Ethereum’s current worth rally is being fueled by a major structural shift in demand, in response to a current investor word from Bitwise Chief Funding Officer Matt Hougan.

Since Might 15, a surge in shopping for exercise from exchange-traded funds (ETFs) and firms has resulted within the acquisition of almost 2.83 million ETH, valued at over $10 billion.

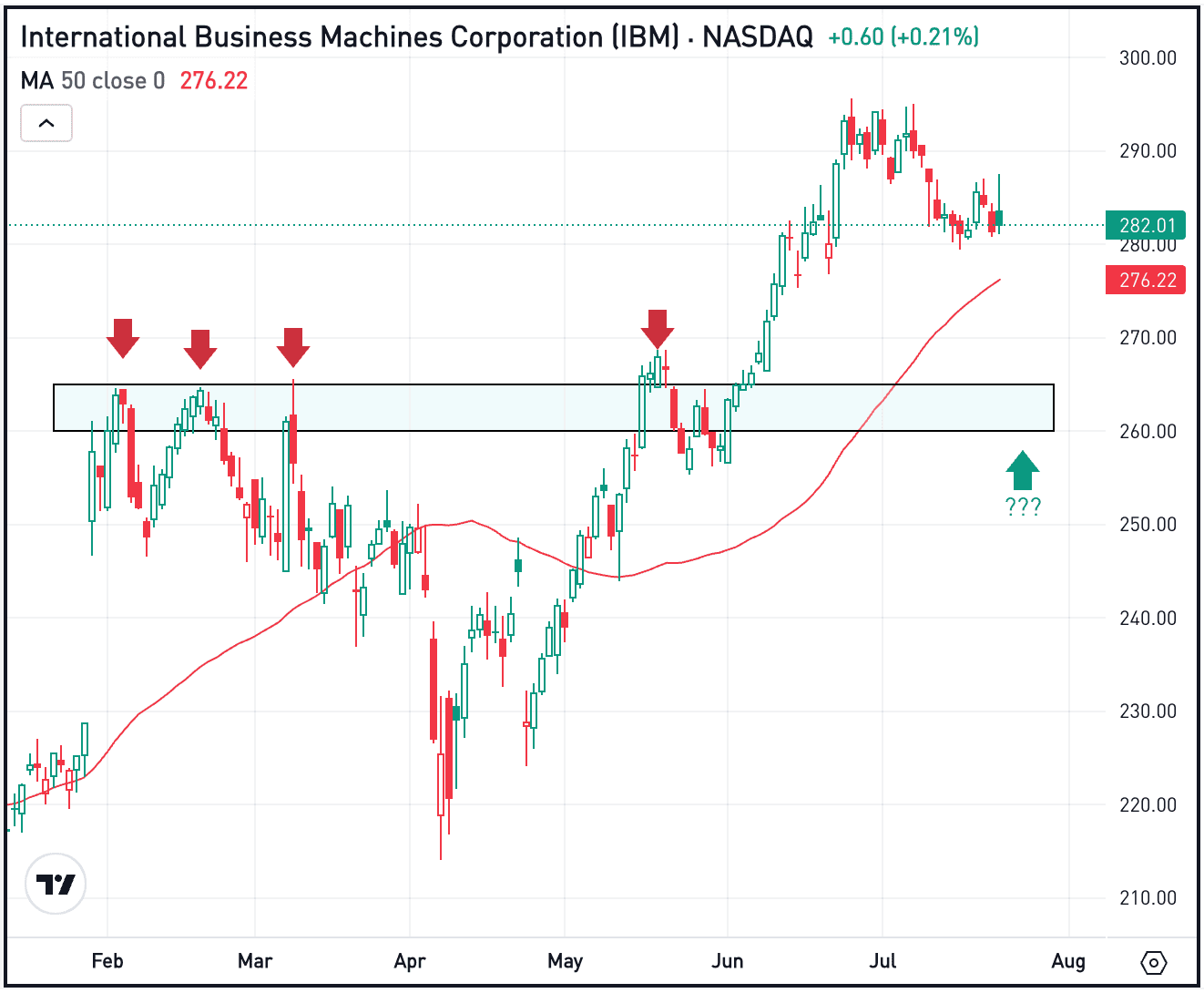

This buying exercise has outpaced new ETH issuance by an element of 32, contributing to a supply-demand imbalance that analysts say may persist. Hougan defined that Ethereum’s worth has climbed greater than 65% up to now month and 160% since April.

Whereas market sentiment performs a task in crypto asset actions, the Bitwise govt attributes this surge primarily to fundamentals, significantly the hole between how a lot ETH is being purchased and the way a lot is being created on-chain. In his view, the present dynamic mirrors what occurred with Bitcoin after the launch of spot BTC ETFs in early 2024.

ETFs and Firms Drive ETH Accumulation

The pattern reversal for Ethereum grew to become evident in mid-Might, when inflows into spot Ethereum ETFs gained momentum. In line with Hougan, these funding automobiles have pulled in over $5 billion since then. In the meantime, company entities have begun positioning ETH as a strategic asset inside their treasuries.

Corporations like Bitmine Immersion Applied sciences (BMNR), SharpLink Gaming (SBET), Bit Digital (BTBT), and The Ether Machine (DYNX) have all introduced massive ETH holdings or buying plans, with Bitmine alone focusing on 5% of whole ETH provide.

SharpLink Gaming, as an example, has acquired greater than 280,000 ETH, whereas Bitmine has amassed over 300,000 ETH. Bit Digital bought its Bitcoin reserves to amass greater than 100,000 ETH, signaling a shift in institutional preferences towards Ethereum.

These firms will not be solely making sizable acquisitions but in addition publicly outlining long-term ETH methods, indicating a structural dedication to the asset.

Outlook Suggests Continued Demand Momentum

The upward trajectory in demand seems more likely to proceed. Hougan notes that though ETH’s market capitalization is about 20% of Bitcoin’s, ETH ETFs nonetheless account for lower than 12% of the belongings underneath administration held in Bitcoin ETFs.

Bitwise expects that hole to slim as stablecoin development and tokenization tendencies, each primarily supported by Ethereum, appeal to additional capital inflows.

Moreover, Hougan highlights the rising enchantment of ETH treasury firms, whose inventory valuations are at the moment buying and selling at premiums to the worth of their underlying ETH holdings. This market situation incentivizes additional ETH accumulation by public corporations, particularly if the premiums stay.

He tasks that these entities may collectively buy one other $20 billion in ETH over the following 12 months, which, given Ethereum’s estimated provide issuance of 800,000 ETH in that point, may symbolize almost seven occasions extra demand than new provide.

Although Ethereum doesn’t share Bitcoin’s onerous cap, Hougan emphasizes that short-term worth motion is essentially dictated by provide and demand mechanics. Given the present imbalance, he believes the upward worth motion may proceed.

Whether or not or not this pattern sustains over the long run, Ethereum’s near-term worth motion appears more and more influenced by institutional conduct and treasury adoption methods.

Featured picture created with DALL-E, Chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.