Cryptocurrency change

Bullish made a shocking Wall Road debut yesterday (Wednesday), with

shares greater than doubling to provide the corporate a virtually $13.2

billion valuation and mint two new crypto billionaires within the

course of.

The

firm’s inventory opened at $90 and climbed as excessive as $118 earlier than

settling at $68 – an 84% acquire from its $37 IPO value. The debut

marked one of many 12 months’s most profitable public choices and alerts

rising mainstream acceptance of digital belongings.

Bullish raised $1.1 billion within the providing after pricing shares above

its already-raised vary of $32–$33. The corporate had initially focused a

extra conservative valuation however investor demand pressured underwriters

to spice up the value.

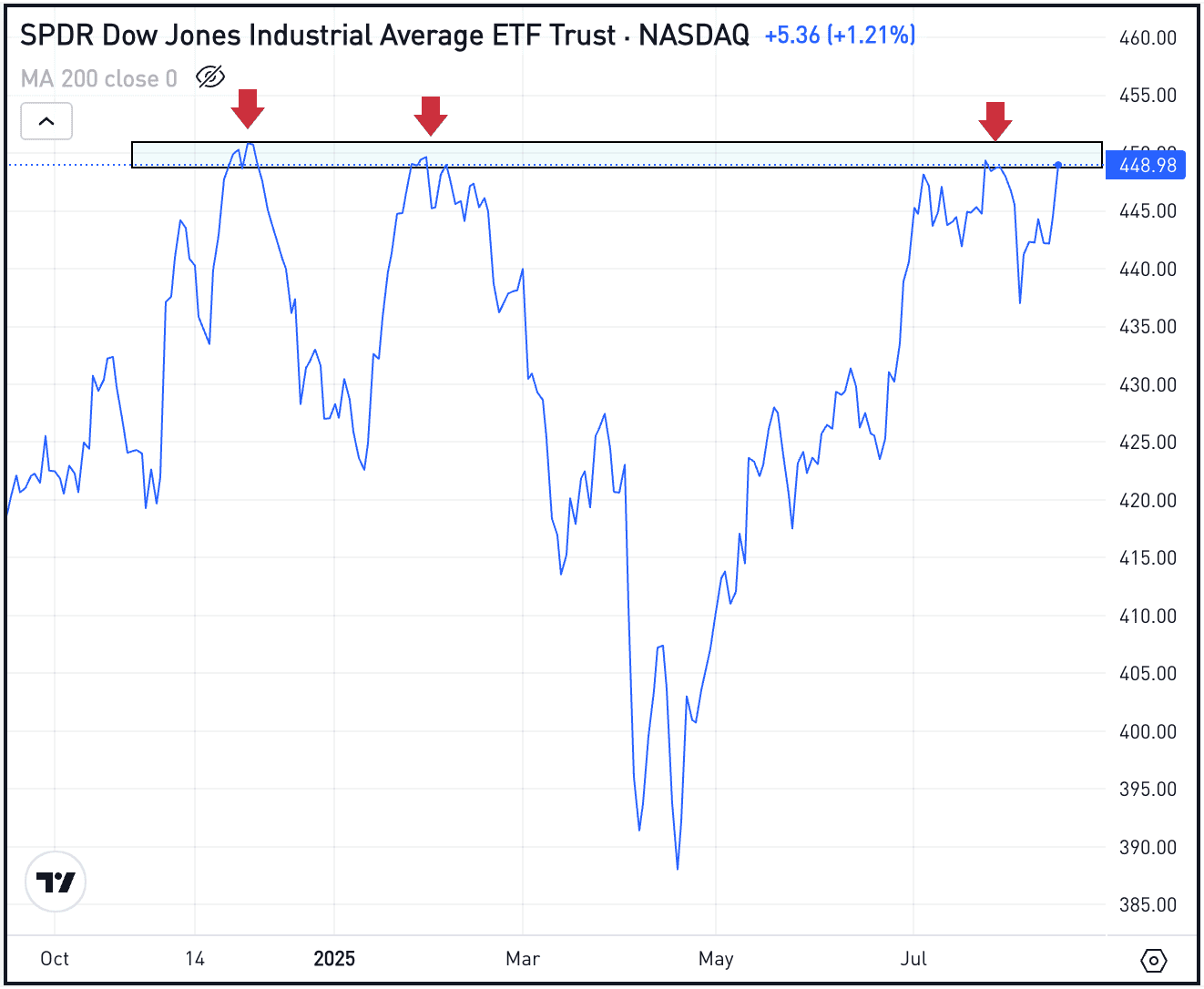

Bullish inventory value after IPO. Supply: Yahoo Finance

Bullish’s

profitable IPO provides to a rising wave

of retail buying and selling corporations going public. The corporate joins an more and more

crowded discipline of current debuts together with eToro, the Israeli-founded fintech

that went public on Nasdaq in Might. eToro raised roughly $620 million at a

$52 IPO value, giving it a valuation of about $4.2 billion.

The NYSE welcomes @Bullish, the digital asset change, to have a good time its IPO! $BLSH@CoinDesk | @ThomasFarley https://t.co/83XyhdrM3l

— NYSE 🏛 (@NYSE) August 13, 2025

Like

Bullish, eToro additionally noticed robust first-day efficiency, opening

at $69.69 and shutting at $67 – a 29% acquire from its providing value. Nevertheless,

in contrast to Bullish’s institutional focus, eToro targets retail traders with its

social buying and selling platform that permits customers to repeat methods of profitable

merchants.

Founders Be a part of

Billionaire Ranks

The

public itemizing catapulted co-founders Brendan

Blumer and Kokuei Yuan into the billionaire membership.

Blumer, who serves as a board member, now holds a 30.1% stake

value roughly $2.8 billion. Yuan, additionally a board member,

owns 26.7% valued at $2.5 billion.

Each males

beforehand struck gold in 2018 when their firm Block.one

raised $4.2 billion by the biggest preliminary coin providing in

crypto historical past. That enterprise, which created the EOS blockchain,

delivered early traders returns exceeding 6,500% earlier than the

Securities and Change Fee later charged the corporate with

promoting unregistered securities.

“We have

gone public right now, and there is a slew of others which can be going

to comply with us, and I believe that’s web useful, as a result of it

provides folks extra choices when it comes to how they entry this asset

class,” Bullish President Chris Tyrer advised Reuters.

The primary

plans to go public emerged in 2022, however

Bullish finally terminated the SPAC merger deal.

Institutional Play in

Crypto Increase

Not like

retail-focused rival Coinbase, Bullish targets institutional

purchasers – a technique that analysts say positions the

firm for steadier income streams. The change has processed $1.25

trillion in complete transactions by March and affords spot, margin

and derivatives buying and selling.

The

timing could not be higher. Company treasuries are

including crypto to their steadiness sheets, change -traded funds are

drawing billions in inflows, and regulatory readability underneath the

present White Home has emboldened institutional traders. Bitcoin

not too long ago hit file highs above $120,000.

“A

pure institutional technique positions Bullish for

extra secure, recurring income than exchanges reliant on

retail volumes, which are usually cyclical and sentiment-driven,”

mentioned Michael Corridor, co-chief funding officer at Nickel Digital

Asset Administration.

Pedigreed Management

CEO Tom

Farley, the previous New York Inventory Change president,

brings Wall Road credibility that would show essential for

profitable institutional mandates. His stake within the firm is

now value $355 million.

“For a

sector nonetheless overcoming reputational headwinds, that form of

management expertise is usually a differentiator in securing

institutional mandates,” Corridor famous.

The corporate

plans to transform a lot of its IPO proceeds into stablecoins,

dollar-pegged cryptocurrencies which have boomed since President

Trump signed laws making a regulatory framework for

the tokens.

Extra Crypto IPOs

Coming

Bullish joins Coinbase

as the one main crypto change buying and selling on U.S. markets. However

that exclusivity will not final lengthy – change operator

Gemini and asset supervisor

Grayscale have each confidentially filed to go public.

The

firm can be the father or mother of crypto information web site

CoinDesk, which it acquired from Digital Forex Group

for $72.6 million in 2023.

Based in

2021 with backing from Block.one, Bullish initially acquired

about $10 billion in seed belongings together with 164,000 Bitcoin. The

firm nonetheless holds greater than 24,000 Bitcoin value over $1.7 billion

as of March.

Blumer, who

gave up his U.S. citizenship in 2020 and now lives within the Cayman

Islands, not too long ago made headlines for buying a €170 million villa

in Sardinia – one of many largest residential offers in Italian

historical past.

The

profitable debut gives a much-needed confidence increase for

crypto corporations eyeing public markets after years of regulatory

uncertainty and market volatility.

Cryptocurrency change

Bullish made a shocking Wall Road debut yesterday (Wednesday), with

shares greater than doubling to provide the corporate a virtually $13.2

billion valuation and mint two new crypto billionaires within the

course of.

The

firm’s inventory opened at $90 and climbed as excessive as $118 earlier than

settling at $68 – an 84% acquire from its $37 IPO value. The debut

marked one of many 12 months’s most profitable public choices and alerts

rising mainstream acceptance of digital belongings.

Bullish raised $1.1 billion within the providing after pricing shares above

its already-raised vary of $32–$33. The corporate had initially focused a

extra conservative valuation however investor demand pressured underwriters

to spice up the value.

Bullish inventory value after IPO. Supply: Yahoo Finance

Bullish’s

profitable IPO provides to a rising wave

of retail buying and selling corporations going public. The corporate joins an more and more

crowded discipline of current debuts together with eToro, the Israeli-founded fintech

that went public on Nasdaq in Might. eToro raised roughly $620 million at a

$52 IPO value, giving it a valuation of about $4.2 billion.

The NYSE welcomes @Bullish, the digital asset change, to have a good time its IPO! $BLSH@CoinDesk | @ThomasFarley https://t.co/83XyhdrM3l

— NYSE 🏛 (@NYSE) August 13, 2025

Like

Bullish, eToro additionally noticed robust first-day efficiency, opening

at $69.69 and shutting at $67 – a 29% acquire from its providing value. Nevertheless,

in contrast to Bullish’s institutional focus, eToro targets retail traders with its

social buying and selling platform that permits customers to repeat methods of profitable

merchants.

Founders Be a part of

Billionaire Ranks

The

public itemizing catapulted co-founders Brendan

Blumer and Kokuei Yuan into the billionaire membership.

Blumer, who serves as a board member, now holds a 30.1% stake

value roughly $2.8 billion. Yuan, additionally a board member,

owns 26.7% valued at $2.5 billion.

Each males

beforehand struck gold in 2018 when their firm Block.one

raised $4.2 billion by the biggest preliminary coin providing in

crypto historical past. That enterprise, which created the EOS blockchain,

delivered early traders returns exceeding 6,500% earlier than the

Securities and Change Fee later charged the corporate with

promoting unregistered securities.

“We have

gone public right now, and there is a slew of others which can be going

to comply with us, and I believe that’s web useful, as a result of it

provides folks extra choices when it comes to how they entry this asset

class,” Bullish President Chris Tyrer advised Reuters.

The primary

plans to go public emerged in 2022, however

Bullish finally terminated the SPAC merger deal.

Institutional Play in

Crypto Increase

Not like

retail-focused rival Coinbase, Bullish targets institutional

purchasers – a technique that analysts say positions the

firm for steadier income streams. The change has processed $1.25

trillion in complete transactions by March and affords spot, margin

and derivatives buying and selling.

The

timing could not be higher. Company treasuries are

including crypto to their steadiness sheets, change -traded funds are

drawing billions in inflows, and regulatory readability underneath the

present White Home has emboldened institutional traders. Bitcoin

not too long ago hit file highs above $120,000.

“A

pure institutional technique positions Bullish for

extra secure, recurring income than exchanges reliant on

retail volumes, which are usually cyclical and sentiment-driven,”

mentioned Michael Corridor, co-chief funding officer at Nickel Digital

Asset Administration.

Pedigreed Management

CEO Tom

Farley, the previous New York Inventory Change president,

brings Wall Road credibility that would show essential for

profitable institutional mandates. His stake within the firm is

now value $355 million.

“For a

sector nonetheless overcoming reputational headwinds, that form of

management expertise is usually a differentiator in securing

institutional mandates,” Corridor famous.

The corporate

plans to transform a lot of its IPO proceeds into stablecoins,

dollar-pegged cryptocurrencies which have boomed since President

Trump signed laws making a regulatory framework for

the tokens.

Extra Crypto IPOs

Coming

Bullish joins Coinbase

as the one main crypto change buying and selling on U.S. markets. However

that exclusivity will not final lengthy – change operator

Gemini and asset supervisor

Grayscale have each confidentially filed to go public.

The

firm can be the father or mother of crypto information web site

CoinDesk, which it acquired from Digital Forex Group

for $72.6 million in 2023.

Based in

2021 with backing from Block.one, Bullish initially acquired

about $10 billion in seed belongings together with 164,000 Bitcoin. The

firm nonetheless holds greater than 24,000 Bitcoin value over $1.7 billion

as of March.

Blumer, who

gave up his U.S. citizenship in 2020 and now lives within the Cayman

Islands, not too long ago made headlines for buying a €170 million villa

in Sardinia – one of many largest residential offers in Italian

historical past.

The

profitable debut gives a much-needed confidence increase for

crypto corporations eyeing public markets after years of regulatory

uncertainty and market volatility.

![[LIVE] Latest Crypto News, August 14 – Bitcoin Price Hits A New ATH Over $124K: Next Crypto To Explode? [LIVE] Latest Crypto News, August 14 – Bitcoin Price Hits A New ATH Over $124K: Next Crypto To Explode?](https://s.w.org/images/core/emoji/16.0.1/72x72/1f4a5.png)