The market efficiency of Ethereum has been steadily rising since October, marking a constructive and long-lasting development. Elevated shopping for exercise has been the primary driver of this constructive momentum that has persevered over time, pushing the cryptocurrency past the vaunted $2,000 resistance mark and igniting a unbroken rally.

The worth of Ethereum has sharply grown as a direct results of this elevated demand and market optimism, with its sights set on breaking via the essential resistance area at $2,300. This upward development serves as one other proof of the rising investor belief and basic bullishness surrounding Ethereum, thereby solidifying its place within the altering cryptocurrency market.

Ethereum Hits 18-Month Highs, Targets $3,000

Ethereum, the second-largest cryptocurrency on the planet, is rising shortly and has reached ranges not seen within the earlier 18 months. With a market valuation of $285 billion, ETH is now buying and selling 5.7% greater at $2,375 as of the time of publication. Some speculators have even shared $3,000 worth predictions for ETH amid the newest market breakout.

Ethereum’s approaching resistance stage poses an enormous problem to consumers of the altcoin, together with the mounted barrier at $2.5K, which has ceaselessly proven to be a major roadblock. But when the market is ready to recapture this crucial space, Ethereum might go on to succeed in the $2.5K – and even $3.000 — sooner or later.

Ethereum at the moment buying and selling at $2,358 territory on the each day chart: TradingView.com

As Ethereum breaks down additional obstacles, buyers and market watchers are holding an in depth eye on the scenario. A notable indication of the elevated curiosity from institutional buyers is the eagerness with which main gamers like VanEck, BlackRock, and Grayscale are awaiting clearance for Spot Ethereum ETFs.

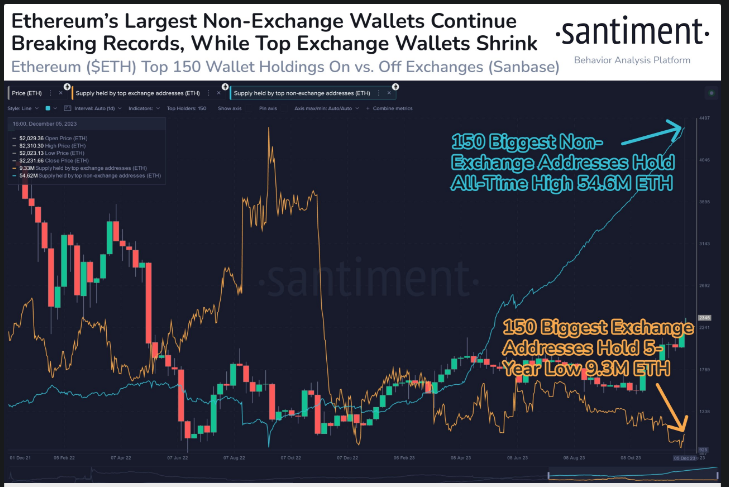

In accordance with Santiment, an on-chain knowledge service, Ethereum has reached $2,349, its highest worth since June 2022. The amalgamation of the constructive long-term development indicating an increase in wealth for the main non-exchange whale wallets and a lower in sell-off energy for the main alternate whale wallets presents a propitious scenario for a gradual upward development.

Ethereum’s Non-Trade Holdings Surge To 55M ETH

A latest tweet from Santinment highlights some intriguing variations in Ethereum’s pockets mechanics. Trade wallets noticed a five-year low of 9.3 million ETH, whereas high non-exchange wallets are constructing as much as a file 54.6 million ETH. This transfer factors to upward developments, with wealth constructing via non-exchange transactions and decreased promoting strain.

Over the course of two months, a bearish divergence between the value and the RSI indicator grew, pointing to a attainable overvaluation of Ethereum at this level. Given the present traits of the market, even when consumers appear to be in cost and general sentiment is bullish, there’s a vital chance of a quick corrective part that entails consolidation and better volatility within the close to future.

In the meantime, a latest ACDE assembly offered details about the approaching Dencun fork of Ethereum, which is about to happen in January 2024. The Goerli community testnet fork was well-prepared for by improvement groups, opening the door for a bigger Goerli shadow community fork within the coming weeks.

ACDE#176 occurred earlier immediately: we mentioned the state of Dencun, timelines for testnets, and strategy planning the next community improve ⛓️

Agenda: https://t.co/ATVLQ7f9XpStream: https://t.co/tDM0tDKxC5

Recap beneath 👇 https://t.co/PhGBkYxhYN

— timbeiko.eth ☀️ (@TimBeiko) December 7, 2023

By utilizing proto-danksharding, Dencun is anticipated to significantly improve knowledge availability for layer-2 rollups. This enchancment ought to lead to decrease rollup transaction prices, which can finally assist finish prospects.

Dencun’s general results embody rollups that improve Ethereum’s scalability, gasoline charge optimization, improved community safety, and the deployment of a number of housekeeping upgrades.

As Ethereum’s worth surges to surpass the $2,300 milestone, hypothesis intensifies in regards to the cryptocurrency’s potential to succeed in the subsequent vital threshold of $3,000. The latest upward trajectory displays the market’s confidence in Ethereum’s underlying know-how and its function within the evolving digital panorama.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. If you make investments, your capital is topic to threat).

Featured picture from Shutterstock