A crypto pockets linked to the infamous $300 million Coinbase hack has reappeared with one other suspicious transfer on the Ethereum blockchain.

Over the weekend, the deal with acquired 3,976 ETH price roughly $18.9 million, in response to on-chain information from Arkham Intelligence. The acquisition was executed utilizing 18.9 million DAI, a stablecoin, and break up throughout a number of transactions earlier than being consolidated into the purchase.

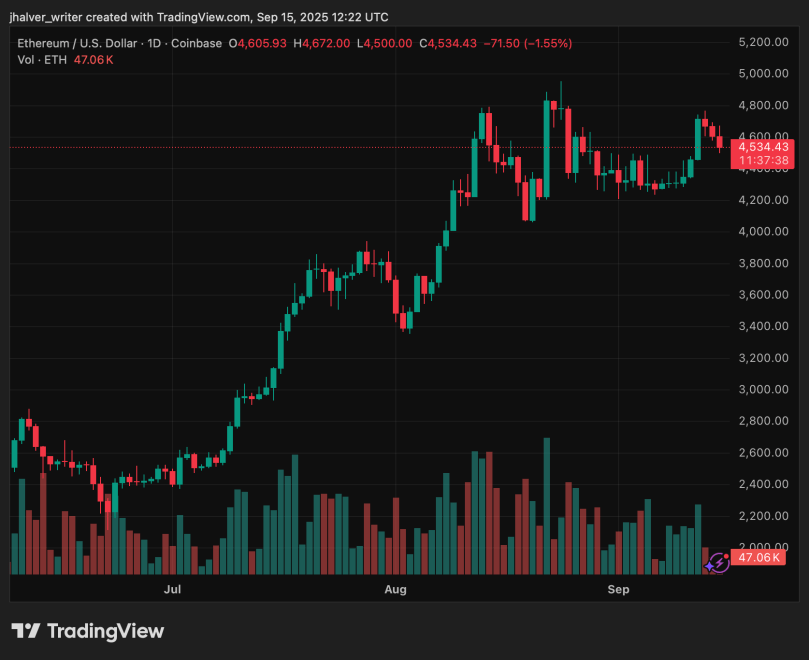

The transaction got here simply as Ethereum broke above $4,700, marking its highest stage in additional than two weeks. At the moment, ETH trades at $4,538, down 2.9% previously 24 hours.

ETH’s worth developments to the upside on the each day chart. Supply: ETHUSD on Tradingview

A Sample of Daring Acquisitions

This isn’t the primary time the pockets has made waves. In July, it purchased 4,863 ETH for $12.6 million and later added 649 ETH at $3,562 per token. Simply final month, the identical pockets scooped up $8 million price of Solana (SOL), although that place has since slipped beneath entry worth.

Analysts say the technique exhibits deliberate fund consolidation, usually seen in cash laundering techniques. Breaking transactions into smaller quantities and utilizing privateness instruments permits the hacker to masks actions, making monitoring tougher.

Blockchain investigator ZachXBT beforehand estimated that the Coinbase-related social engineering rip-off drained at the very least $330 million from victims, warning that the actual determine could also be considerably larger.

Rising Considerations Over Rising Crypto Hacks

The most recent Ethereum buy exhibits broader considerations within the crypto business, the place hack-related losses reached $163 million in August alone, in response to safety agency PeckShield.

With exploits shifting from sensible contract bugs to social engineering and cross-chain bridge vulnerabilities, wallets like this proceed to pose a significant risk to investor confidence.

Regardless of Coinbase providing a $20 million reward for data on the perpetrators and tightening safety, the hacker stays unidentified. The most recent $19M ETH seize proves the resilience and boldness of cybercriminals working within the house.

As crypto rallies and institutional inflows develop, the query stays: is the hacker merely driving bullish momentum, or is that this a part of a deeper technique to launder stolen funds? Regulators and blockchain investigators are watching intently, however for now, the crypto world is left with extra questions than solutions.

Cowl picture from ChatGPT, ETHUSD chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.