Borrowing charges for USDC, some of the liquid dollar-pegged stablecoin, stay excessive on Aave and Compound v2, two of the world’s prime decentralized protocols. Based on Kaiko, a blockchain analytics platform, charges have ranged from 4% to fifteen% on Aave and round 13% on Compound.

It needs to be famous that this surge is when the crypto and decentralized finance (DeFi) scene is recovering after an prolonged “winter” that froze participation.

Borrowing USDC on Aave and Compound Is Costly

Kaiko notes that the utilization charge for USDC on Aave has remained near optimum ranges, indicating regular demand for the stablecoin amongst debtors, primarily within the second half of November. Taking a look at tendencies, it’s evident that borrowing charges in Aave v2 have been stabilizing between 4% and 15% over the previous week.

In the meantime, on Compound v2, borrowing USDC has been dearer than others, together with USDT and DAI. The USDC borrowing charge is round 13%, a lot greater than borrowing Ethereum-based DAI or Tether Holding’s USDT.

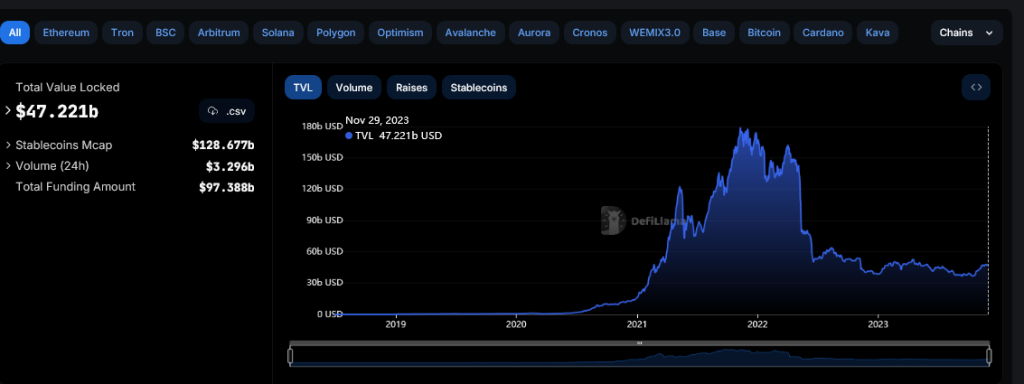

There is no such thing as a exact cause to elucidate this divergence. Nonetheless, the explanation why demand is various might be multifaceted. One of many key causes is that after depressed exercise within the higher a part of 2022 and 2023, exercise is increasing as whole worth locked (TVL) not solely in Ethereum however in different chains, together with Solana, reveals.

DeFiLlama says the whole TVL is round $47 billion, up from roughly $38 billion registered in mid-October. Subsequently, with rising demand, USDC holders will seemingly need extra yield from prepared debtors.

Past this, rising borrowing charges might be resulting from customers averse to utilizing centralized exchanges opting to safe a stablecoin that’s absolutely audited, publishing attestation statements repeatedly.

Within the case of USDC, these attestations are impartial audits that confirm whether or not Circle, the issuer, holds adequate reserves to again each token in circulation.

Are Bulls Prepared To Carry Crypto Costs Greater?

Whereas the excessive borrowing charges for USDC might make it much less enticing for some debtors, it additionally highlights the robust demand for stablecoins and their rising significance in DeFi. Within the crypto market, the demand for stablecoins, comparable to USDC, can point out the beginning of a bull run.

Stablecoins present a gateway into crypto. When there’s a greater demand for these tokens, the possibilities of the crypto market rising additionally enhance. Because the crypto and DeFi scene matures, stablecoins like DAI and USDT are anticipated to play a vital position.

Function picture from Canva, chart from TradingView