Ethereum crypto is agency and breaking out. With ETH rallying, merchants are focusing on $3,500 amid institutional demand from Wall Road.

On a day when Bitcoin surged above $118,000 and printed contemporary all-time highs above $113,500, many anticipated altcoins and a few of the finest cryptos to purchase to observe swimsuit. The excellent news is that almost all did rise. XRP crypto climbed almost 7% to commerce above $2.55, whereas Solana crossed $160, including 9% prior to now week. Among the many property buyers and merchants have been additionally intently watching was ETH ▲8.81%.

DISCOVER: 9+ Finest Excessive-Danger, Excessive-Reward Crypto to Purchase in July 2025

Ethereum Crypto Targets $3,500

Ethereum is barely up after a comparatively subdued first half of the 12 months.

Within the final day, the coin pushed above $2,600, racing to commerce above $2,900, extending weekly features to just about 15%.

At this tempo, analysts count on the coin to commerce above $3,500 within the coming weeks, setting the tempo for additional features to $4,100.

From the Ethereum value chart, the native resistance is round $3,000. If this liquidation stage is damaged, ETH may simply climb to $3,500 in a purchase development continuation sample.

This rally, ideally with increasing participation, would verify the features of early Might 2025, which pushed ETH above $2,000.

DISCOVER: 20+ Subsequent Crypto to Explode in 2025

World Liberty Monetary, Establishments Accumulating ETH

Behind these refreshing increased highs are supportive fundamentals that place ETH among the many subsequent cryptos to blow up in Q3 2025. There could also be political hyperlinks to the current surge.

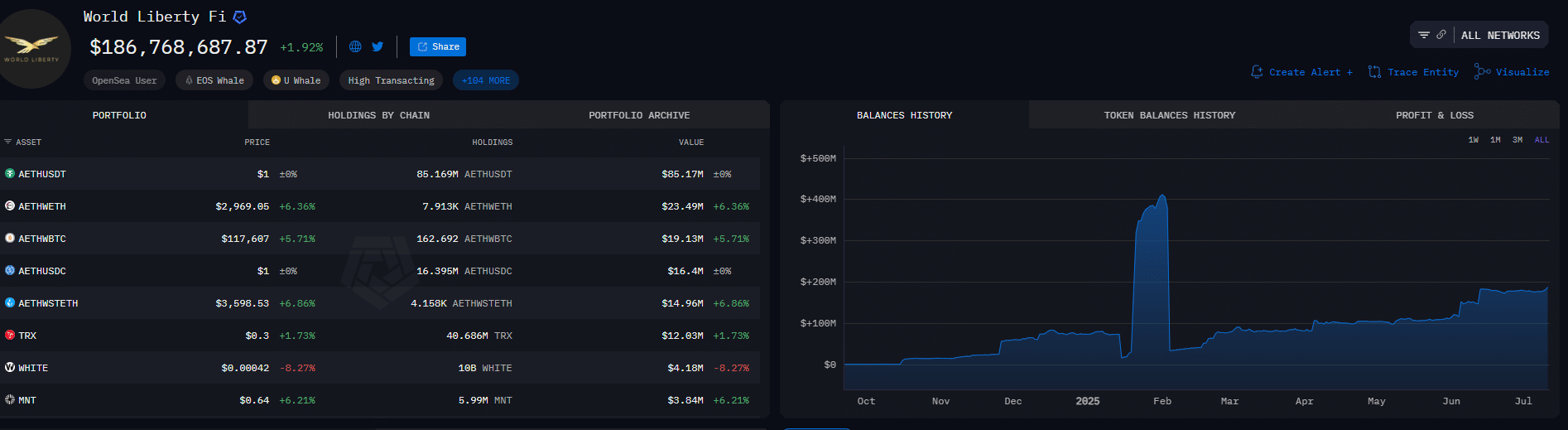

In line with Artemis Intelligence, the Trump household has been closely accumulating Ethereum and Ethereum-based tokens by their DeFi undertaking, World Liberty Monetary.

(Supply: Artemis)

This accumulation comes as no shock.

Eric Trump, who’s behind World Liberty Monetary, has beforehand posted on X endorsing ETH. As of July 11, the DeFi protocol holds over $150 million value of ETH, supplying it to Aave, a decentralized cash market, to earn yield.

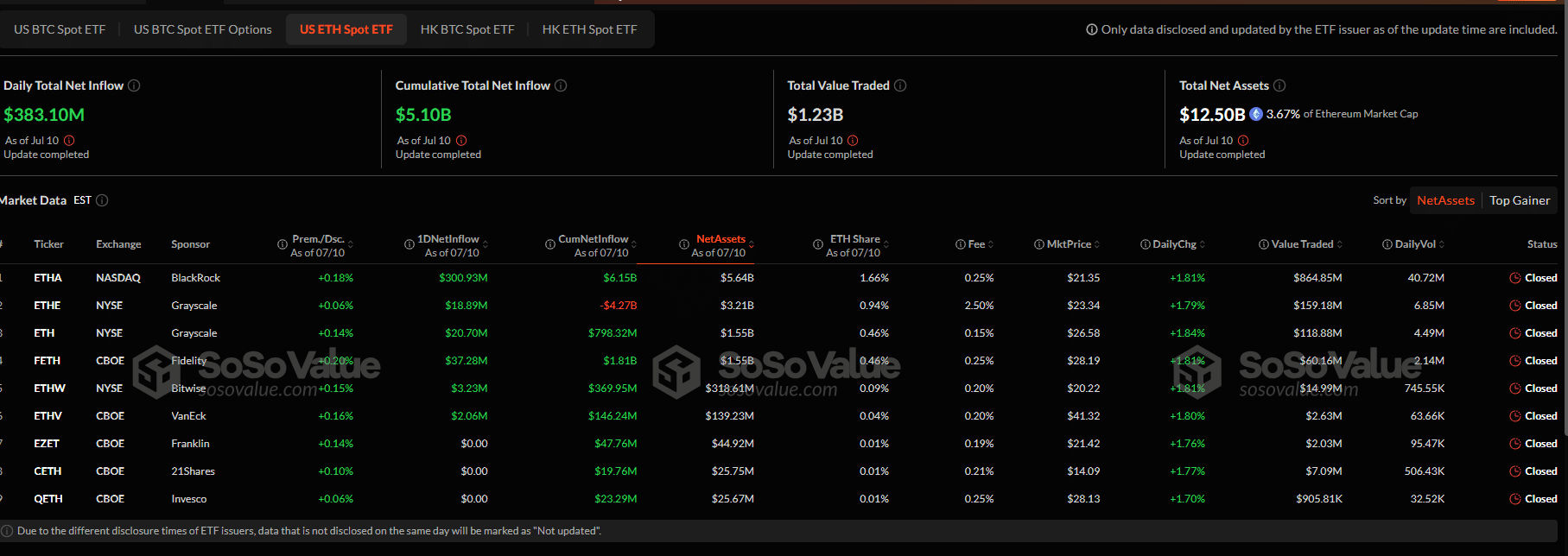

Moreover, there was sharp curiosity in spot Ethereum ETFs. In line with Soso Worth, establishments at the moment maintain almost 4% of the entire ETH provide, or over $12.5 billion in Ethereum-backed shares.

Current traits present tens of millions in institutional flows into ETH over the past 4 buying and selling days.

(Supply: Soso Worth)

On July 10 alone, establishments scooped up $383 million value of spot Ethereum ETF shares, primarily by BlackRock and Grayscale.

Curiously, this wave of demand for ETH comes regardless of the U.S. SEC not allowing issuers to stake buyers’ ETH deposits.

If the regulator lifts this restriction, billions of {dollars} may move into spot Ethereum ETFs as establishments scramble to earn a close to risk-free yield on their ETH.

At the moment, the Ethereum community affords a 3% APY yield for stakers.

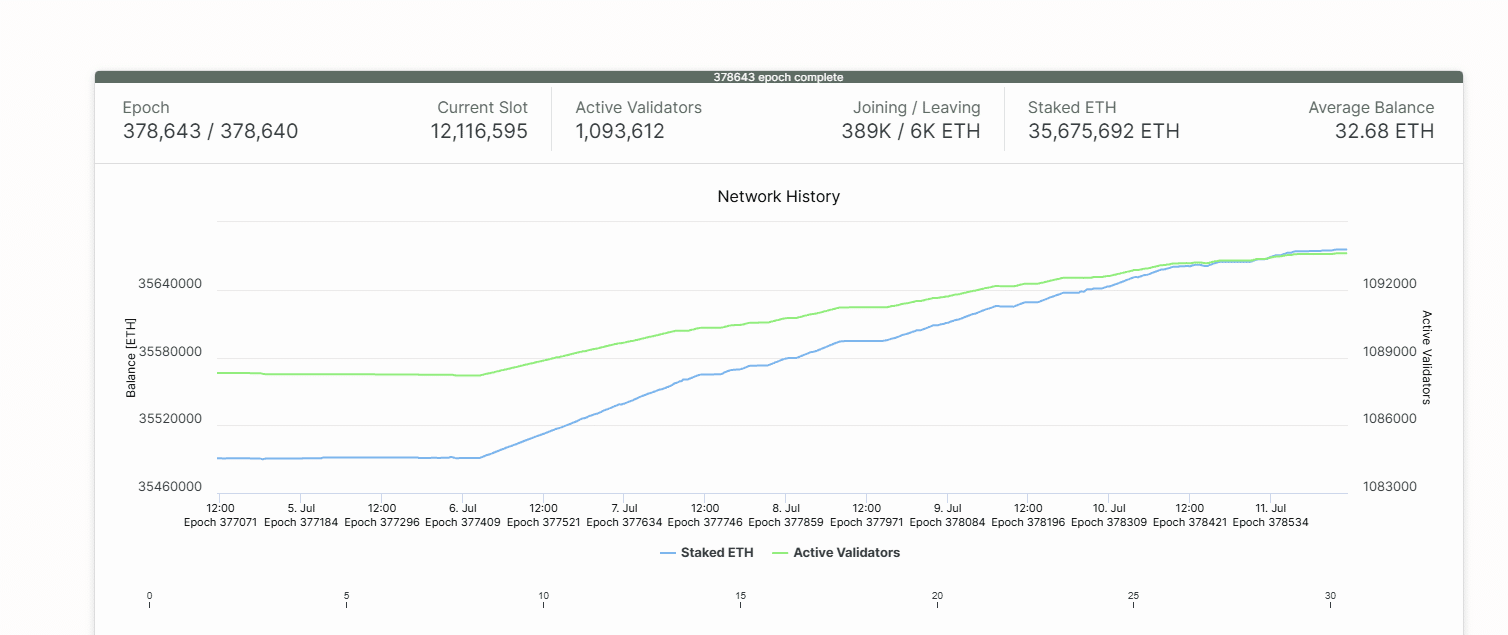

Current knowledge reveals that over 35.66 million ETH have been staked by greater than 1 million energetic validators. Every validator locks up a mean of 32.68 ETH.

(Supply: Beaconcha.in)

Wall Road Watching

Accompanying the present surge are feedback from crypto influencers and founders.

Not too long ago, Joseph Lubin of Consensys and Sharplink introduced plans to purchase tens of tens of millions of ETH.

In an interview, Lubin mentioned Ethereum is gaining traction in how conventional finance views digital property.

Particularly, he famous the rising variety of corporations holding ETH of their treasuries.

Due to the proof-of-stake consensus mechanism, ETH rewards stakers, and the built-in yield makes it enticing for long-term HODLers who need to earn yield on the asset.

In distinction, Bitcoin doesn’t provide holders any yield, and the one method for holders to revenue is thru capital features.

DISCOVER: Finest New Cryptocurrencies to Put money into 2025 – Prime New Crypto Cash

Ethereum Worth Targets $3,500 Amid Institutional Demand

Ethereum value agency, bulls focusing on $3,500

Ethereum restoration follows an underwhelming H1 2025

Spot Ethereum ETF inflows are principally constructive

Wall Road companies exploring ETH and yield-earning methods

The submit Ethereum Crypto Targets $3,500 Amid Robust Institutional Demand appeared first on 99Bitcoins.