Ethereum is clearing a key space on the charts because it tops $4,000 and hits a multi-year excessive. The Each day Breakdown digs into the transfer.

Earlier than we dive in, let’s ensure you’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all that you must do is log in to your eToro account.

What’s Taking place?

The Nasdaq 100 briefly hit a document excessive on Monday, however retreated and closed decrease alongside the opposite main US inventory indices forward of right now’s key CPI inflation report. Buyers additionally noticed Bitcoin and different key cryptocurrencies retreat from yesterday’s highs too, after it seemed like BTC might make a run at its all-time highs.

Recall that final month’s CPI print confirmed an uptick in inflation, as did the PCE report a couple of weeks in the past. One other sizzling report right now may make buyers nervous that inflation is making a comeback — one thing that would impression expectations for decrease rates of interest.

For now, the market is pricing in a charge lower on the Fed’s subsequent assembly in September. We’ll see if right now’s information influences these odds within the coming days.

On the earnings entrance, Sea Ltd and On Holding (maker of On Cloud sneakers) are making some noise this morning, whereas CoreWeave, Cava, and Rigetti Computing report tonight.

On the crypto entrance, Tezos, Balancer, and Bitcoin Money are pushing greater.

If you wish to improve your investing data this summer season, be sure to affix our eToro Academy Study & Earn Problem, the place you’ll be able to take programs, cross quizzes, and earn as much as $20 in rewards. Phrases and circumstances apply.

Wish to obtain these insights straight to your inbox?

Enroll right here

The Setup — Ethereum

On Monday, Ethereum hit a multi-year excessive because it briefly topped $4,300. Notably, that additionally despatched it over a key resistance space, because the $3,900 to $4,000 zone has stifled the rallies since 2024. Now above this space, bulls are hoping that this prior space of resistance turns into present assist transferring ahead. Bear in mind, the all-time excessive is up close to $4,867.

Chart as of 8:00 a.m. ET on 8/12/2025. Supply: eToro ProCharts, courtesy of TradingView.

For buyers who can’t commerce or aren’t snug buying and selling cryptocurrencies outright, they’ll think about ETFs for BTC and ETH. On the ETH entrance, ETHA stays the most important ETF by belongings, whereas additionally supporting choices buying and selling.

Bulls can make the most of calls or name spreads to take a position on upside, whereas bears can use places or places unfold to take a position on draw back. In both case, buyers might think about using sufficient time till expiration.

For these trying to study extra about choices, think about visiting the eToro Academy.

What Wall Avenue’s Watching

CRCL

Shares of Circle are buying and selling greater this morning, up virtually 10% in pre-market buying and selling after the agency reported its quarter outcomes. Income jumped greater than 50% 12 months over 12 months as sturdy stablecoin development within the quarter helped propel gross sales. Whereas effectively off the post-IPO highs, Circle remains to be up greater than 400% from its IPO worth. High analysts have a consensus worth goal of roughly $200 a share for CRCL.

NVDA

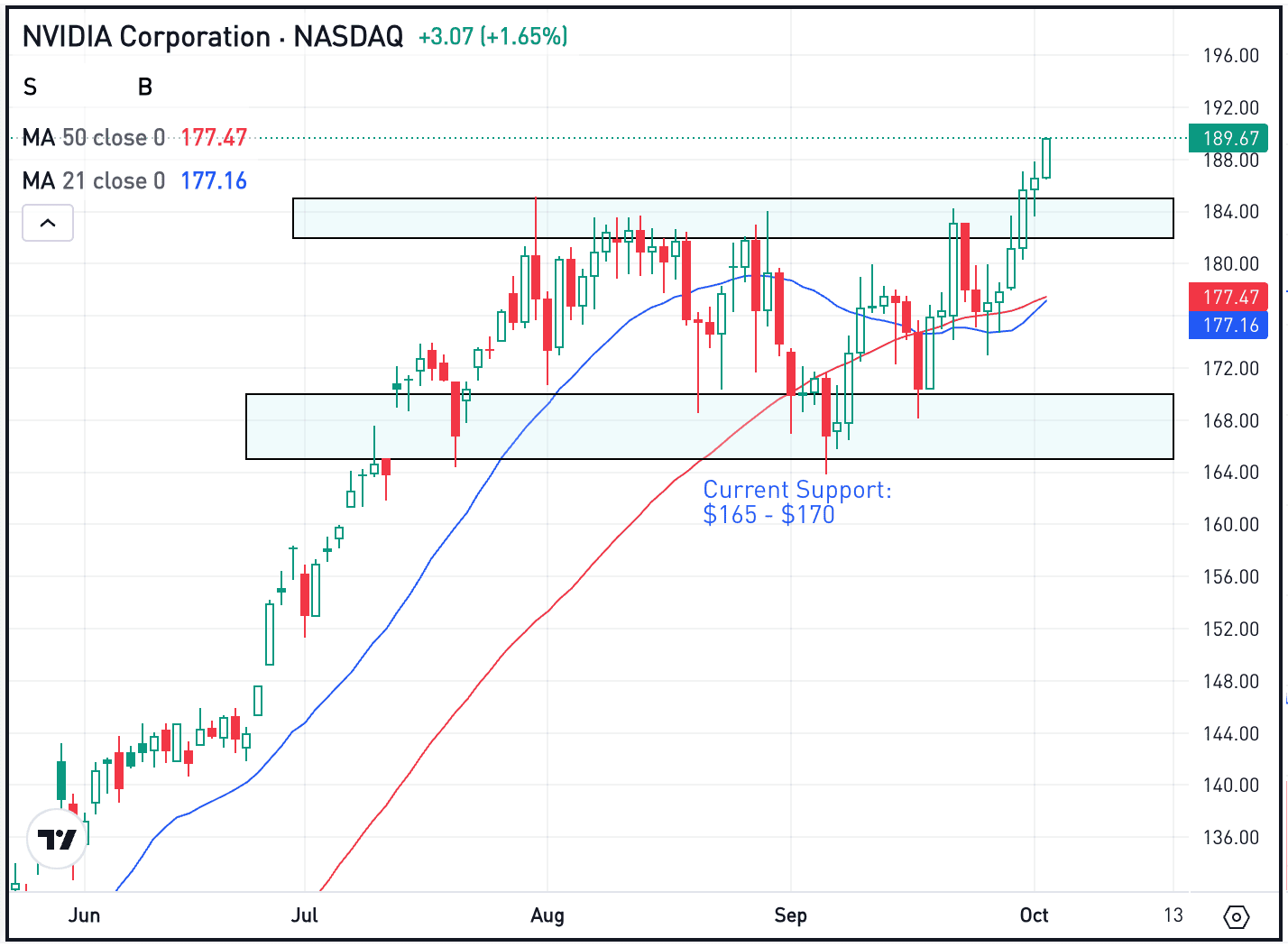

Nvidia and Superior Micro Units failed to shut greater yesterday regardless of stories suggesting that they’ll be capable of resume chip gross sales to China — after agreeing to provide 15% of the income from these chip gross sales to the US authorities. Take a look at the chart for NVDA.

SPX500

The tariff drama is seeing extra can-kicking down the highway, this time with negotiations between the US and China receiving a 90-day delay. Whereas it’s a great factor for markets, it’s one other instance of why buyers have stopped taking the tariffs threats as severely as they have been in March and April. The FXI ETF is one method to achieve publicity to Chinese language equities.

Disclaimer:

Please be aware that as a consequence of market volatility, a few of the costs might have already been reached and eventualities performed out.

![Best Altcoins Under $1 in 2025 [October] – Top Crypto Picks for High Growth Best Altcoins Under $1 in 2025 [October] – Top Crypto Picks for High Growth](https://changelly.com/blog/wp-content/uploads/2025/10/best-altcoins-under-1-dollar-October.png)