Simply as Amazon laid the rails for the digital financial system, Metaplanet president Simon Gerovich says his firm is constructing the brand new monetary infrastructure. And he argues that the market usually misprices corporations in durations of structural change, obsessing over value whereas lacking the facility beneath the hood.

Like Jeff Bezos’ well-known comment throughout Amazon’s dot-com crash, “The inventory will not be the corporate, and the corporate will not be the inventory,” Gerovich frames Metaplanet as a case research in misunderstood worth, with laborious numbers and historic perspective to bolster his case.

Metaplanet fundamentals stronger than ever

To say Metaplanet’s efficiency this yr is spectacular could be an understatement of epic proportions. Q3 Bitcoin revenue income soared to ¥2.44 billion, up 115.7% quarter-over-quarter. Working revenue smashed forecasts by 88%, and of all public corporations globally, solely three now maintain extra Bitcoin.

Metaplanet now owns over 30,000 BTC, at present valued at roughly $3.7 billion. The stability sheet is pristine, with leverage underneath 1%, a rarity amongst crypto-heavy corporations.

Quick-term value ache is plain: Metaplanet’s inventory has slid, a blow for group morale and for traders. However as with Amazon within the early 2000s, share value and firm worth can stay out of sync for prolonged durations.

Is the Amazon parable believable?

Critics referred to as Gerovich’s comparability to Amazon “ridiculous,” but he remained undaunted. Early Amazon skeptics noticed a glorified on-line bookstore, lacking the multitrillion-dollar rails being laid for the whole digital financial system.

In the present day, he argues, Metaplanet isn’t only a “Bitcoin holding firm.” It’s constructing monetary infrastructure for a brand new financial epoch, with complete addressable market (TAM) measured within the a whole lot of trillions (the present valuation of fiat financial belongings globally).

A mannequin as previous as banking, as lean as a startup

Metaplanet’s enterprise is nothing new: internet curiosity margin. Banks borrow at one fee, lend at a better one, and pocket the distinction. The essential twist is that Metaplanet’s unfold is generated by holding Bitcoin as a reserve asset, funded with practically costless yen.

Japanese households and companies at present maintain over $10 trillion in idle yen, incomes near-zero curiosity, the uncooked materials for Metaplanet’s higher-yielding mannequin.

Metaplanet doesn’t have the massive overheads and forms of conventional banks. Buyers who purchase its inventory already profit from its Bitcoin-focused technique. The corporate can also be taking a look at methods to supply dependable, higher-yield choices for individuals in Japan who need higher returns; concepts that might develop worldwide.

The massive image: Bitcoin as pristine collateral

Metaplanet’s guess is straightforward but bold: Bitcoin is changing into the world’s hardest collateral. The migration of traders, from JPY earners to international USD swimming pools, will search yield, security, and return, and Metaplanet is constructing the bridge to facilitate that shift.

There’s greater than $100 trillion sitting in international financial savings and banking accounts, incomes lower than inflation. If Bitcoin turns into extra broadly accepted, as Metaplanet believes, even a small portion of that cash transferring into Bitcoin may dramatically change the corporate’s progress and worth.

Nice corporations usually look most undervalued simply as their moat deepens and the market can’t see over the near-term horizon. Metaplanet’s thesis is that the Bitcoin stability sheet isn’t a gimmick, however the linchpin for a $100 trillion+ yield alternative. As Gerovich states:

“This isn’t small imaginative and prescient. It is among the largest alternatives in international markets. For those who don’t but see it, that’s comprehensible—most didn’t see Amazon both.”

The market won’t “get it” but, however historical past reveals the basics ought to ultimately power a repricing. And identical to Amazon, constructing one thing new usually means ready for the market to catch up.

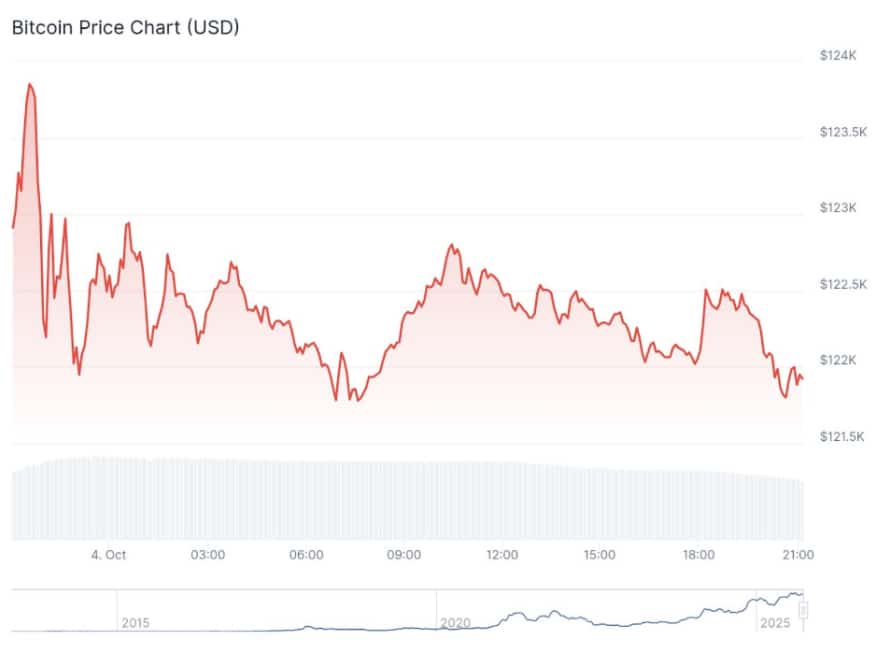

On the time of press 12:02 pm UTC on Oct. 4, 2025, Bitcoin is ranked #1 by market cap and the value is up 1.35% over the previous 24 hours. Bitcoin has a market capitalization of $2.43 trillion with a 24-hour buying and selling quantity of $74.41 billion. Study extra about Bitcoin ›

On the time of press 12:02 pm UTC on Oct. 4, 2025, the entire crypto market is valued at at $4.17 trillion with a 24-hour quantity of $195.52 billion. Bitcoin dominance is at present at 58.36%. Study extra concerning the crypto market ›

Talked about on this article