Per CryptoQuant’s second September weekly report, Ethereum’s newest uptrend from about $1,400 in April to a excessive close to $5,000 has unfolded alongside heavier allocations in funds and whale accumulation, a pullback in alternate deposits, and exercise peaks throughout transactions, addresses, and smart-contract calls.

Ethereum trades beneath a realized value band of $5,200 whereas fund holdings and on-chain use hit data.

The report frames the following section round whether or not value can clear the realized value higher band that capped prior advances.

Based on CryptoQuant, Ethereum fund holdings, pushed largely by U.S. spot ETFs, have reached 6.7 million ETH, almost double since April. Addresses holding 10,000 to 100,000 ETH added roughly 6 million ETH over the identical interval, with this cohort now at 20.6 million ETH, a brand new excessive.

The “sensible cash” share embedded in these balances means a fabric portion of demand is already in place, compressing the room for momentum to do the heavy lifting with out contemporary flows. The charts on web page 2 of the report present each the fund-holding curve and cohort balances making new peaks.

Staking has climbed in parallel.

The full ETH staked stands at round 36.2 million, up by roughly 2.5 million ETH since Could. The rising validator rely reduces circulating provide and helps a tighter float, but it additionally sequesters capital that will in any other case meet new demand if value drifts or volumes skinny out.

That blend of decrease float and better dedication from validators helps clarify why spot market stress can ease even when value consolidates.

On-chain throughput has expanded. Whole each day transactions peaked at about 1.7 million on August 16, and energetic addresses reached roughly 800,000 on August 5, each new highs, per the community dashboards. Sensible-contract calls surpassed 12 million each day for the primary time, marking the heaviest programmatic use of the bottom layer to this point.

Elevated utilization throughout DeFi, stablecoin transfers, and token exercise builds price income and reinforces the settlement-layer function that underpins ETH’s cash-flow and utility narratives. If exercise cools, volatility typically follows as value discovers the right a number of on decrease throughput.

Spot-side provide stress has eased.

CryptoQuant’s exchange-inflow collection reveals deposits to centralized venues falling from roughly 1.8 million ETH in mid-August to about 750,000 ETH per day after the early-September value excessive.

5 Days to Smarter Crypto Strikes

Learn the way execs keep away from bagholding, spot insider front-runs, and seize alpha — earlier than it is too late.

Dropped at you by CryptoSlate

Fewer cash transferring to exchanges sometimes line up with thinner realized promoting, which aids stability throughout retests. Low inflows also can coincide with quieter order books, so costs can journey extra on smaller trades if a catalyst lands.

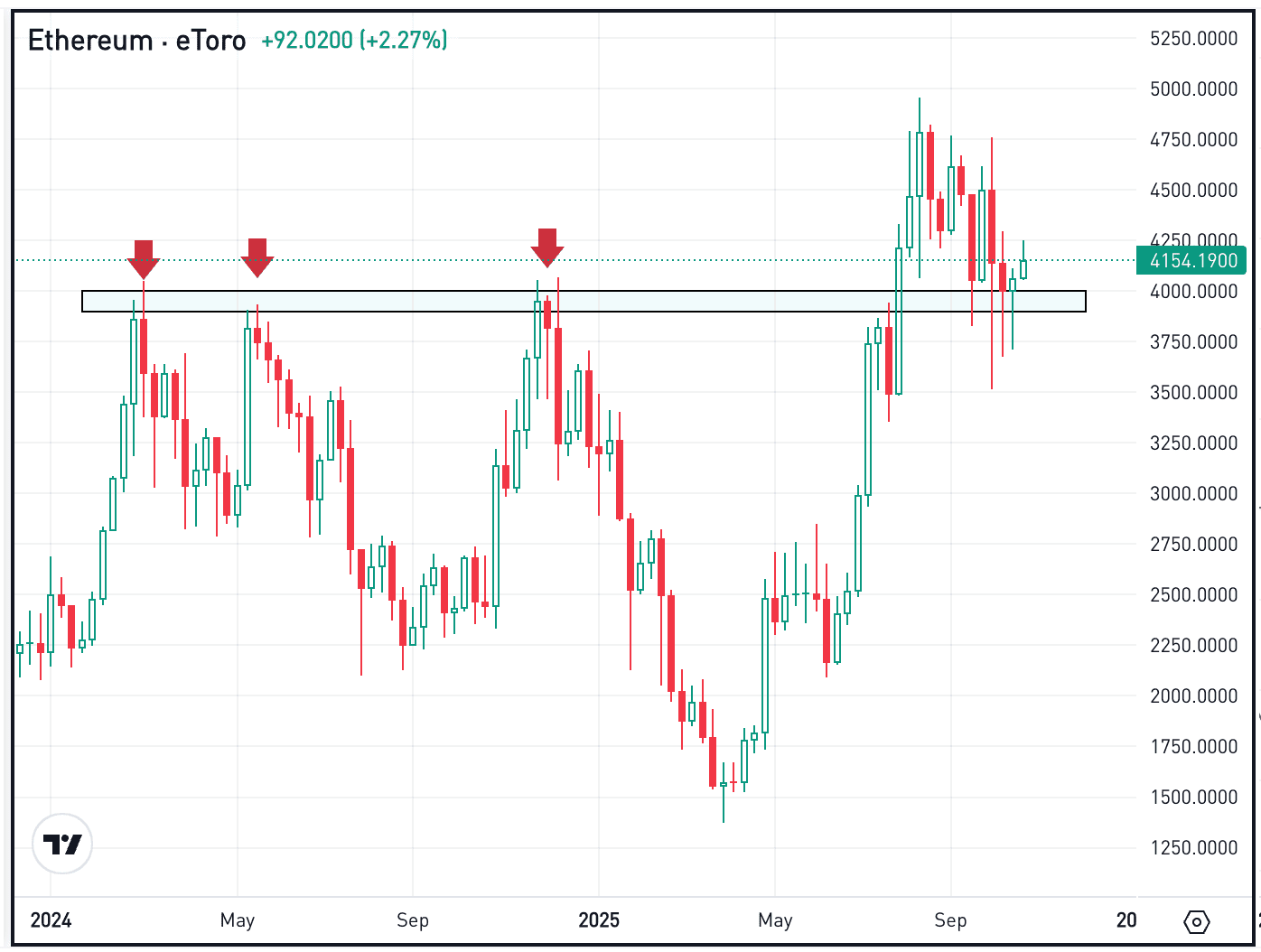

The technical fulcrum is the realized value higher band close to $5,200. CryptoQuant plots that stage because the area that repelled advances in 2020–2021 and once more in early 2024. ETH trades round $4,400 within the report window, so the market sits one step beneath a threshold with a observe file of pausing uptrends.

Clearing that zone would shift buying and selling into territory the place realized holders, on common, sit deeper in revenue, and the place provide forces rely extra on whether or not newer inflows outpace long-dated distribution.

The circulation image affords a easy guidelines for the weeks forward.

Fund holdings are already at a file, so incremental internet creations matter greater than absolute measurement. Whale cohorts maintain over 20 million ETH, so internet additions from this group carry outsized weight versus retail churn.

Staking is at 36 million ETH, so any acceleration or slowdown in validator deposits will change the liquid float on the margin. Alternate inflows are subdued in contrast with August, so watch whether or not that collection stays compressed or reverts as value revisits prior highs. All 4 traces are seen throughout the report’s holdings, staking, community, and influx charts.

For valuation context, CryptoQuant ties the April-to-September advance to a twin engine of institutional participation and on-chain throughput. That framing pairs the top-down demand seize of ETFs with bottom-up settlement use throughout DeFi and tokens.

It additionally leaves room for durations the place exercise outruns value or vice versa. In these phases, realized bands and exchange-flow gauges assist separate consolidation from distribution, particularly when positioning is already heavy amongst massive holders.

The near-term setup, due to this fact, revolves round whether or not ETH holds its footing right into a second try on the realized band, with funds, whales, staking, and exercise offering many of the sign on whether or not the cycle retains its tempo or pauses.

Based on the report, the realized value higher band close to $5,200 stays the extent in focus.