The Ethereum value is likely to be doing properly post-spot Bitcoin ETF launch, however current strikes by Celsius threaten to destabilize the worth motion. The now-bankrupt crypto lender appears to have begun its reimbursement plan to its collectors, as on-chain knowledge reveal the motion of its ETH holdings to crypto exchanges.

In line with crypto market intelligence firm Arkham Intelligence, Celsius Community carried out transfers value over $125 million value of ETH final week to numerous crypto exchanges.

Celsius Transfers ETH To Exchanges

Information exhibits that between January 8 and January 12, Celsius executed transfers value $95.5 million to crypto trade Coinbase whereas additionally sending $29.73 million to FalconX. On the time of writing, Celsius Community’s steadiness sheet has 584,601 ETH value $1.47 billion. Notably, it additionally has 9,799 BTC value $418.2 million and 659 million CEL tokens value $133.2 million on its books, amongst different cryptocurrencies.

Appears to be like like Celsius took the chance to unload >$125M of ETH over ETF Week.

Prior to now week, they’ve deposited $95.5M to Coinbase and despatched $29.73M to FalconX.

They nonetheless have $1.4 billion (540K ETH) remaining.https://t.co/jp1PJbN46r pic.twitter.com/xgfX6yU5Ye

— Arkham (@ArkhamIntel) January 13, 2024

Celsius’s motive behind the transfers into trade factors to nothing aside from an intending selloff, as the corporate is properly on its solution to clearing its liabilities underneath chapter proceedings.

Celsius filed for chapter in July 2022 shortly after the autumn of TerraUSD and the LUNA ecosystem, resulting in collectors having their funds trapped on the platform for the final 18 months. Nevertheless, the defunct crypto lender has been making main strikes in its chapter proceedings to refund collectors. In line with experiences, the firm bought $240 million value of ETH in December 2023.

Notably, the corporate communicated its resolution earlier this month on January 5 to unstake $465 million value of Ethereum (ETH) which will likely be distributed to its collectors.

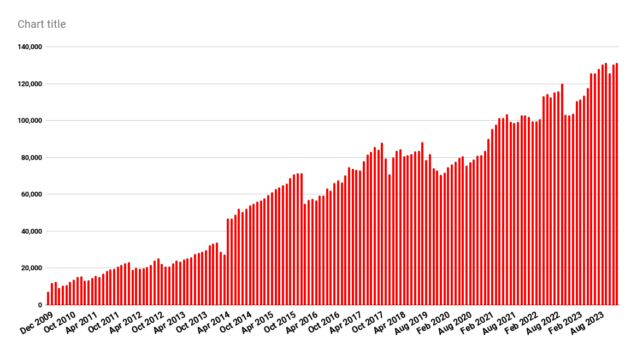

ETH value exhibits power as new buying and selling week opens up | Supply: ETHUSD on Tradingview.com

Incoming Ethereum Worth Crash?

Ethereum is presently on a roll, nonetheless on a 13% acquire previously seven days. Nevertheless, enormous selloffs like this have a tendency to shake market confidence, resulting in a sell-off from different traders. Then again, some are inclined to consider that the crypto is sufficiently resilient.

It’s necessary to notice that Ethereum retained its bullish sentiment in the course of the time these transfers had been made, as value motion revealed a 23% bounce from $2,191 on January 8 to $2,706 on January 12. Ethereum has declined since then and is now buying and selling at $2,514. In line with Coinglass, $23.84 million value of ETH positions had been liquidated previously 24 hours.

Regardless of the current massive transfers, Celsius nonetheless retains important cryptocurrency property together with ETH, BTC, MATIC, and LINK. A choice to proceed the promoting off of those property might result in an even bigger dent within the value of the property, significantly Ethereum, which is now testing the $2,500 help stage.

On-chain knowledge from Spotonchain additionally reported FTX and Alameda Analysis shifting 1,000 ETH value $2.33 million to crypto trade Coinbase in the course of the week.

Featured picture from The Each day Hodl, chart from Tradingview.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal threat.