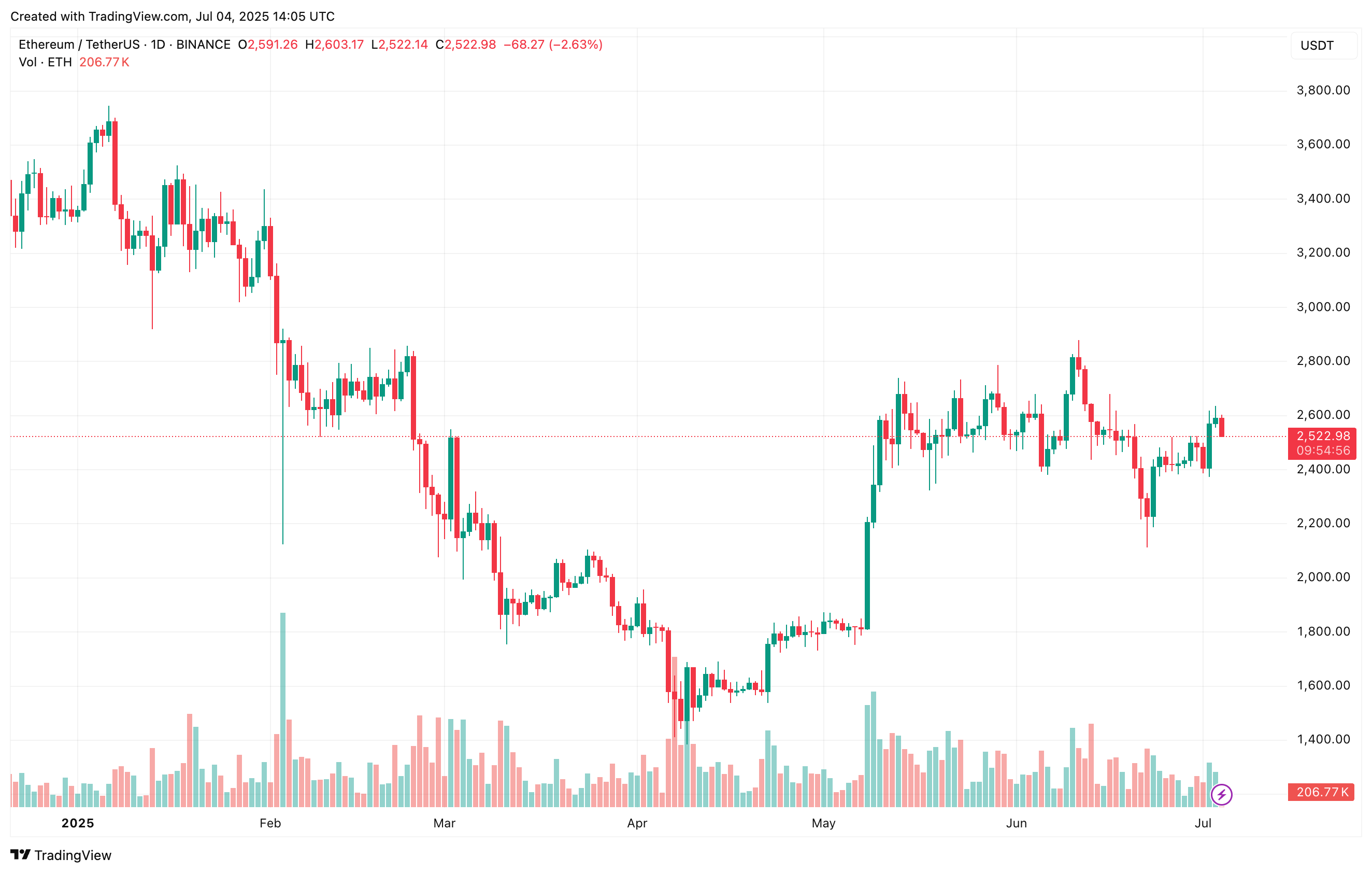

Ethereum (ETH) is up 4.2% over the previous seven days, buying and selling within the mid-$2,500 vary on the time of writing. Though the digital asset stays down 19% on a year-over-year (YoY) foundation, some analysts are optimistic that it’s prepared for a liftoff.

Ethereum Enters Wyckoff ‘Liftoff’ Part

In an X put up printed at this time, crypto dealer Merlijn The Dealer famous that Ethereum seems to be following the Wyckoff Accumulation sample and has efficiently cleared each the ‘creek’ and ‘spring’ phases, doubtlessly coming into the ‘liftoff’ section characterised by parabolic value motion.

Associated Studying

Within the Wyckoff accumulation sample, the ‘creek’ represents overhead resistance the place value struggles to interrupt increased, whereas the ‘spring’ is a false breakdown beneath help, meant to lure bears and ensure sturdy arms. The ‘liftoff’ section follows the spring, marked by a pointy restoration and breakout above resistance, signaling the beginning of a brand new bullish development.

The analyst shared the next Ethereum every day chart, which exhibits the cryptocurrency on the verge of a possible breakout, with its subsequent main resistance on the $3,700 stage. A profitable breakout and retest of this stage may set the stage for a brand new all-time excessive (ATH).

Fellow crypto analyst Crypto GEMs additionally pointed towards Ethereum preparing for a vital transfer to the upside. The analyst shared the next chart which compares ETH’s value motion in 2025 to that in 2024.

If Ethereum mirrors its 2024 efficiency, it may break above the $3,000 mark within the close to time period. Nonetheless, not all analysts share this bullish outlook.

As an example, famous crypto analyst Carl Moon shared a four-hour Ethereum chart displaying the asset buying and selling inside a rising wedge sample. He cautioned that except ETH breaks out of this formation, it might face a drop to $2,200.

To elucidate, a rising wedge sample is a bearish chart formation the place value strikes upward inside converging trendlines, indicating weakening bullish momentum. It typically indicators an upcoming breakdown, as patrons lose management and sellers push the worth decrease after the wedge is breached.

ETH Community Sees Renewed Exercise

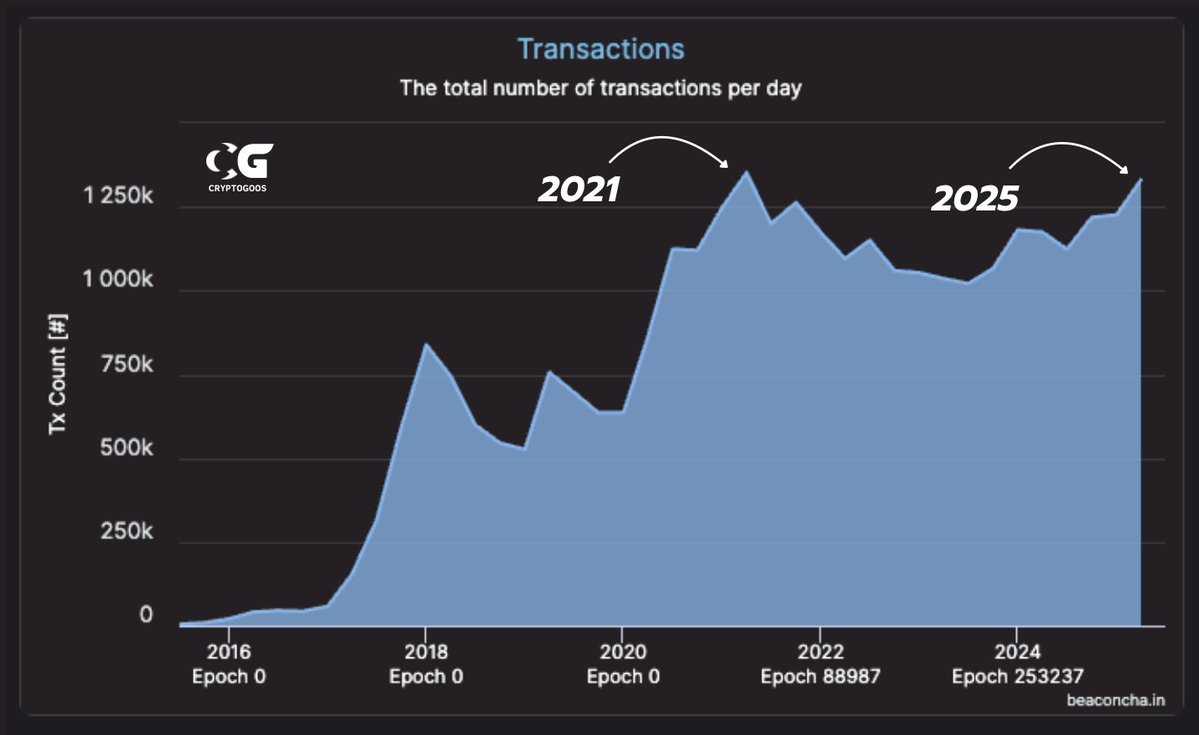

In a separate X put up, crypto analyst CryptoGoos remarked that every day transactions on Ethereum are nearing ATH stage for the primary time since 2021. Usually, heightened community exercise tends to precede main value actions.

Analyst Crypto Rover echoed this view, noting that energetic addresses throughout the Ethereum community have hit a brand new all-time excessive. They added that ETH beneath $3,000 is “an absolute steal.”

Associated Studying

In the meantime, Ethereum liquid staking can also be inching towards historic ranges, with 35.5 million ETH now locked. At press time, ETH trades at $2,522, down 3.8% previously 24 hours.

Featured picture from Unsplash, charts from X and TradingView.com