The outlook for the crypto market within the second half of 2025 stays constructive, in response to Coinbase Institutional, which highlights a mixture of macroeconomic tendencies, enhancing regulatory readability, and growing company involvement as key tailwinds.

The agency’s report, authored by David Duong, World Head of Analysis at Coinbase Institutional, outlines situations favorable for additional development throughout the digital asset area, together with a possible new all-time excessive for Bitcoin.

Elements reminiscent of anticipated Federal Reserve charge cuts, stabilizing financial indicators, and bipartisan legislative momentum round crypto coverage contribute to the agency’s optimistic stance.

Nonetheless, Coinbase’s analysis acknowledges dangers, significantly the rise of company entities utilizing debt to build up digital property. These leveraged methods, whereas accelerating adoption, can also introduce structural vulnerabilities if liquidity situations tighten or investor sentiment shifts.

With corporations now capable of report crypto at truthful market worth following rule adjustments from the Monetary Accounting Requirements Board in late 2024, stability sheets holding BTC and different digital property have gotten extra frequent. Nonetheless, the usage of convertible debt to fund such methods presents issues round potential promoting stress during times of market stress.

Leveraged Company Methods Increase Considerations About Market Stability

As of mid-2025, roughly 228 publicly traded corporations collectively maintain greater than 820,000 BTC, in response to information cited by Coinbase. Round 20 of these corporations, and several other others with publicity to Ethereum, Solana, and XRP, are pursuing leveraged acquisition methods impressed by corporations like Technique (previously MicroStrategy).

Duong notes that whereas these approaches haven’t but created instant instability, the dearth of standardized funding fashions might turn out to be problematic over time.

If market situations deteriorate or debt maturities strategy, corporations could be compelled to promote giant parts of their crypto reserves to satisfy obligations, doubtlessly amplifying volatility.

Coinbase estimates that many of the excellent debt from these corporations received’t mature till 2029 or later, which can assist mitigate short-term threat. Moreover, if loan-to-value ratios stay reasonable, the businesses concerned should still have entry to refinancing or liquidity administration choices that scale back the chance of pressing asset liquidations.

Nonetheless, Duong cautions that systemic vulnerabilities stay tough to trace, and broader company curiosity on this mannequin continues to develop, leaving open questions on how resilient these methods might be below future market stress.

Regulatory Developments and Broader Outlook

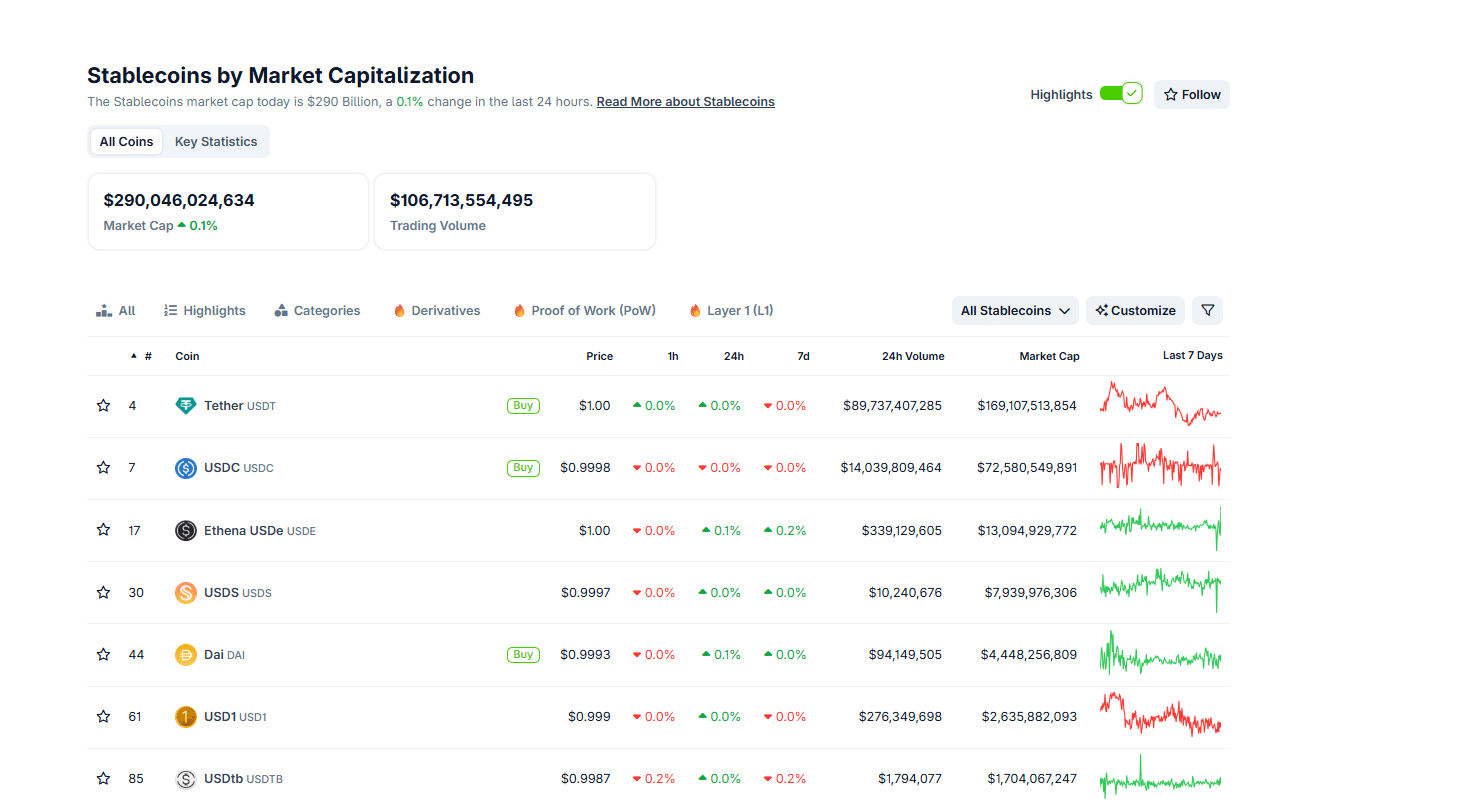

The US regulatory atmosphere can be evolving, with pending laws such because the GENIUS, STABLE, and CLARITY Acts doubtlessly reshaping the crypto market by August.

These payments purpose to make clear oversight roles between the SEC and CFTC, outline stablecoin requirements, and supply guardrails for institutional and retail engagement.

In the meantime, the SEC is reviewing roughly 80 crypto ETF functions, starting from staking-enabled merchandise to single-asset altcoin funds, with choices anticipated between July and October.

Coinbase concludes that whereas dangers are current, particularly from leveraged gamers, the long-term trajectory for Bitcoin stays upward. The agency expects broader macro tendencies, institutional adoption, and regulatory progress to assist continued growth by way of the top of 2025, with choose altcoins additionally positioned to profit based mostly on project-specific fundamentals.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.