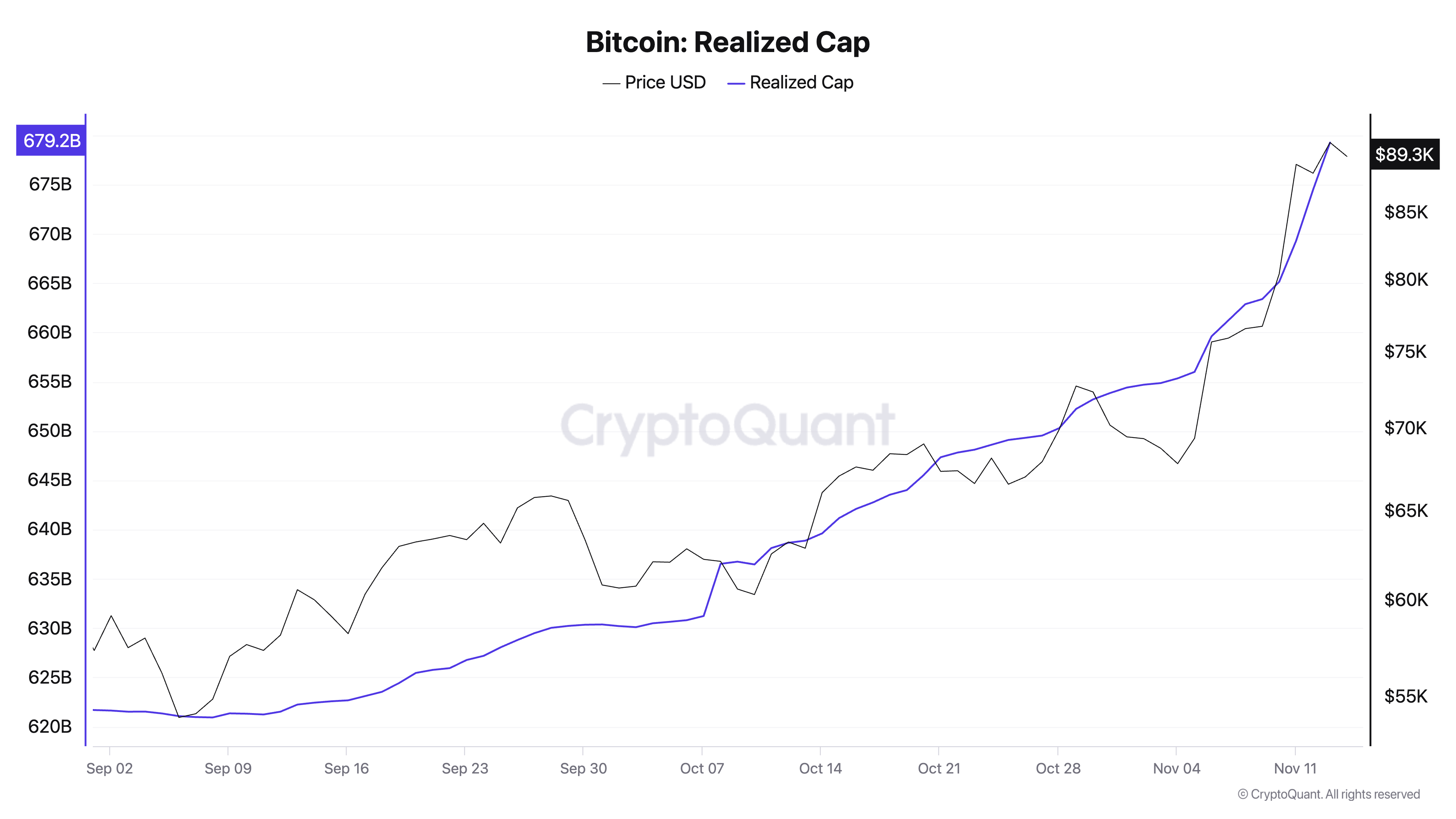

The distinction between Bitcoin’s realized cap and market cap is an underrated indicator of the phases of Bitcoin’s value cycles. The realized cap reveals Bitcoin’s worth based mostly on the final value every coin moved, displaying the precise capital invested into the asset.

When the market cap, which displays the worth of all current cash based mostly on the present spot value, considerably diverges from the realized cap, it reveals a shift in sentiment. These shifts have traditionally aligned with phases of both euphoria or worry.

A excessive market cap relative to the realized cap reveals that buyers maintain unrealized features. Whereas that is an unambiguous signal of a bullish sentiment available in the market, it could actually additionally precede potential overextension. Conversely, when the market cap dips under the realized cap, it indicators widespread capitulation and undervaluation of the asset.

The present discrepancy between Bitcoin’s market cap and realized cap displays the overwhelming bullish sentiment that has dominated the market this month.

Bitcoin’s value enhance was pushed by optimism surrounding the US presidential election. On Nov. 5, President Donald Trump’s win sparked a rally within the crypto market, as his upcoming administration is anticipated to introduce concrete, Bitcoin-focused insurance policies.

The end result of the election created a bullish momentum, with buyers gearing up for a way more favorable regulatory atmosphere for crypto. This sentiment drove Bitcoin’s value to over $90,000, establishing a brand new ATH.

The worth spike was mirrored in Bitcoin’s market cap, which elevated from $1.132 trillion initially of September to $1.789 trillion by mid-November. Most of this enhance occurred within the days following the election, indicating heightened shopping for exercise and a rush of capital into the market.

Whereas the surge positively displays the market’s enthusiasm and confidence in Bitcoin’s long-term potential underneath the Trump administration, the value itself additionally doubtless fueled speculative shopping for. Such speedy development in market cap, significantly after a serious occasion like a nationwide election, is commonly an indication of heightened hypothesis.

Whereas the market cap grew considerably, Bitcoin’s realized cap grew a lot slower. Shifting from $621.691 billion on Sep. 1 to $679.281 billion on Nov.13, the realized cap’s rise clearly reveals that new capital continues to enter the market.

This upward development in realized cap reveals that Bitcoin is being purchased and offered at progressively increased valuations, step by step setting new price foundation ranges. The election additionally appears to have accelerated this development within the realized cap, with a notable enhance from $656.006 billion on Nov.5 to $679.281 billion by Nov. 13.

The widening distinction between the market and realized cap throughout this era is especially telling. In September, the hole between the 2 stood round $510 billion; by mid-November, it had expanded to roughly $1.1 trillion.

The divergence means that Bitcoin’s present market value is considerably increased than the common value paid by holders, indicating that many buyers are actually holding substantial unrealized income. Traditionally, such a big hole has been related to market cycles nearing a euphoric part, the place optimism and hypothesis drive costs effectively past earlier ranges.

Whereas the realized cap development indicators a gradual influx of capital and continued curiosity in Bitcoin, the speedy growth of the market cap relative to the realized cap might point out an overextended market the place the valuation could also be considerably inflated by speculative shopping for.

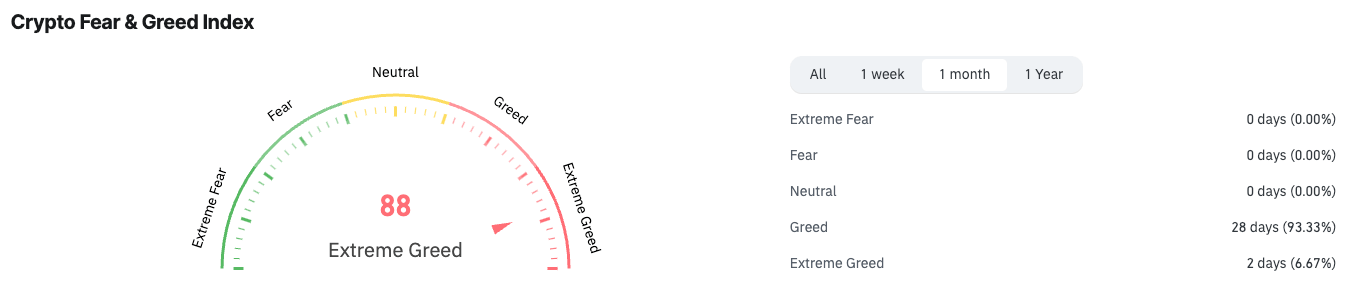

This hazard can be evident when wanting on the crypto worry and greed index, which has dipped effectively into the acute greed territory, remaining tied to greed for 28 out of the previous 30 days, in accordance with CoinGlass information.

This sample of divergence typically precedes intervals of consolidation or correction. Bitcoin’s stint at above $92,000 was comparatively short-lived and was instantly adopted by a correction to round $87,500 on Nov. 13.

The worth has since rubberbanded between roughly $87,000 and $91,500 as of press time. Quick, aggressive corrections like these will be anticipated within the coming weeks because the divergence between the market cap and realized cap persists.

If realized cap development slows or reverses within the coming weeks, it might point out that long-term holders are starting to distribute their holdings in response to persistently excessive costs. This might put further strain on value development, and we might see one other, extra prolonged correction under $90,000.

Nonetheless, the regular enhance within the realized cap to date reveals that long-term holders stay assured, including energy to this rally even because the market cap will increase.

It is going to be necessary to watch adjustments within the positions of huge institutional holders, with a specific give attention to ETFs and derivatives. The dimensions of those positions will doubtless propel motion from retail buyers and alter sentiment within the coming weeks.

The submit Divergence between Bitcoin’s market and realized caps indicators euphoria appeared first on CryptoSlate.