MakerDAO, the main DeFi platform, has revealed a major $1 billion funding in tokenized US Treasury securities in a transfer that has rocked the crypto trade. This strategic motion is more likely to change the essential rules of the decentralized finance (DeFi) ecosystem.

Main Gamers Enhance Tokenization

Widespread reward has been given to MakerDAO’s option to broaden its portfolio exterior of its most important Ethereum dependence. With a startling $1 billion allotted to tokenized US Treasuries, the platform is just not solely lessening its over-concentration on one asset but in addition supporting the thought and way forward for tokenized real-world property (RWAs).

As MakerDAO’s entry into the $2 billion tokenized RWA market establishes a brand new norm for the sector, this motion is anticipated to drive extra growth and enlargement on this market.

🚨 MakerDAO’s $1B Tokenized Treasury Funding: Main Gamers Dive In!

MakerDAO’s $1B play into tokenized U.S. Treasuries is shaking up the market.

Heavyweights like BlackRock’s BUIDL, Superstate, and Ondo Finance are vying for a chunk.

MKR token noticed a 5% enhance on this information.… pic.twitter.com/ACGOZDeGGg

— Crypto City Corridor (@Crypto_TownHall) July 14, 2024

The participation of main gamers like BlackRock’s BUIDL, Superstate, and Ondo Finance provides much more to the relevance of this development. The involvement of those behemoths factors to the strategic necessity of tokenizing standard monetary merchandise akin to treasuries slightly than solely a development.

As these huge gamers unfold all through the DeFi terrain, the convergence of legacy banking and blockchain expertise will get more and more evident.

MKR Token Positive aspects Momentum

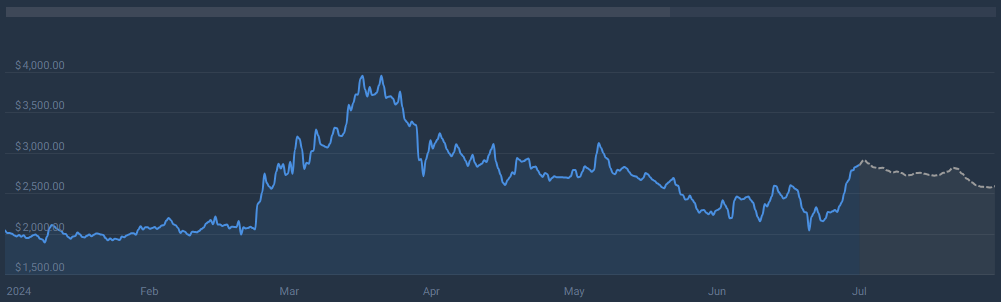

MakerDAO’s native token, MKR, has seen a 30% enhance in worth following this information, which displays the nice sentiment amongst merchants and traders.

In the meantime, the latest Maker value projection exhibits a 9.22% drop from its current values, the MKR token is predicted to succeed in $2,597 by August 14, 2024.

However the total optimistic outlook mixed with a present Worry & Greed Index score of 52 (Impartial) factors to an opportune second for traders to consider together with MKR into their portfolios.

Integrating Crypto And Conventional Finance

Past solely a monetary selection, MakerDAO’s $1 billion buy in tokenized US Treasuries is a powerful declaration in regards to the future for decentralized finance and the junction of standard monetary devices with blockchain expertise.

This motion exhibits the platform’s dedication to pushing previous the boundaries of what’s possible within the DeFi area, resulting in recent challenges and alternatives for the entire ecosystem.

The following months are more likely to present extra cooperation and involvement between the representatives of huge monetary establishments and blockchain startups because the crypto group eagerly watches the developments.

The revolutionary motion of MakerDAO will certainly affect the event of the DeFi market in addition to the bigger monetary scene within the subsequent years.

Featured picture from Pexels, chart from TradingView