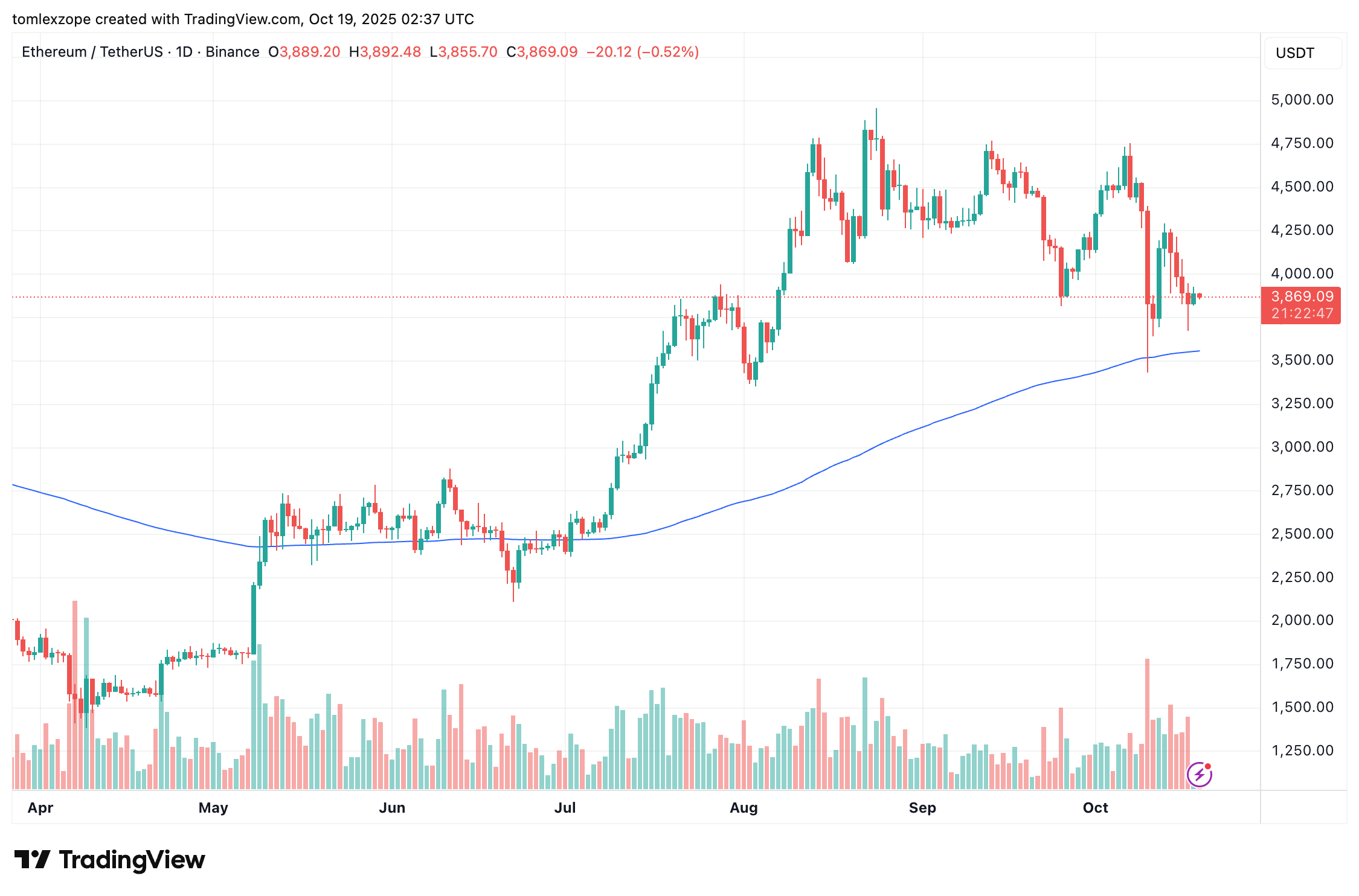

The worth of Ethereum seems to be recovering properly over the weekend after a interval of investor uncertainty. The “king of altcoins”, following what regarded like an aggressive return above the $4,200 degree earlier this week, is now lagging underneath the psychological $4,000 mark.

Whereas the Ethereum value has been constructing some constructive momentum over the previous day, the shadows of the October 10 downturn nonetheless appear to be weighing on investor sentiment. A market phenomenon generally known as the “Kimchi Premium” suggests a number of tedious weeks forward for the second-largest cryptocurrency.

What Occurred Final Time Kimchi Premium Noticed A Comparable Surge

In a latest put up on the social media platform X, market analyst CryptoOnchain revealed that the Kimchi Premium has been on the rise over the previous weeks. This commentary relies on the motion of the on-chain indicator Korea Premium Index, which measures the worth distinction between South Korean exchanges and different international exchanges.

This metric, or the “Kimchi Premium,” exhibits how a lot additional Korean merchants are prepared to pay for a specific cryptocurrency (Ethereum, on this case). When the index is constructive, it signifies that Korean retailers are prepared to pay a premium for the crypto belongings. In the meantime, a unfavorable Korean Premium Index alerts that the retailers are solely prepared to purchase the cryptocurrency at a reduction.

Based on CryptoOnchain, the Korea Premium Index for Ethereum not too long ago noticed a notable surge to round 8.2%, its second-highest degree this yr. The market analyst famous that this degree of Kimchi Premium is a troubling signal, because it traditionally suggests excessive retail FOMO (Worry of Lacking Out) and a possible value high.

Usually, whales are inclined to benefit from the worth hole by promoting on Korean exchanges when the Korea Premium Index is on the rise. As a consequence of elevated promoting strain, the Ethereum value now faces a better danger of correction.

For example, the final time ETH noticed a Kimchi Premium this excessive was in January, coinciding with the worth fall to round $1,500. With this in thoughts, buyers may wish to tread with warning, as the chances of a sustained downward pattern are considerably larger.

Ethereum Value At A Look

As of this writing, the worth of ETH stands at round $3,875, reflecting no important change previously 24 hours. In what was anticipated to be a bullish interval for the cryptocurrency market, “Uptober” has not significantly lived as much as the expectations of buyers. After a constructive begin to the month, the Ethereum value is at the moment down by nearly 10%.