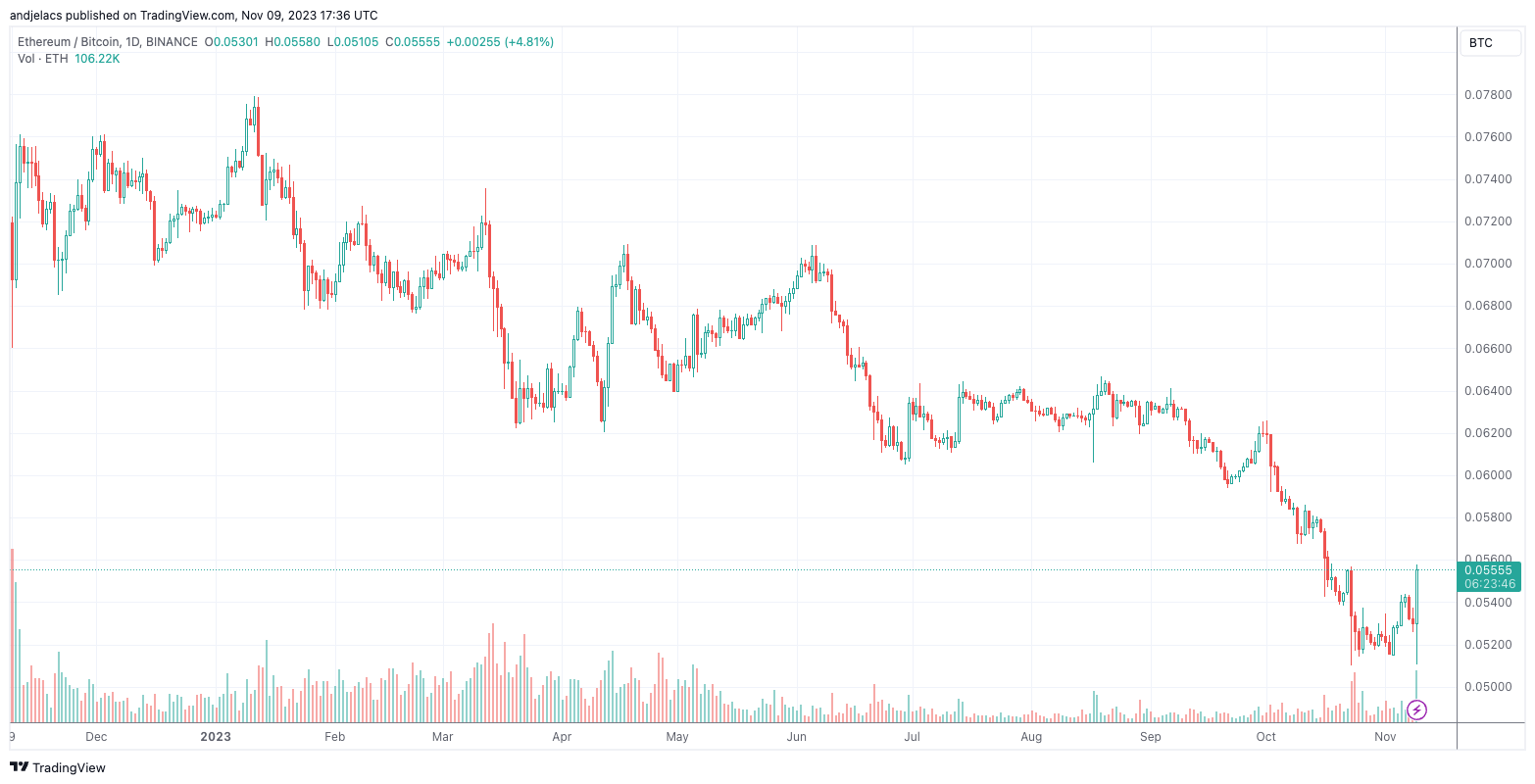

The ETH/BTC ratio represents Ethereum’s energy towards Bitcoin—the standard-bearer of the crypto market. This ratio will increase in worth when Ethereum good points momentum or retains its worth higher than Bitcoin, suggesting that the market favors ETH over BTC. Conversely, a decline within the ETH/BTC ratio signifies Ethereum’s underperformance relative to Bitcoin, which might recommend investor desire for the relative security of Bitcoin.

Actions within the ETH/BTC ratio are extra than simply worth motion; they signify the shifting tides of investor confidence and market sentiment between two of the most important cryptocurrencies. This ratio refines the uncooked worth information into comparative efficiency, going past the fiat worth of Ethereum and presenting its relative standing throughout the crypto area.

CryptoSlate evaluation discovered that, up to now 30 days, the general correlation coefficient between the ETH/BTC closing worth and buying and selling quantity was barely detrimental at roughly -0.103. This means that buying and selling volumes didn’t closely affect worth actions throughout the month—a stunning perception given the tumultuous nature of cryptocurrency markets.

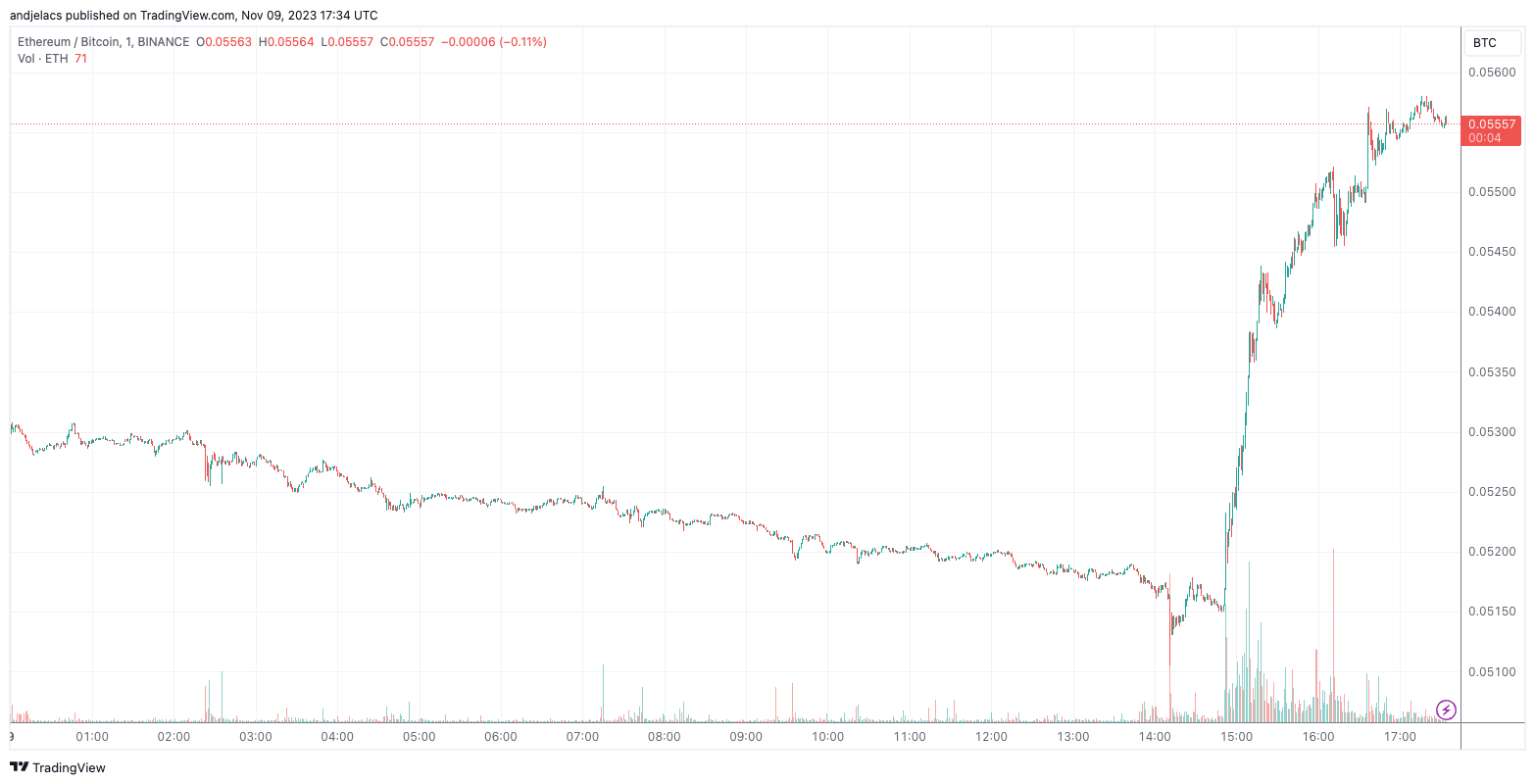

Nevertheless, trying on the previous 24 hours, the correlation turns optimistic at round 0.264. This shift accompanies a spike in ETH/BTC, the place the ratio peaked at 0.05493. This optimistic correlation within the final day signifies a synchronized worth and buying and selling quantity improve, pushed by the market’s response to BlackRock’s Ethereum ETF registration.

In a year-long retrospective, the ETH/BTC market confirmed a correlation coefficient of round 0.377 between worth and quantity, indicating a average optimistic affiliation. This pattern implies that investor engagement, as measured by quantity, has usually risen in tandem with ETH’s worth relative to BTC, reflecting a broader confidence in Ethereum’s market proposition.

These fluctuations within the correlation coefficient, noticed over totally different time frames, present the interaction between Ethereum’s relative valuation and buying and selling exercise. It paints an image of a market delicate to quick developments—like BlackRock’s registration—but additionally cautious of the broader developments within the crypto business.

Why is that this shift necessary? The ETH/BTC ratio’s spike and the elevated buying and selling exercise imply heightened market consideration. BlackRock’s registration echoes its earlier steps with the iShares Bitcoin Belief, preluding what many anticipate to be an official ETF utility. This exercise spotlights Ethereum’s rising stature and suggests an undercurrent of optimism regardless of the SEC’s historic unwillingness to approve an ETF.

This juxtaposition of BlackRock’s daring stride towards regulatory uncertainty brings fairly a little bit of uncertainty to Ethereum’s future. The registration is a beacon of institutional validation for Ethereum, however it’s shrouded within the unpredictability of the SEC’s selections—a well-recognized suspense for the crypto business.

The submit BlackRock Ethereum ETF sparks surge in ETH/BTC ratio appeared first on CryptoSlate.