Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin (BTC), Ethereum (ETH), and XRP prolonged their slide Tuesday as renewed US–China tensions deepened market jitters, sending silver surging to a file excessive.

Beijing introduced sanctions on the US items of South Korean shipbuilder Hanwha Ocean and warned of additional motion in opposition to the maritime sector, escalating tensions between the world’s two largest economies and damping hopes of a near-term thaw.

World equities fell, and the fallout rippled by digital belongings, triggering one other wave of liquidations that pushed main tokens to multi-week lows.

( @realDonaldTrump – Reality Social Put up )( Donald J. Trump – Oct 12, 2025, 12:43 PM ET )

Don’t fear about China, it should all be wonderful! Extremely revered President Xi simply had a foul second. He doesn’t need Despair for his nation, and neither do I. The usA. desires to assist… pic.twitter.com/30ot0cICw4

— Fan Donald J. Trump 🇺🇸 TRUTH POSTS (@TruthTrumpPosts) October 12, 2025

Crypto Costs Tumble With No Decision In Sight

US Treasury Secretary Scott Bessent stated that talks with China are nonetheless on, however the uncertainty has left a darkish cloud hanging over the crypto market.

After taking a breather from the current downtrend, crypto costs have continued to fall up to now 24 hours.

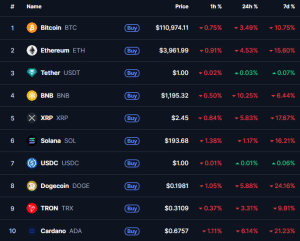

BTC and ETH have dropped over 3% and 4%, respectively, in accordance with knowledge from CoinMarketCap. Ethereum is now down greater than 15% up to now seven days and BTC over 10%.

High 10 cryptos by market cap (Supply:CoinMarketCap)

The remainder of the highest ten largest cryptos by market cap all fell, too. BNB, which not too long ago set a brand new all-time excessive (ATH), has plunged 10%, marking the largest loss within the prime ten checklist.

XRP and Solana (SOL) fell 6% and 1%, respectively, whereas Dogecoin (DOGE), Tron (TRX) and Cardano (ADA) dropped 5%, 3%, and 6%, respectively. Overall, the crypto market cap dropped over 3%.

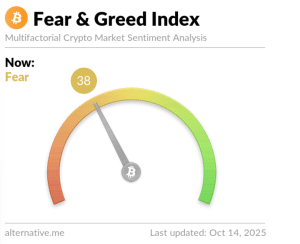

The Crypto Worry & Greed Index, a preferred software used to gauge investor sentiment, slumped to a “concern” studying of 38 from a “greed” stage of 70 only a week in the past.

Crypto Worry & Greed Index (Supply: Different.me)

CoinGlass knowledge reveals liquidations within the crypto market surpassed $694.81 million up to now 24 hours, with lengthy positions accounting for $511.80 million of the overall. Some quick merchants additionally received hit, with $195.31 million liquidated from trades that have been in opposition to the market.

Silver Value Hits Document Excessive, Alongside With Gold

The seek for safe-haven investments despatched to the silver value to a file excessive of $53 per ounce, taking its beneficial properties for the yr to greater than 85%.

Silver is commonly seen as a proxy for gold, which additionally soared to a different all-time excessive earlier right now.

Commenting on the efficiency of gold, silver and the crypto market, Bitcoin critic Peter Schiff warned that “crypto consumers are in for a impolite awakening.” He additionally stated that crypto buyers will be taught “a really useful however costly lesson.”

Gold and silver proceed to soften up as Bitcoin and Ether proceed to soften down. Crypto consumers are in for a impolite awakening and can quickly be taught a really useful however costly lesson. Luckily, most crypto house owners are younger with a number of time to earn again what they’re about to lose.

— Peter Schiff (@PeterSchiff) October 14, 2025

That’s after he stated that Bitcoin’s flash crash this previous Friday “wasn’t a shopping for alternative however a warning.” He added that gold’s continued surge is “exposing the fiction that Bitcoin is digital gold.”

In the meantime, famend analyst Michael van de Poppe stated that BTC’s current correction is “nothing particular,” and predicted that “volatility will stay excessive earlier than there’s a transparent new development.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection