Be part of Our Telegram channel to remain updated on breaking information protection

The US Commodity Futures Buying and selling Fee (CFTC) has opened a path for some offshore crypto exchanges to re-enter the American market below its International Board of Commerce (FBOT) framework, clearing the way in which for companies together with Binance and ByBit to service native traders.

Performing CFTC Chair Caroline Pham mentioned in an Aug. 28 assertion that the transfer “supplies the regulatory readability wanted to legally onshore buying and selling exercise” after what she known as an period of “unprecedented regulation by enforcement.”

She added that US merchants will as soon as once more have “alternative and entry to the deepest and most liquid international markets” in digital property.

Pham additionally welcomed again American firms that had been compelled to arrange store abroad.

“Beginning now, the CFTC welcomes again People that need to commerce effectively and safely below CFTC rules, and opens up US markets to the remainder of the world,” she mentioned. “It’s simply one other instance of how the CFTC will proceed to ship wins for President Trump as a part of our crypto dash.”

New CFTC Pathway Might Lead To Buying and selling Quantity Enhance For Binance And Different Exchanges

Over the previous few years, offshore exchanges had been “pushed out of america,” Pham mentioned. This has compelled change platforms, equivalent to Binance, to discover various avenues to achieve entry to the US market.

The change ended up servicing US merchants via a separate entity known as Binance.US, a platform that’s nonetheless not out there in all states.

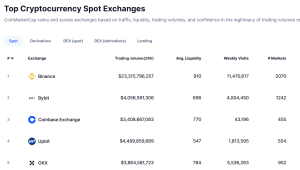

Whatever the restrictions, Binance stays the most important crypto change platform on this planet by way of buying and selling quantity. Knowledge from CoinMarketCap reveals the change’s 24-hour volumes are at the moment above $23 billion.

Prime crypto exchanges by buying and selling quantity (Supply: CoinMarketCap)

The subsequent greatest crypto change by buying and selling quantity is ByBit, one other off-shore platform with greater than $4 billion in 24-hour buying and selling quantity.

ByBit was blocked from working within the US again in 2021 resulting from regulatory points that included inadequate KYC procedures.

The CFTC’s new pathway will tackle the restrictions that these platforms and others have needed to cope with over the previous few years. This might doubtlessly result in elevated volumes on widespread exchanges which might be headquartered outdoors of the US, particularly because the Donald Trump Administration forges forward with its pro-crypto coverage.

CFTC Performing On Professional-Crypto Steering From The White Home

Throughout his election marketing campaign final yr, Trump made a collection of guarantees to the crypto group, which was dealing with a regulatory onslaught from rhe US Securities and Trade Fee (SEC) and its former Chair, Gary Gensler.

Since taking the White Home in January, Trump has began delivering on a number of of his guarantees. In the identical month as his inauguration, the US President signed an government order endorsing the “accountable progress and use of digital property, blockchain know-how, and associated applied sciences.”

Congress additionally handed the GENIUS Stablecoin Act, a key invoice that establishes the rules for stablecoin issuers within the US. Many have seen the transfer as a step in the suitable path in the direction of giving the Web3 trade the regulatory readability it has been asking for over time.

The Trump Administration additionally dismantled a crypto enforcement unit throughout the US Justice Division, in addition to eased enforcement and appointed extra crypto-friendly management throughout quite a few regulatory businesses, together with the SEC.

The SEC’s Crypto Job Power is hitting the highway and internet hosting a collection of roundtables throughout the nation to supply alternatives for extra stakeholders to supply suggestions and to listen to from representatives of crypto-related tasks.

Particulars 👉https://t.co/AIj4oFvUQV pic.twitter.com/hbB9T9EDyH

— U.S. Securities and Trade Fee (@SECGov) August 22, 2025

In July, the President’s crypto working group additionally launched a report laying out a roadmap for Trump’s mission to make the US the “crypto capital of the world.”

A complete of 18 suggestions had been made to the CFTC, two of that are involved with the company straight. The remaining suggestions in regards to the CFTC concerned different businesses such because the SEC and US Treasury.

That led to the CFTC launching an aggressive “Crypto Dash” initiative at the beginning of the month, which acts on the steering obtained from the White Home.

The initiative has two phases and is designed to quickly roll out guidelines for cryptos and different digital property. As a part of the initiative, the CFTC moved ahead to permit spot buying and selling of digital property on registered futures exchanges, and not too long ago began “stakeholder engagement” on the entire suggestions made within the White Home’s report.

“The Trump Administration has ushered in a brand new daybreak for crypto, and it’s as much as market members to grab this chance to be part of the Golden Age of innovation,” Pham mentioned in an Aug. 21 assertion.

“Underneath President Trump’s sturdy management and imaginative and prescient, the CFTC is full pace forward on enabling rapid buying and selling of digital property on the Federal stage in coordination with the SEC’s Venture Crypto,” Pham added.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection