South Korea’s native media, Newsis, just lately reported the case of sure crypto merchants who had despatched about $3 billion abroad in a bid to revenue from the ‘Kimichi Premium.’ Curiously, the court docket discovered 14 out of 16 of those merchants not responsible regardless of their alleged actions.

How This Group Of Crypto Merchants Operated

These crypto merchants are mentioned to have despatched these sums of cash by means of native banks below the guise of those transactions being overseas trade remittances. Nonetheless, this was allegedly not the case, as they’d then use the funds to buy digital currencies overseas and ship these crypto property again to home exchanges, the place they ultimately offload them.

This was executed to allegedly revenue from the ‘Kimichi Premium.’ This phenomenon happens when crypto property are costlier in South Korea than abroad because of the nation’s specific rules.

This has created an arbitrage alternative that crypto merchants have sought to take advantage of. In the meantime, the Korean authorities has tried to forestall merchants from doing so.

That’s the reason the prosecution charged 16 individuals, together with somebody known as Mr. A within the information report, with violating the Particular Monetary Info Act. Mr. A and others have been accused of illegally transferring overseas forex price 4.3 trillion gained ($3 billion) abroad between April 2021 and August 2022 to take advantage of the Kimichi premium allegedly.

The prosecution believes these crypto merchants made a market revenue of as a lot as 210 billion gained ($158 million). Of their protection, the defendants argued towards any wrongdoing since they weren’t exactly those facilitating the overseas trade enterprise however the financial institution.

The merchants argued they have been platform customers, not digital asset enterprise operators. The financial institution concerned additionally tried to absolve itself from the case because it claimed it carried out the transaction primarily based on the “false proof” the defendants submitted.

Court docket Finds The Defendants Not Responsible

The court docket agreed with most defendants’ arguments, acquitting 14 (together with Mr. A) out of the 16 individuals charged. An area Choose who dominated over the case opined that their actions didn’t violate the target of the International Trade Transactions Act and, subsequently, couldn’t be punished below that regulation.

The Choose added that there was “nothing to counsel that the defendants operated as digital asset enterprise operators.” If the reverse was the case, they might have been punished for not registering their enterprise or making sure disclosures as required by the regulation.

Curiously, Choose Park additional distinguished the present case from a Supreme Court docket precedent as he famous that the very best court docket didn’t “explicitly decide the problems on this case.” The prosecution already submitted an attraction, dissatisfied with the court docket’s ruling.

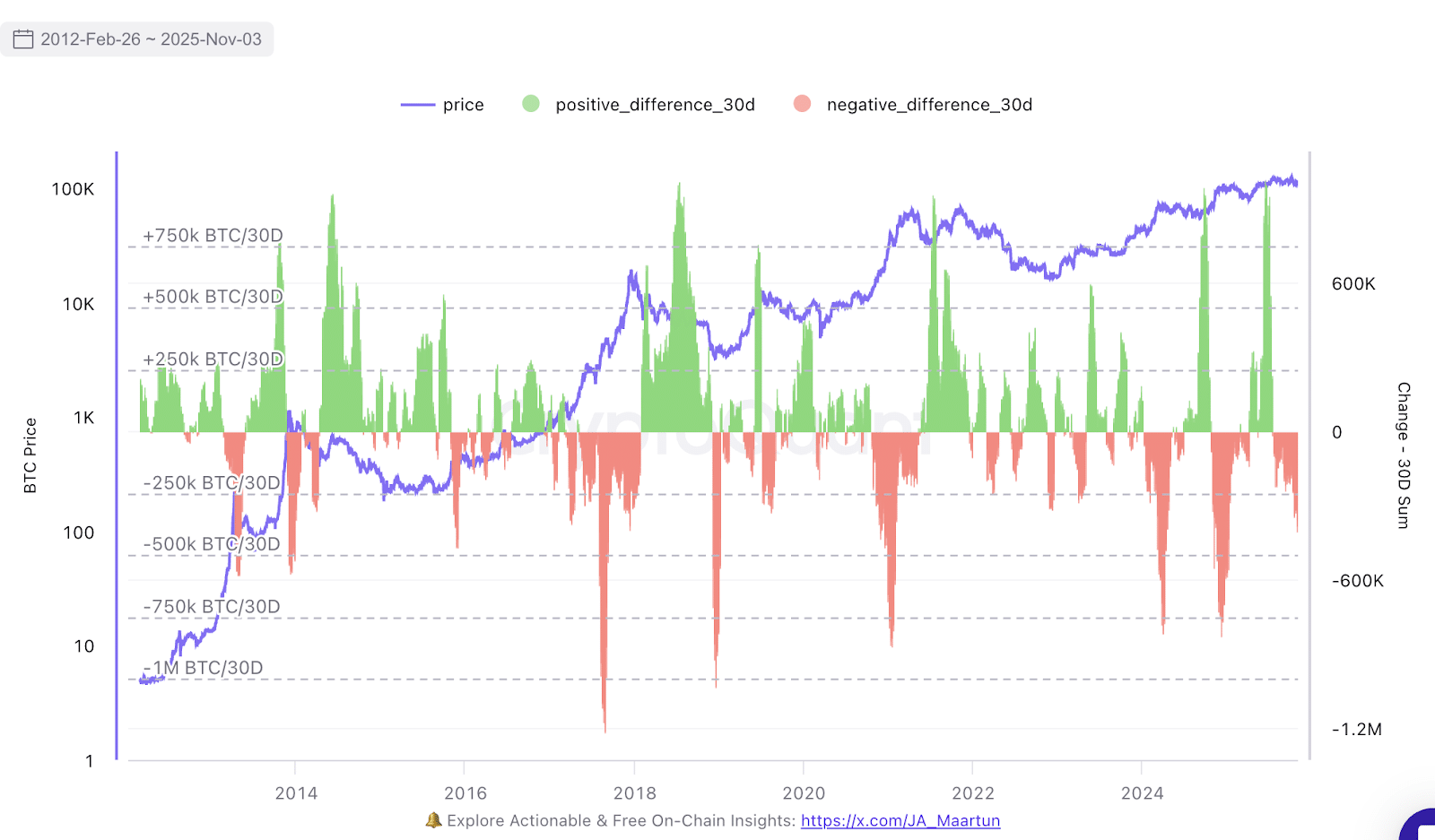

Chart from Tradingview

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site completely at your individual threat.