On January 22, Coinbase submitted a letter addressed to the US Treasury’s Monetary Crimes Enforcement Community (FinCEN) as a response to the discover of proposed rulemaking (NPRM). The letter challenges the concept crypto-mixing companies are used primarily for unlawful actions and cash laundering.

Lack Of A “Minimal Threshold” Within the New Guidelines

On Monday Evening, Coinbase’s Chief Authorized Officer (CLO), Paul Grewal, took to the X social media platform (previously referred to as Twitter) to current Coinbase’s ideas on the US Treasury’s proposed rule on crypto mixing.

As Grewal explains within the thread, the alternate’s place on laws is supportive so long as they’re “efficient.” Nonetheless, it doesn’t think about the case with “bulk information assortment and reporting necessities for all transactions involving any crypto mixing–even with no indication of suspicious exercise.”

The NPRM “proposes requiring home monetary establishments to implement recordkeeping and reporting necessities on transactions involving convertible digital forex (CVC) mixing,” because the letter states.

The CLO highlights two key factors that problem the NPRM within the letter. The primary level focuses on the shortage of a “regulatory hole” to be crammed as Exchanges like Coinbase are already required to “examine and report suspicious mixing exercise” related to the platforms.

Grewal additionally questions why the US Treasury requested to obtain studies of non-suspicious exercise alongside the suspicious information.

The second level emphasizes that the shortage of a “minimal threshold” within the new proposed guidelines will solely result in bulk reporting, as “all mixing must be reported, no matter how small the values.” He notes that Coinbase agrees with Congress’s earlier assertion that this information dump wastes time and sources.

Grewal believes that the US Treasury ought to help exchanges in assembly their obligation to report suspicious mixing exercise to correctly concentrate on the difficulty of convertible digital forex (CVC)’s unlawful mixing. Lastly, the CLO added some subjections that may very well be helpful if a brand new rule for crypto mixing regulation is important.

If a brand new rule is required, no less than: A/ add a cash threshold to attenuate the unhelpful info reported and mitigate the heavy burden this poses on exchanges; B/ make the rule a recordkeeping – not reporting – requirement; and C/ present an prolonged implementation interval.…

— paulgrewal.eth (@iampaulgrewal) January 22, 2024

Grewal highlights that “particular steerage is simpler than necessary bulk studies,” a sentiment that appears to align with the ideas of Consensys’ Director of World Regulatory Issues Invoice Hughes, who shared on X the important thing factors of the letter that the blockchain software program firm despatched as a response to the US Treasury on January 22 as properly. He said:

Right now, @Consensys submitted a letter to FinCEN regarding its proposal to have regulated monetary intermediaries surveil and report exercise referring to crypto token mixers. TLDR: if this has to occur, then please make it slim sufficient to not do actual harm to the ecosystem and its customers.

The Significance Of Monetary Privateness

Some earlier crypto mining laws have led to sanctions for crypto mixers and bans that forestall US crypto customers and companies from working with them. Most notably, in August 2022, the US Treasury sanctioned Twister Money for allegedly failing to “impose efficient controls” that may forestall it from laundering funds for malicious cyber actors, ensuing within the service being blacklisted and the arrest of one of many builders.

Though crypto mixers can be utilized for illicit actions, identical to some other instrument or asset, the principle function of the sort of instrument is to assist customers protect their privateness on the subject of crypto transactions by making them tougher to hint.

These instruments can assist shield crypto customers and improve their safety and identification from potential malicious events making an attempt to trace a person’s transaction historical past.

There could be many causes behind the need to maintain their anonymity. Nevertheless, as Coinbase’s letter states, “There’s nothing suspicious or illicit in needing such a modicum of monetary privateness from the world.”

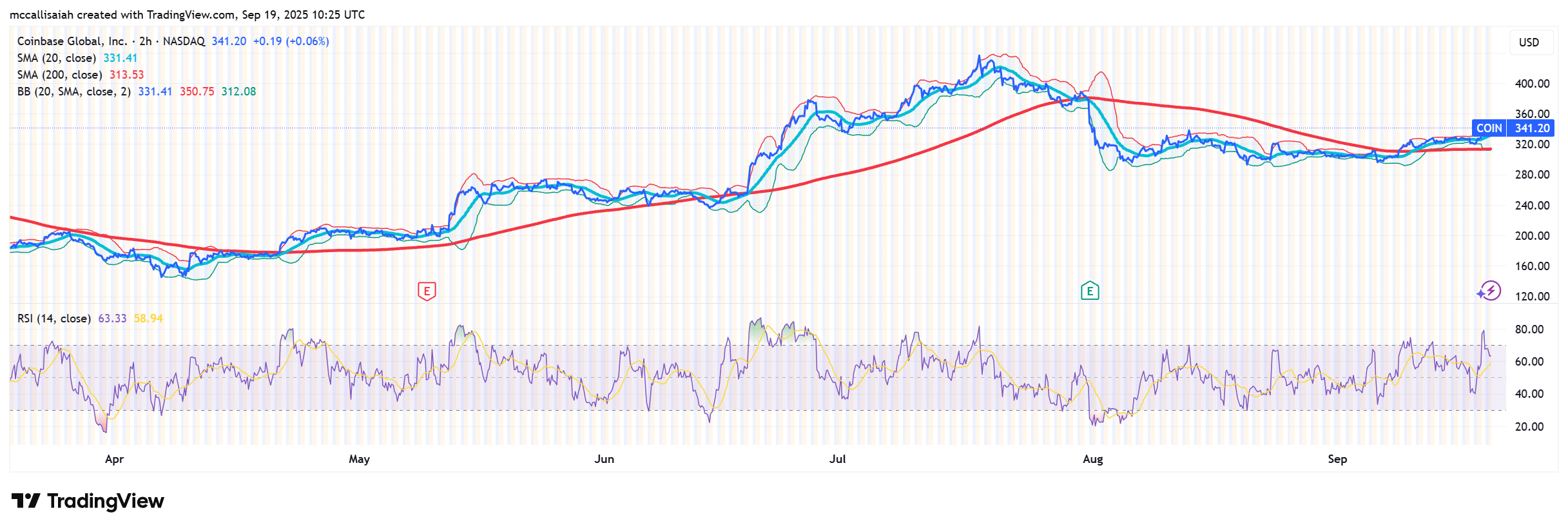

COIN is buying and selling at $121.49 within the every day chart. Supply: COIN on TradingView.com

Featured picture from Unsplash.com, Chart from Tradingview.com