Amid the highly-anticipated approval of Bitcoin spot exchange-traded funds (ETFs), which has sparked pleasure inside the crypto trade and opened doorways for institutional investments, the Worldwide Financial Fund (IMF) managing director, Kristalina Georgieva, has expressed important views in the direction of the nascent sector.

Are Crypto Belongings Not Equal To Cash?

In a current interview with Yahoo Finance, Georgieva emphasised the excellence between cash and crypto property when discussing cryptocurrencies.

In keeping with Georgieva, crypto must be considered an asset class reasonably than a type of forex. She highlighted the alleged various ranges of safety and threat related to completely different cryptocurrencies, relying on whether or not property again them. Georgieva likened crypto to a cash administration fund reasonably than a real type of cash. The Worldwide Financial Fund Director claimed:

Our view is that we have now to distinguish between cash and property. After we discuss crypto, we are literally speaking about an asset class. It might be backed up and in that sense, safer and fewer dangerous, or it might be not backed up and subsequently a riskier funding. However it’s not precisely cash. It’s extra like a cash administration fund

Curiously, in accordance with Yahoo, Georgieva’s feedback got here simply hours earlier than the US Securities and Alternate Fee (SEC) accredited the launch of latest spot Bitcoin-backed ETFs.

This regulatory inexperienced mild permits monetary establishments like Cathie Wooden’s Ark and BlackRock to introduce these ETFs. A complete of 11 spot Bitcoin ETFs have been accredited, enabling common traders to realize publicity to the world’s largest cryptocurrency with out the necessity to personal it immediately.

Whereas the debut of the Bitcoin ETFs marks a major milestone for the crypto trade and alerts rising institutional acceptance, Georgieva stays cautious concerning the potential of cryptocurrencies to rival conventional currencies just like the US greenback.

Georgieva underlined the greenback’s dominance, which is “supported” by the scale of the US economic system and the depth of its capital markets. Georgieva believes that any state of affairs the place cryptocurrencies problem the greenback’s stature continues to be far sooner or later and never a urgent concern.

Analyst Urges Buyers To Embrace The Bitcoin Dip

The approval of spot Bitcoin ETFs has been heralded as a landmark day for the crypto trade, with trade specialists anticipating a surge in investments.

Associated Studying: Ripple CEO Garlinghouse Will Converse At The World Financial Discussion board (WEF)

Analysts like Gautam Chhugani from Bernstein advise traders to view any minor selloffs as alternatives, emphasizing the uneven upside potential of Bitcoin. Chhugani said:

Our easy recommendation to all traders is — to purchase the dip and give attention to the brand new bitcoin adoption cycle. The minor selloffs are alternatives in view of the uneven upside forward

Then again, Coinbase Chief Monetary Officer Alesia Haas sees the ETF approval as a catalyst that can entice trillions of {dollars} beforehand unable to entry crypto property.

For the reason that approval of the ETFs, Bitcoin has skilled a retracement, at present buying and selling on the $42,700 stage, representing a 6% decline over the previous seven days. The long-term influence of the ETFs on Bitcoin’s value and the broader trade is but to be decided.

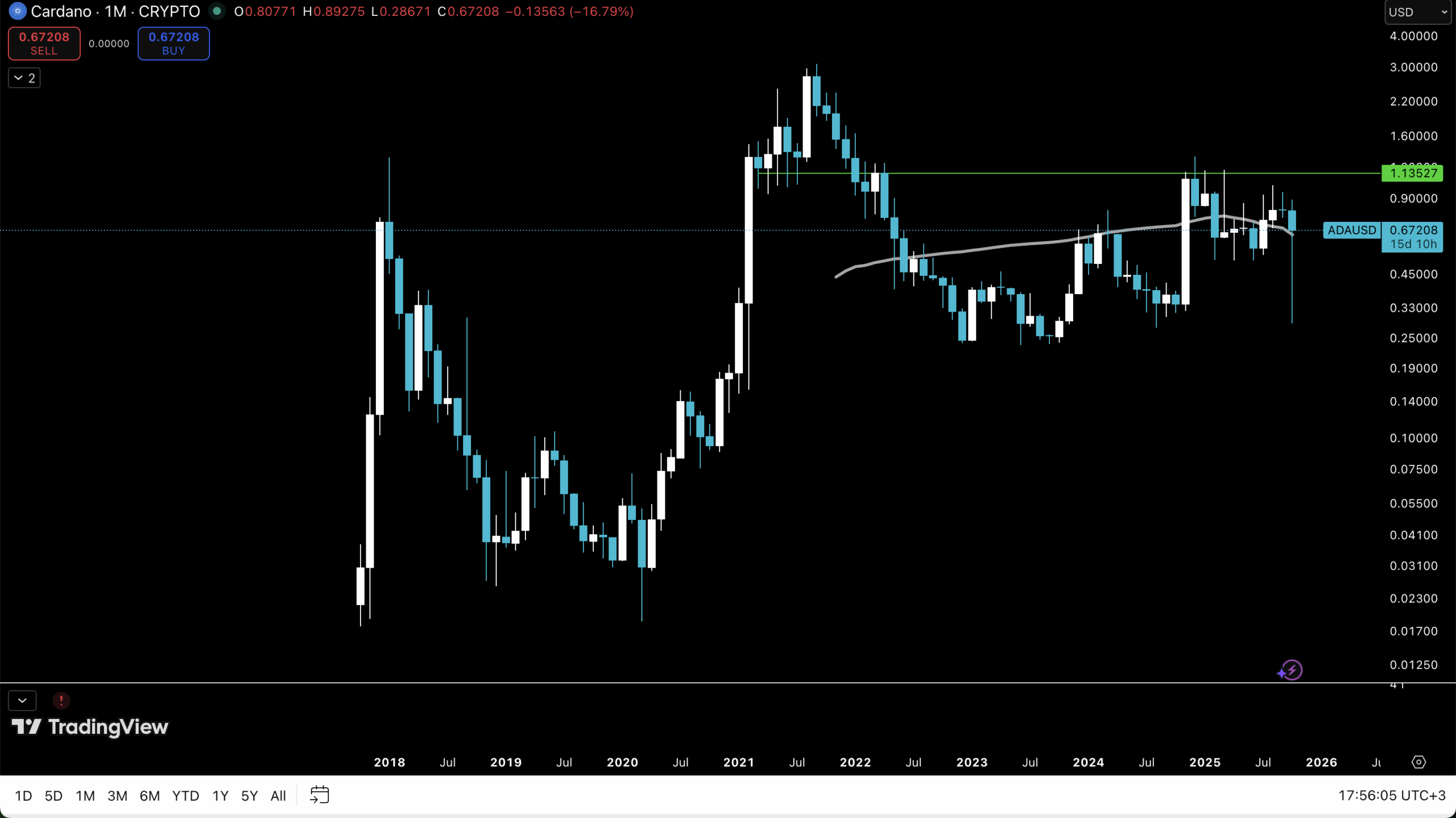

Featured picture from Shutterstock, chart from TradingView.com