Bitcoin ($BTC) has progressively established itself as a standalone asset throughout the framework of asset allocation.

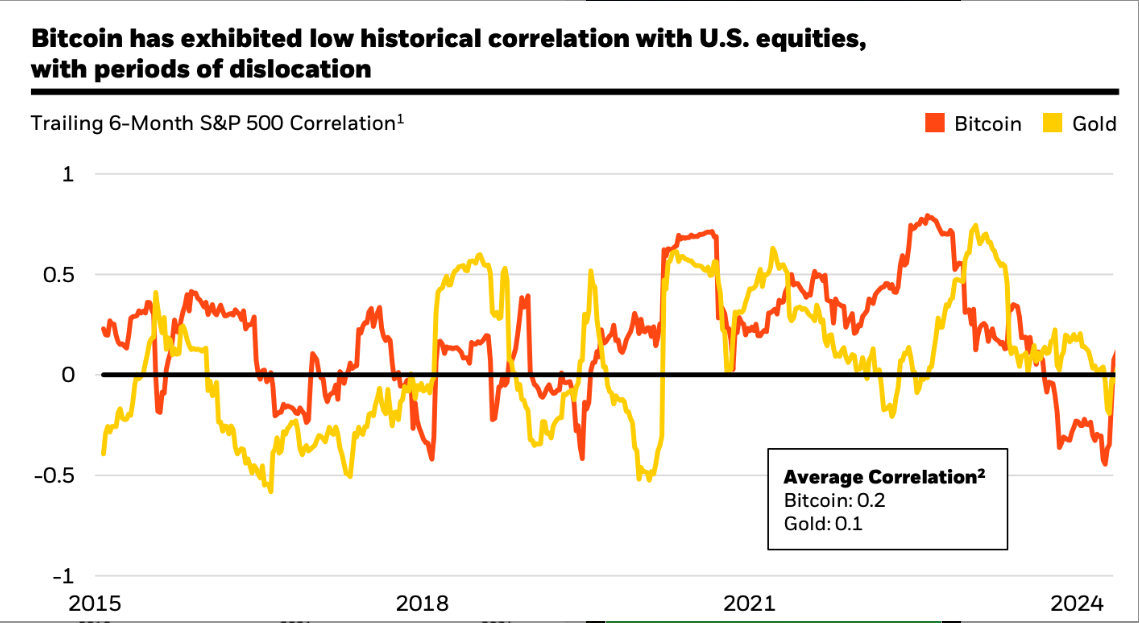

Thought-about by establishments resembling BlackRock as a superb diversification software attributable to its low correlation with conventional asset courses (shares, bonds), Bitcoin is attracting an rising variety of buyers.

Under, we will see how Bitcoin has behaved throughout completely different crises in comparison with different belongings.

Nonetheless, investing immediately in cryptocurrencies entails important challenges: excessive volatility, managing digital wallets, and the executive complexity of tax reporting for positive aspects or losses. An fascinating resolution to learn from the benefits of this market whereas bypassing these obstacles is to put money into cryptocurrency-related shares. These shares supply an oblique different to Bitcoin whereas enjoying a diversifying function in an funding technique.

Why Are Cryptocurrency-Associated Shares Diversification Instruments?

Shares of cryptocurrency-related firms occupy a singular place within the funding panorama. They permit buyers to learn from the expansion tendencies of the crypto market with out immediately investing in digital belongings. Like Bitcoin, they exhibit traits that make them enticing in a diversified asset allocation:

Average Correlation with Conventional Property: Though a few of these shares are traded on exchanges, they don’t at all times observe the actions of conventional indices (S&P 500, Nasdaq). Their efficiency relies upon extra on crypto market fluctuations and blockchain expertise adoption.

Excessive Development Potential: Corporations working within the crypto ecosystem (mining, buying and selling platforms, blockchain applied sciences) are positioned in quickly increasing markets. This development is impartial of conventional financial cycles.

Oblique Publicity to Crypto Volatility: In contrast to immediately buying Bitcoin, these shares can supply diminished threat by way of the diversification of firms’ income streams (e.g., NVIDIA or PayPal derive important revenue from different sectors).

Foremost Classes of Cryptocurrency-Associated Shares

Cryptocurrency-Specialised Corporations These firms are immediately uncovered to cryptocurrency efficiency. They embody buying and selling platforms like Coinbase International (COIN), whose revenues improve with transaction volumes, or mining firms resembling Marathon Digital Holdings (MARA), Riot Platforms ($RIOT), and Hut 8 Mining ($HUT).These shares are perfect for buyers searching for a excessive correlation with Bitcoin whereas diversifying their portfolios.

{Hardware} Producers Corporations like NVIDIA ($NVDA) and $AMD profit from the rising demand for mining tools. Whereas their actions are influenced by the crypto market, in addition they revenue from different development drivers, resembling synthetic intelligence, video video games, and cloud computing. These firms present partial publicity to the crypto market with a extra diversified threat profile.

Blockchain-Pushed Corporations Tech giants resembling Block, Inc. (SQ) or MicroStrategy ($MSTR) use blockchain to develop revolutionary monetary options. PayPal (PYPL) and Visa (V) additionally combine blockchain to facilitate digital funds. These firms supply oblique publicity to the crypto sector whereas capitalizing on broader blockchain alternatives.

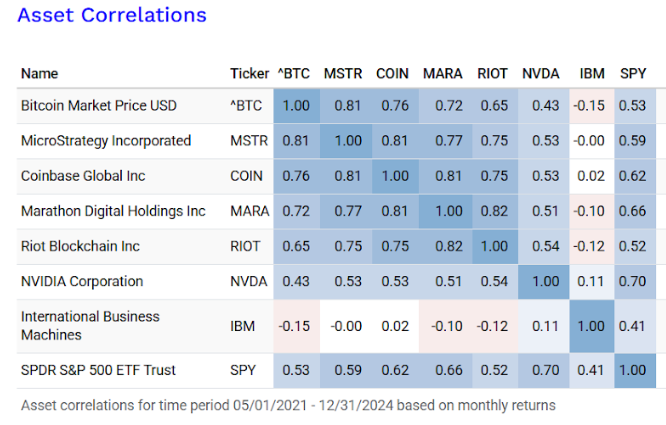

Which Shares Are Most Correlated with Bitcoin?

Sure shares have a stronger correlation with Bitcoin attributable to their direct dependence on its efficiency. For instance:

MicroStrategy (MSTR): This firm holds important Bitcoin reserves, making its valuation extremely linked to BTC worth actions.

Marathon Digital Holdings (MARA) and Riot Platforms (RIOT): These mining firms rely immediately on the profitability of operations, which is influenced by Bitcoin costs.

Coinbase (COIN): The buying and selling volumes on its platform range based on general curiosity in cryptocurrencies.

Conversely, firms like NVIDIA or IBM have a decrease correlation with Bitcoin as they diversify their actions past the crypto market.

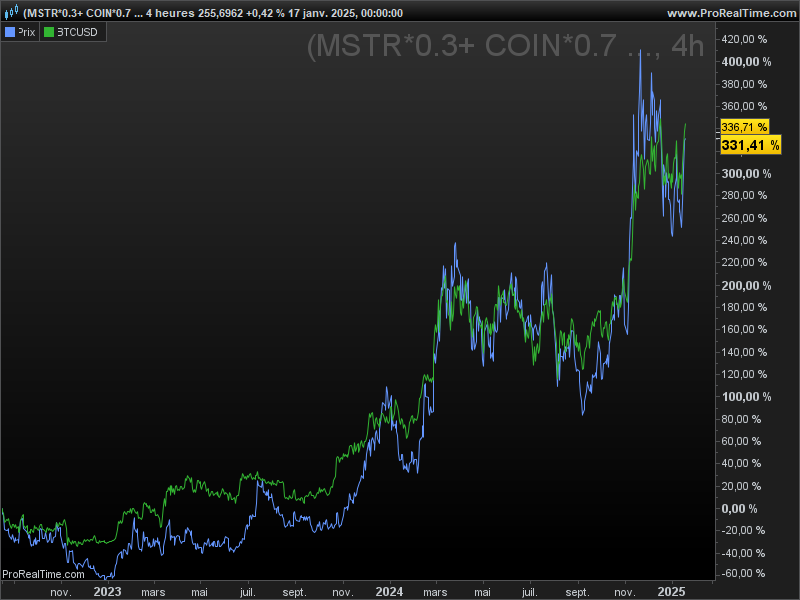

It’s even attainable to intently mimic Bitcoin’s efficiency by combining a number of shares. For example, a portfolio comprising (MSTR0.3 + MARA0.3 + COIN*0.7)/1.3 intently tracks Bitcoin’s actions.

Learn how to Combine These Shares into Asset Allocation

Outline Your Funding Objectives Earlier than investing, it’s important to set your aims. Do you wish to maximize portfolio diversification, scale back volatility, or capitalize on crypto development? These objectives will decide which sorts of shares to prioritize.

Diversify Throughout the Crypto Sector Mix firms immediately correlated with Bitcoin (like MicroStrategy or Riot) with diversified firms (like NVIDIA or PayPal).Take into account ETFs such because the Grayscale Bitcoin Belief (GBTC) or Amplify Transformational Knowledge Sharing ETF (BLOK) to unfold investments throughout a number of sector gamers.

Undertake a Gradual Strategy Given the volatility of crypto-related shares, it could be sensible to speculate progressively. A technique like Greenback-Price Averaging (DCA) can assist mitigate the consequences of market fluctuations.

Often Reevaluate Your Allocation Crypto-related shares are delicate to technological improvements and regulatory modifications. Often reviewing your allocation ensures alignment together with your aims.

Crypto Shares as a Complement to Bitcoin in a Diversified Portfolio

Incorporating cryptocurrency-related shares into an asset allocation can improve portfolio diversification. Whereas Bitcoin serves as an uncorrelated asset relative to conventional markets, these shares supply hybrid publicity. They mix the potential development of the crypto market with extra steady fundamentals, thereby decreasing among the dangers related to direct crypto funding.

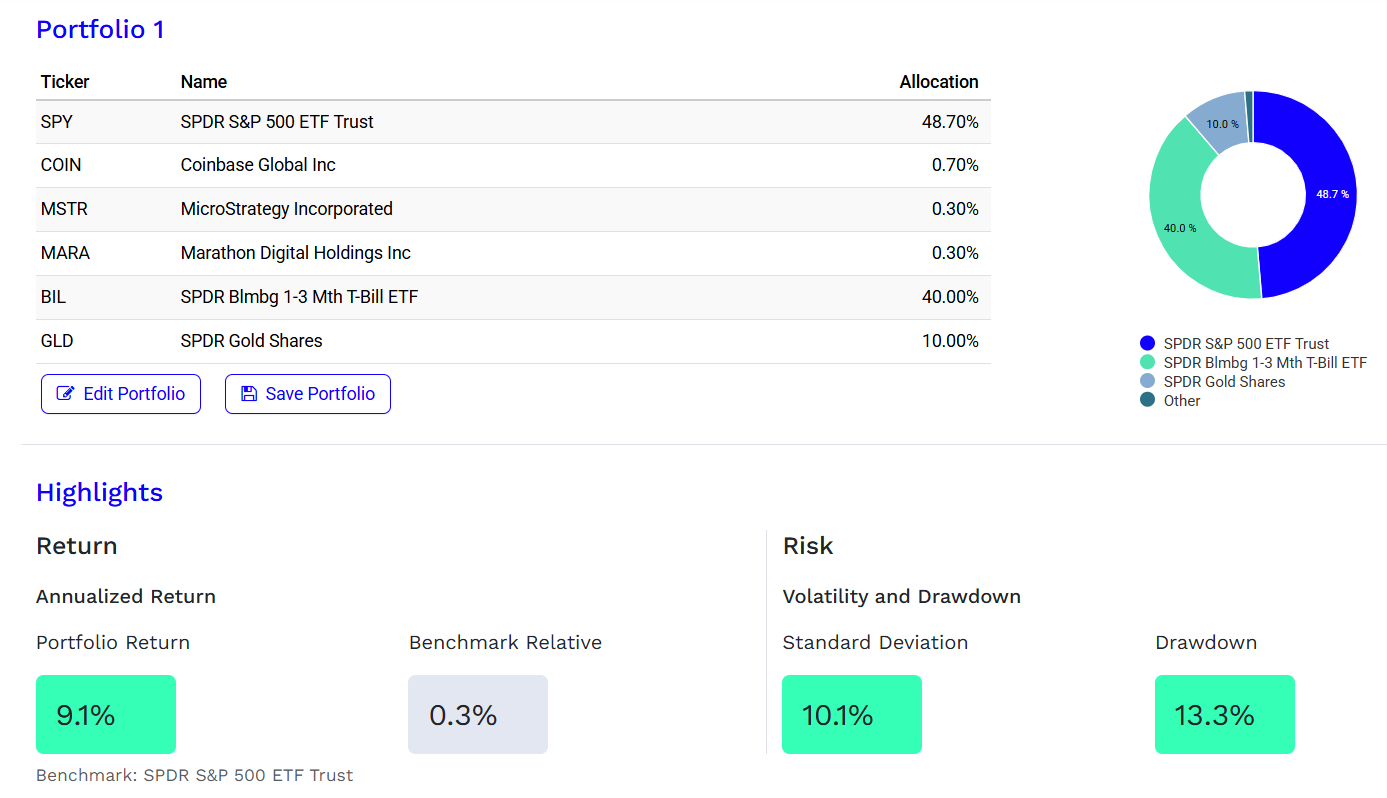

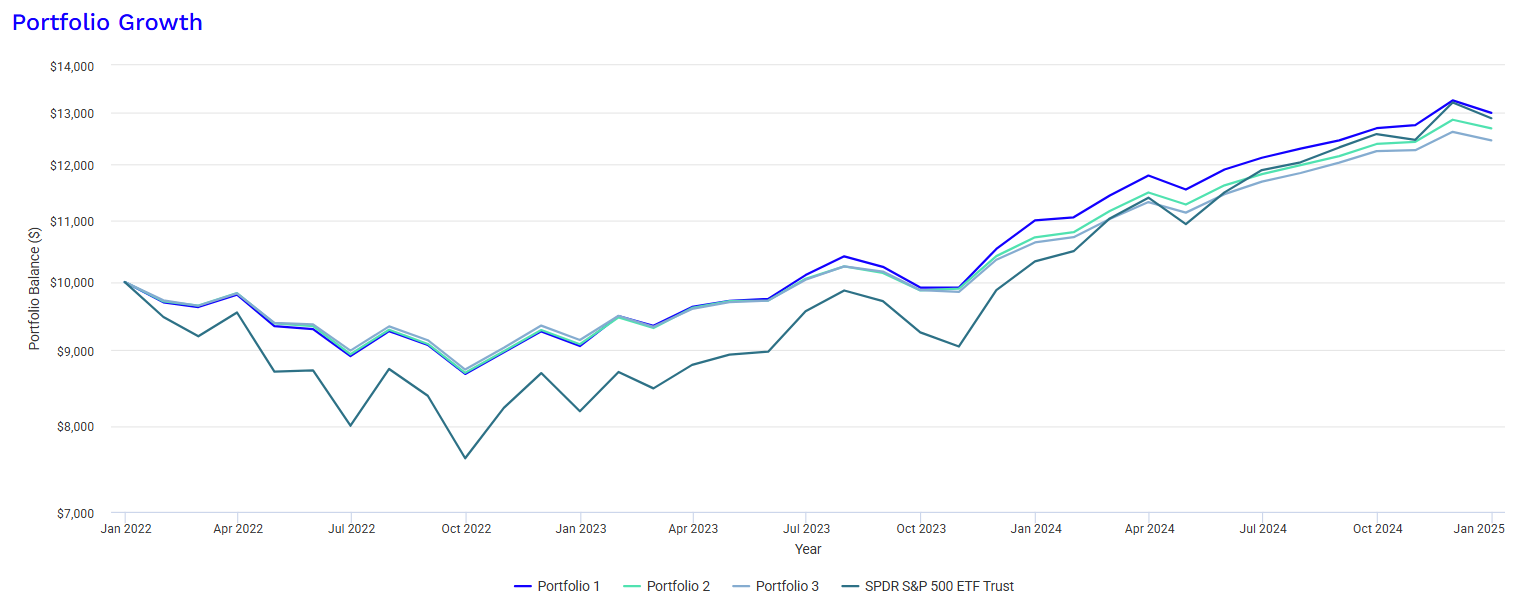

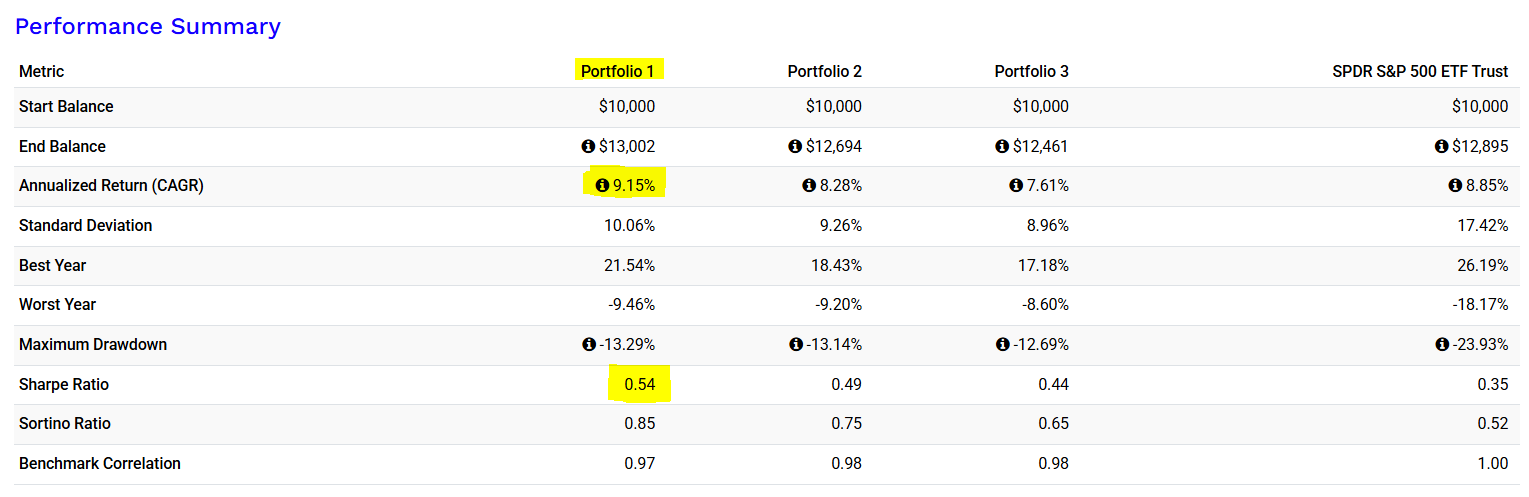

Our three-year evaluation of a balanced portfolio reveals that including 1.3% Bitcoin had a constructive influence on risk-adjusted efficiency. Nonetheless, changing Bitcoin with a basket of three cryptocurrency-related shares yielded even higher outcomes. However, fully excluding cryptocurrencies led to a big decline in efficiency.

Portfolio 1: With cryptocurrency-related shares

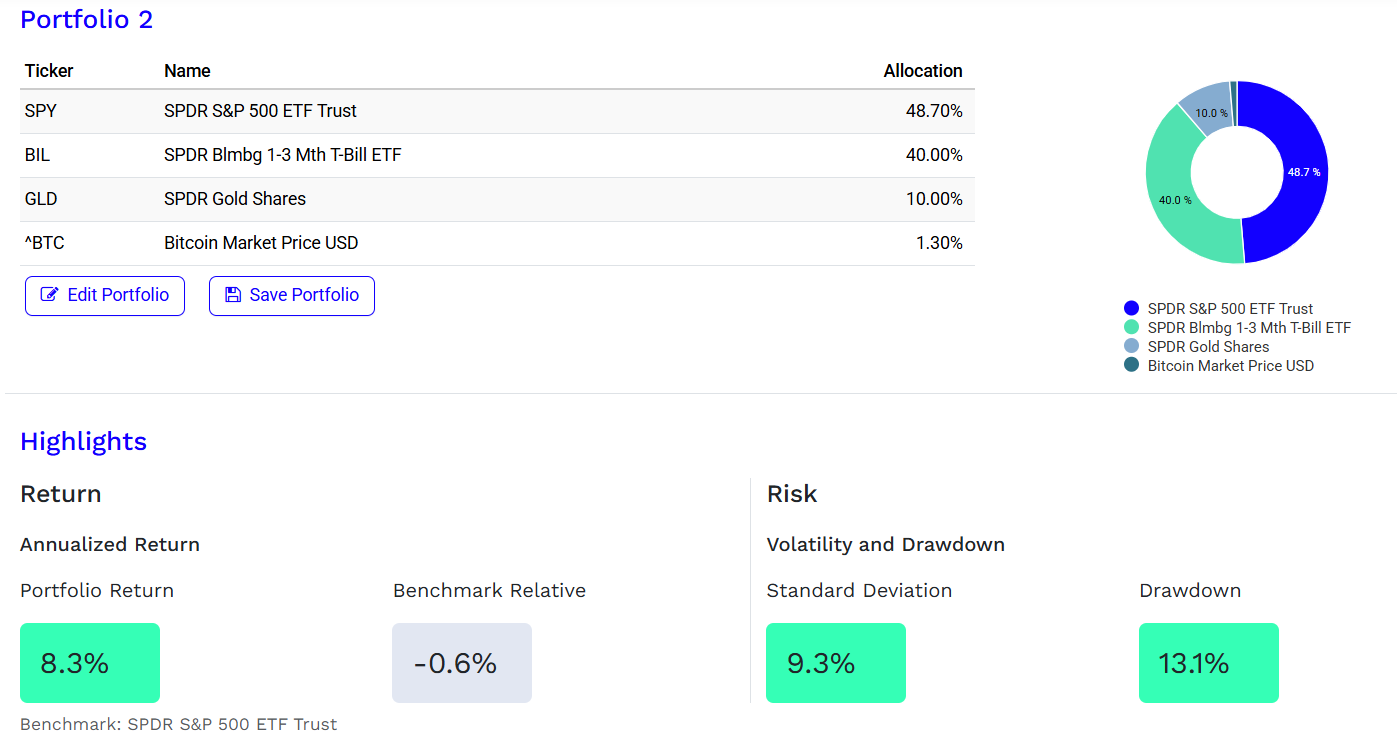

Portfolio 2: With Bitcoin

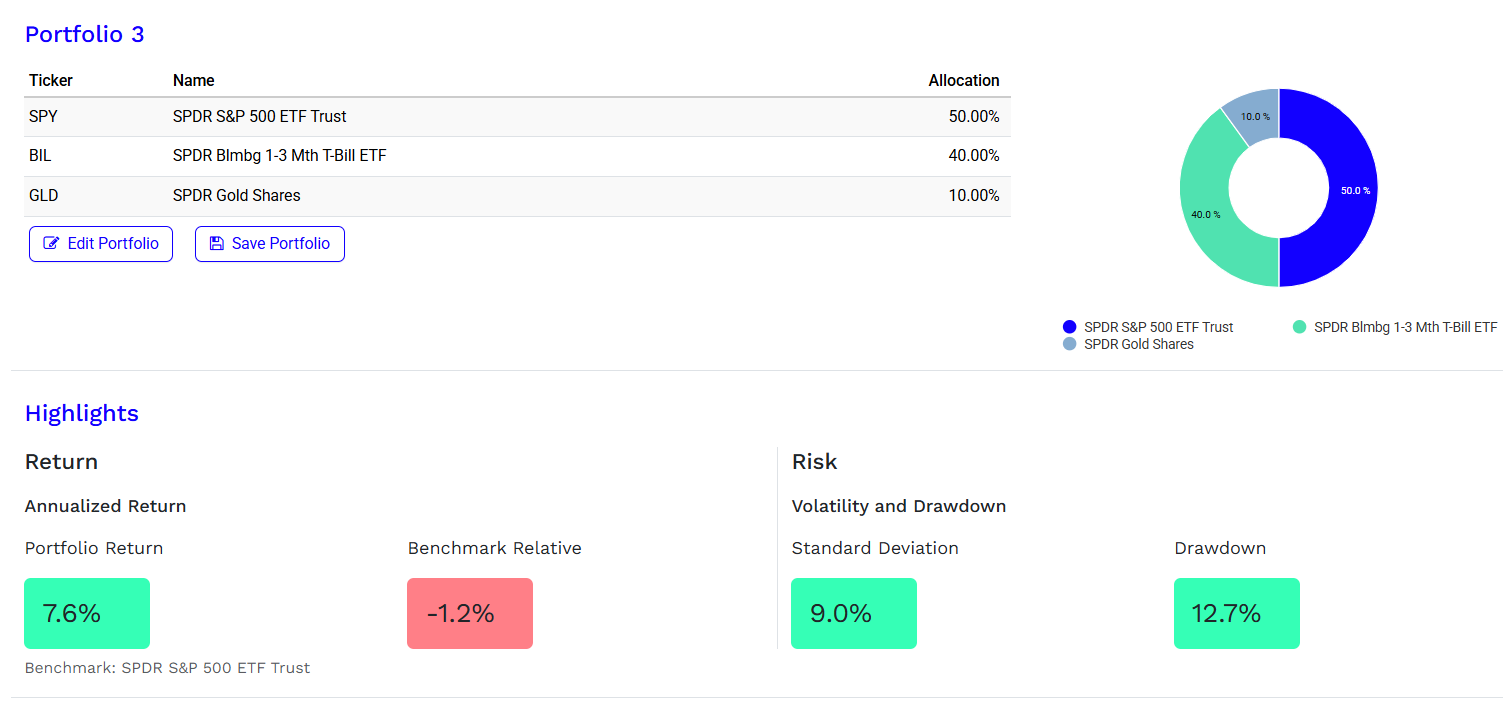

Portfolio 3: With out Bitcoin or cryptocurrency-related shares

Dangers of Investing in Cryptocurrency-Associated Shares

Investing in cryptocurrency-related shares, resembling these in mining, exchanges, and blockchain applied sciences, affords potential rewards but additionally important dangers:

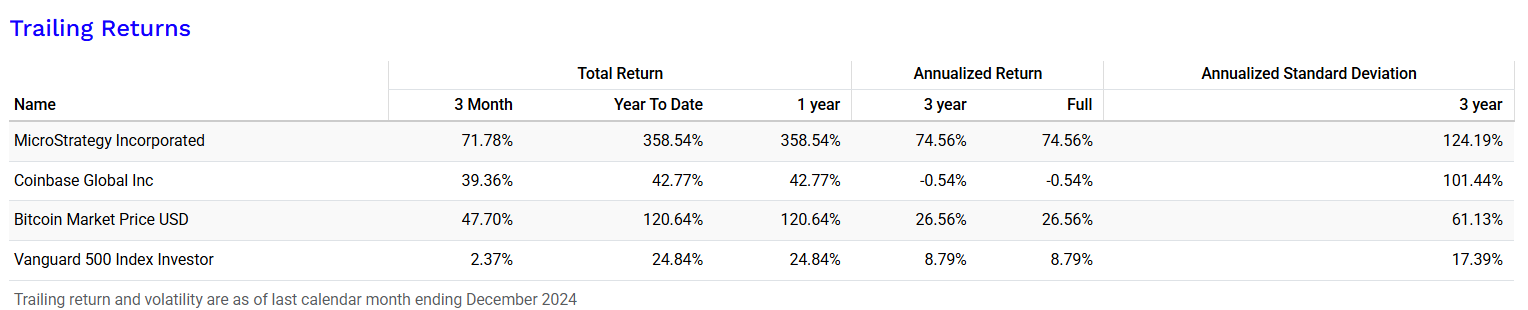

Excessive Volatility: Cryptocurrency costs fluctuate wildly, impacting the worth of associated shares.We are able to see under that the belongings associated to crypto are way more unstable than Bitcoin itself and even the S&P 500. Actually, for MSTR, the usual deviation during the last three years is 124.19%, in comparison with 17.39% for the S&P 500 and 61.13% for the Bitcoin.

Regulatory Dangers: Altering authorities laws might hurt the profitability of firms on this sector.

Safety Dangers: Cyberattacks and technical failures can result in important losses for firms and buyers.

Liquidity Dangers: Low buying and selling volumes in some shares could make shopping for or promoting troublesome, with greater transaction prices.

Adoption and Expertise Dangers: Sluggish adoption or disruptive applied sciences might scale back the worth of cryptocurrency-related firms.

Market Manipulation: The unregulated nature of the market will increase the danger of worth manipulation.

Whereas providing sturdy development potential, these dangers require cautious consideration and diversification for efficient threat administration.

Conclusion

Investing in cryptocurrency-related shares is a brilliant technique to learn from the rise of this sector whereas diversifying your portfolio. These shares present publicity to the alternatives provided by crypto with out the complexities of direct administration. As a complement to Bitcoin, they strengthen the diversification function of a portfolio and supply enticing development potential in a quickly evolving monetary setting. Nonetheless, you will need to take into account the dangers related to these investments. Value fluctuations in cryptocurrencies, unsure regulation, and market volatility can result in important losses. Traders ought to subsequently concentrate on these dangers and proceed with warning when including these shares to their portfolio.

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any specific recipient’s funding aims or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.