Apple inventory has rebounded over the previous couple of months, however has lagged the Magnificent 7 leaders. The Each day Breakdown dives deep.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our day by day insights, all it is advisable do is log in to your eToro account.

Deep Dive

Down over 7% thus far this yr, Apple is the second-worst-performing Magnificent 7 part of 2025, trailing solely Tesla. Regardless of this, Apple is certainly one of simply three corporations with a market cap of $3 trillion or extra, sitting behind Nvidia and Microsoft.

Nevertheless, Apple has discovered some momentum these days, rallying greater than 12% over the previous three months. Is that this an indication that Apple is again — or only a bounce after a flailing begin to the yr?

Digging Into the Enterprise

We all know Apple because the iPhone maker — and the corporate behind Macs, AirPods, iPads, and extra. Because of its large success, which actually dates again to the iPod and Apple Music (keep in mind that?), Apple has constructed a fortress stability sheet and generates immense money movement.

One downside although? Progress.

Whereas Apple has loved robust development over time, income and revenue development have struggled during the last a number of years. That has compelled some traders to search for development in different areas — for example, with shares like Amazon and Nvidia — even when meaning accepting extra volatility.

Dangers and Alternatives

Once we take a look at the valuation, Apple trades at just below 30x ahead earnings. That is costlier than the general market, however bulls argue that Apple nonetheless deserves a premium. As for whether or not it’s costly or low-cost based mostly by itself historic vary, Apple inventory sits someplace in between. Over the past 5 years, shares have usually been thought-about “low-cost” at round 22x to 25x earnings and “costly” above 32x.

Buyers at the moment are turning their consideration to Apple’s merchandise, with an iPhone refresh due within the coming months and a rising deal with AI.

AI developments have been anticipated to raise the person expertise, however delays have left each traders and clients questioning whether or not Apple can ship. Buyers can nonetheless count on a gentle stream of upgrades over time — together with new iPhones, iPads, Macs, and extra — nevertheless it’s the AI part they’re most desperate to see take form.

The corporate is reportedly engaged on “an formidable slate of latest units, together with robots, a lifelike model of Siri, a sensible speaker with a show, and home-security cameras,” in accordance to Bloomberg.

After all, there are dangers to this strategy — together with delays, merchandise that fail to launch, or disappointing buyer reactions. Buyers must weigh Apple’s traditionally robust enterprise towards their expectations for future income and revenue development.

Wish to obtain these insights straight to your inbox?

Enroll right here

Digging Deeper — Apple’s Companies Enterprise

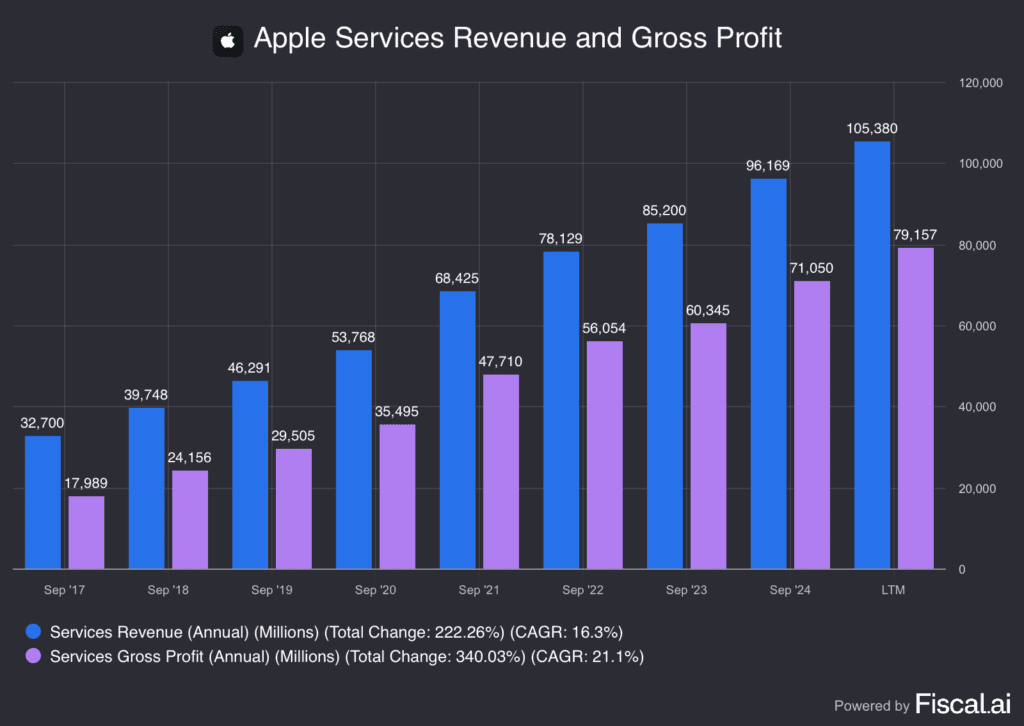

Apple’s {hardware} enterprise could also be trying to find new development shops, however its Companies enterprise — which incorporates the App Retailer, Apple Music, iCloud, Apple Pay, and extra — continues to hum alongside properly.

Income continues to develop at a stable tempo, whereas gross earnings — which command 75% gross margins and are greater than double the margins achieved with its Merchandise enterprise — additionally proceed to develop. So though it’s a a lot smaller income footprint, this phase makes up greater than 40% of gross revenue and continues to develop at a gentle clip.

That is one motive (of a number of) why Apple has been capable of stay so dedicated to its large share repurchase plan, which elevates its earnings per share — (regardless of gradual revenue development, a shrinking share rely permits earnings per share to extend).

What Wall Road’s Watching

TGT

Shares of Goal are below stress this morning, down nearly 10% after the retailer reported earnings. The corporate beat on earnings and income estimates, however gross sales stay below stress. Additional, CEO Brian Cornell introduced he’s stepping down and being changed by COO Michael Fiddelke. Goal inventory pays a dividend yield north of 4.3%.

HTZ

Hertz inventory is rallying on studies that it’s going to promote used vehicles on-line via a partnership with Amazon Autos. Clients who dwell inside 75 miles of 4 main cities — Dallas, Houston, Los Angeles and Seattle — will be capable of use the brand new service. HTZ inventory is up greater than 40% yr so far.

Disclaimer:

Please word that because of market volatility, a number of the costs could have already been reached and situations performed out.