Tech has been the best-performing sector up to now in Q2. The Day by day Breakdown explores whether or not that momentum can proceed into Q3 and This fall.

Friday’s TLDR

Tech has been a laggard

However was the highest sector in Q2

And now, it’s breaking out

What’s Occurring?

Tech shares have come roaring again to life, surging 21.5% within the second quarter. For traders, the rally gives a much-needed break after a tough stretch: tech was the worst-performing sector from Q3 2024 by way of Q1 2025, falling roughly 7.5% over that interval.

Main the comeback are Microsoft and Nvidia, which now boast a mixed market cap of $7.5 trillion. They have been the one two members of the Magnificent 7 to notch new document highs in the course of the quarter, reinforcing their dominance and reigniting enthusiasm throughout the broader tech panorama.

As we flip the web page to the second half of the 12 months, a key query arises: Can tech maintain this momentum?

The sector carries the strongest anticipated earnings development for 2025, at round 21%, and holds the second-highest development forecast for 2026. That development outlook, mixed with renewed investor urge for food, might assist lengthen the rally — but it surely’s removed from assured.

AI Is Serving to Gasoline the Rally

The continued AI increase and semiconductor energy proceed to drive a lot of tech’s narrative. Progress shares have been energized by AI developments, whereas cybersecurity names have additionally maintained robust uptrends. On the identical time, mega-cap tech firms are ramping up spending to construct the following wave of AI infrastructure, additional validating the theme’s endurance.

In the meantime, semiconductor shares — a cornerstone of the AI commerce — are gaining steam. Nvidia and Broadcom have not too long ago reached new all-time highs, whereas Taiwan Semiconductor sits simply shy of its personal. Even beforehand beaten-down chipmakers like AMD, ASML, and Lam Analysis have proven significant indicators of life.

With tech accounting for over 30% of the S&P 500’s weighting, its route is essential for the broader market. If the sector holds its footing, it might — on the very least — assist stabilize a inventory market nonetheless recovering from early-2025 volatility. At greatest, it might gasoline one other leg increased into year-end.

What Traders Ought to Contemplate

Tech’s prior underperformance helped ease valuation considerations, even because the sector continued to ship regular development. The second quarter could have marked a turning level — or it might show to be a brief rebound. The danger? A return to lagging efficiency. The chance? That tech reclaims its management position and drives features by way of the remainder of 2025.

Need to obtain these insights straight to your inbox?

Enroll right here

The Setup — Know-how ETF

Many traders consider the QQQ ETF because the go-to expertise ETF. Whereas its high holdings are made up of many in style mega-cap tech names, its efficiency really tracks the Nasdaq 100, and it incorporates shares like Costco, Starbucks, PepsiCo, and Reserving Holdings.

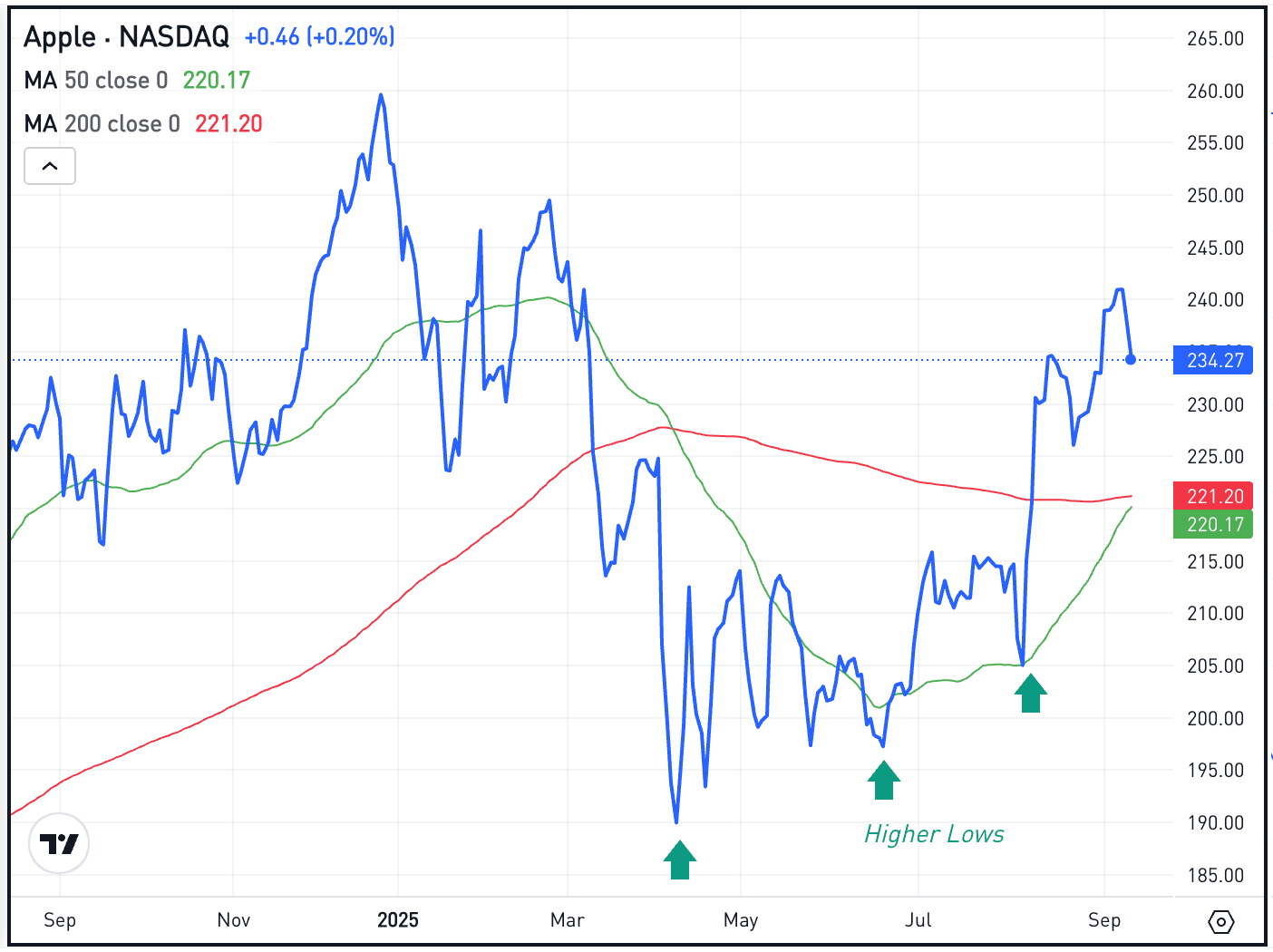

In the meantime, the XLK is the expertise ETF, and it has clearly damaged out over the $235 to $240 resistance space.

If traders imagine that expertise shares will proceed increased, this ETF (or the QQQ) could possibly be one method to strategy these shares. In both case, bulls will need to see tech shares maintain up above prior resistance. For the XLK, which means staying above the $235 to $240 zone.

If it will possibly achieve this, maybe tech can keep momentum by way of earnings season in late July and early August, and into the second half of the 12 months. Aggressive bulls may begin accumulating the ETF now, whereas extra conservative bulls might watch for some kind of pullback because the XLK is within the midst of its fifth straight weekly rally.

Nevertheless, ought to tech shares lose momentum and the ETF breaks beneath this $235 to $240 zone, a bigger pullback might ensue.

Choices

Shopping for calls or name spreads could also be one method to speculate on extra upside — both amid the breakout or on a pullback. For name consumers, it might be advantageous to have ample time till the choice’s expiration.

For those who aren’t feeling so bullish or who’re on the lookout for a deeper pullback, places or put spreads could possibly be one method to take benefit.

To be taught extra about choices, contemplate visiting the eToro Academy.

Disclaimer:

Please notice that as a consequence of market volatility, among the costs could have already been reached and situations performed out.