Ethereum (ETH) dropped over 6% up to now 24 hours, sliding to round $3,630 after briefly touching the $3,800 mark.

Associated Studying

The pullback comes after a sturdy July rally, which noticed the world’s second-largest cryptocurrency surge greater than 50%, its greatest month-to-month achieve in three years.

Regardless of the current dip, on-chain information suggests the uptrend might not be over. Glassnode’s newest evaluation factors to a possible new all-time excessive (ATH) of $4,900, fueled by bullish investor sentiment, rising ETF inflows, and rising open curiosity (OI) in futures markets.

Glassnode Factors to a $4,900 Ethereum Goal

Based on Glassnode, Ethereum is buying and selling close to its March 2024 ranges, but unrealized income stay comparatively decrease. This divergence implies a big upside potential as traders usually are not but cashing out, signaling confidence in additional positive factors.

The agency’s evaluation reveals that if unrealized income attain the identical ranges as in 2024, ETH would doubtless climb towards $4,900, marking a brand new ATH and testing the crucial psychological resistance at $5,000.

This might replicate a rising shift in how traders deal with Ethereum, from a speculative token to a core monetary asset.

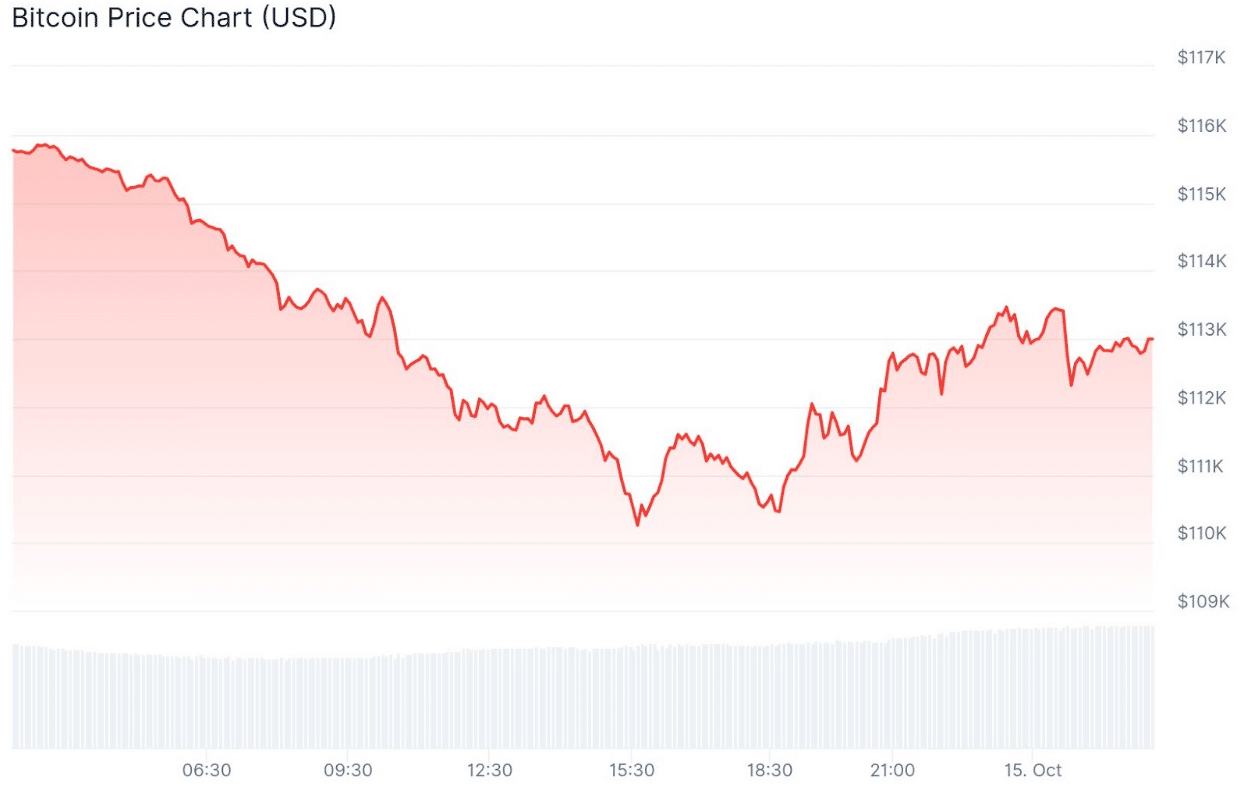

ETH’s worth data a small decline on the each day chart. Supply: ETHUSD on Tradingview

Open Curiosity and ETF Demand Reinforce Bullish Outlook

Rising open curiosity additional helps Ethereum’s bullish case. Crypto futures information signifies that extra merchants are opening lengthy positions on ETH, reflecting expectations of additional upside. Ethereum’s OI has been a key contributor to the broader altcoin market rebound.

Furthermore, spot Ethereum ETFs, particularly BlackRock’s iShares Ethereum ETF, noticed over $4 billion in inflows in July 2025, pushing whole ETH ETF holdings to $21.85 billion. The surge underscores Ethereum’s rising standing amongst institutional traders and will amplify future worth actions.

Associated Studying

With Ethereum going through resistance at $4,000, the convergence of sturdy technicals, investor optimism, and institutional demand paints a promising outlook. If momentum continues, ETH could quickly chart new territory above its earlier highs.

Cowl picture from ChatGPT, ETHUSD chart from Tradingview