Analyst Weekly, October 27, 2025

Earnings Season, So Far

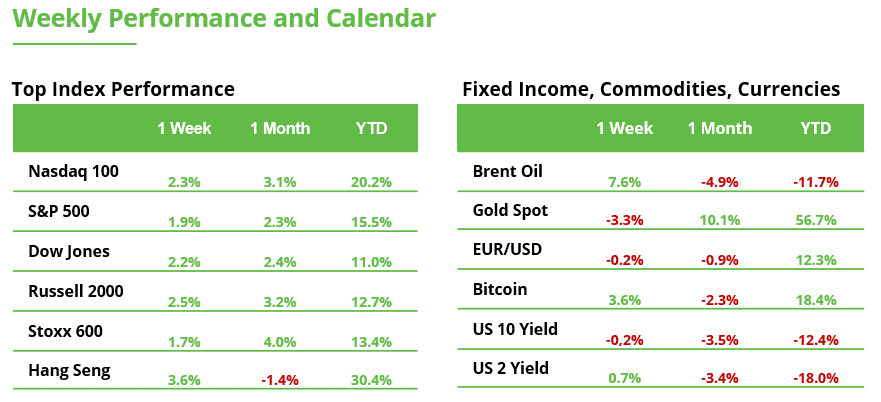

Early Q3 outcomes have usually are available in higher than anticipated, with top-line progress enhancing throughout most sectors. Roughly 85% of S&P 500 firms have overwhelmed expectations up to now, the perfect tempo in 4 years. Estimated gross sales progress rose between July and October in 10 of the S&P 500’s 11 sectors, signaling wholesome demand. Financials, tech, and discretionary names are main the cost, whereas utilities stay the lone mushy spot.

That stated, the margin image is extra blended. Rising prices and wage pressures may weigh on earnings, whilst firms proceed to beat on income. To date, EPS estimates haven’t moved a lot larger, suggesting traders are ready for stronger affirmation earlier than repricing expectations. After a giant fairness run-up this yr, markets might have earnings to catch as much as valuations. General, early indicators are encouraging, however sustaining this momentum will depend upon.

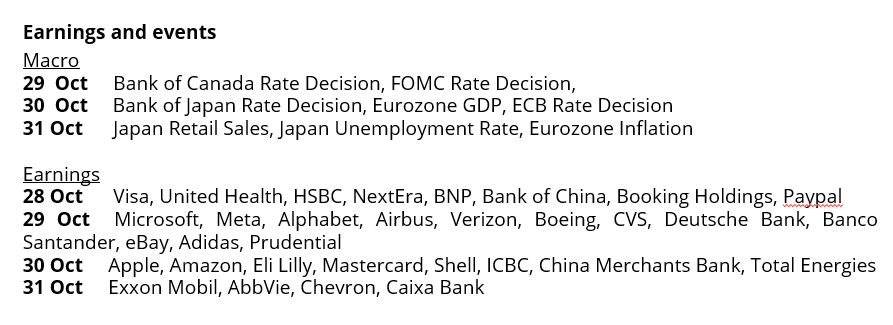

This week may resolve whether or not the bull market retains charging or pauses for breath. 5 giants, Microsoft, Alphabet, Meta, Amazon, and Apple, collectively make up 1 / 4 of the S&P 500 and can report outcomes mid-week. General, 44% of the S&P 500’s market capitalization will probably be reporting outcomes this week. Buyers are zeroed in on their AI methods: the dimensions of spending and, crucially, when it begins to repay. Huge Tech’s mixed capex may prime $420 billion subsequent yr, a lot of it tied to AI infrastructure. To date, income progress in cloud and digital adverts has justified optimism, however revenue progress throughout the “Magnificent Seven” is slowing from 27% final quarter to about 14%. With valuations stretched, any cracks within the AI or earnings story may check the market’s rally.

Fed to Finish QT and Prolong Fee Cuts

The Federal Reserve seems able to shift from tightening to assist mode. With the labor market softening and inflation easing towards goal, we anticipate policymakers to sign further price cuts by year-end and a proper finish to QT. Financial institution reserves as a share of GDP have fallen sharply, tightening liquidity and forcing short-term charges larger than the Fed’s goal. Ending QT would assist stabilize funding markets and ease stress on credit score.

Markets have already begun pricing in a rate-cutting cycle, with swap charges trending decrease by means of autumn. The coverage pivot may present reduction for small- and mid-cap shares, which have lagged throughout QT, and assist broader market sentiment heading into 2026, particularly if commerce tensions proceed to chill.

Markets Wager on a US-China Commerce Truce Amid Coverage Crosscurrents

Markets are positioning for a constructive consequence from subsequent week’s US-China summit, as either side sign progress towards easing commerce tensions.Negotiators have reached preliminary consensus on points together with export controls, fentanyl, and transport levies, whereas the US has dropped threats of 100% tariffs.

Preliminary market response displays optimism that neither chief needs to destabilize the worldwide financial system. Nonetheless, traders stay alert to dangers: China might press Washington to make clear its Taiwan stance, whereas rare-earth provide and tech coverage stay leverage factors. The broader backdrop is supportive: we anticipate the upcoming Fed price cuts and an finish to quantitative tightening to spice up danger urge for food. If talks yield a tariff truce and soybean deal, cyclical and China-sensitive sectors may prolong features, reinforcing the market’s “soft-landing” narrative.

No One Can Ignore Huge Tech

We’re heading into one of the eventful weeks of the yr. 5 US tech giants are set to report their quarterly outcomes: Alphabet, Meta, and Microsoft on Wednesday, adopted by Amazon and Apple on Thursday. Collectively, they symbolize round 1 / 4 of the S&P 500, a putting instance of how extremely concentrated the US market has change into.

To date, the US earnings season has been operating positively, and the seasonal sample additionally argues towards any main adverse surprises. However, traders ought to anticipate elevated volatility throughout this part. Volatility, nonetheless, mustn’t at all times be considered as a warning signal, it’s typically a pure companion of an intact uptrend.

Can Microsoft Break Its July Excessive?

The Microsoft inventory gained 2.1% final week, closing at $523.61. Whereas the all-time excessive from July 31 at over $560 has not but been reached, the hole has narrowed noticeably. After the report excessive, the inventory quickly fell to $492, a decline of about 12%. Due to the current restoration, the loss has now been lowered to round 7%.

The long-term uptrend stays intact, and from a technical perspective, a lot factors to a continuation of the rally. One other push towards the report excessive appears attainable. Nonetheless, if the inventory experiences a short-term pullback, the correction may initially prolong towards the assist zones between $482–488 or $461–466. These areas are thought-about technically related ranges (Honest Worth Gaps).

Microsoft, weekly chart. Supply: eToro

US Sanctions Push Brent Costs Greater – Technical Resistance Stays

Brent crude recovered 6.5% final week to $65.16. The set off was the US sanctions towards Russia’s largest oil producers, which have heightened issues about potential provide disruptions.

Nonetheless, a take a look at the weekly chart exhibits that oil costs nonetheless face a number of technical resistance ranges. The mere avoidance of a decrease low shouldn’t be sufficient to finish the long-standing downtrend.

About 5 weeks in the past, after reaching a excessive of $69.89, a brand new wave of promoting started. This excessive now represents the important thing hurdle for the bulls. Consumers have additionally failed a number of occasions on the $70 mark again in July.

Solely a sustained breakout above these ranges, ideally confirmed by a weekly shut, would considerably brighten the technical image. Till then, the oil market stays susceptible to renewed sell-offs.

Oil (Brent), weekly chart. Supply: eToro

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.