Recent information printed by on-chain analytics platform Santiment and highlighted by market commentator Ali Martinez reveal that the most important Dogecoin buyers have spent the final 4 weeks quietly increasing their positions whereas exercise on the community accelerates – all because the memecoin’s value grinds towards a make-or-break technical ceiling.

Dogecoin Whales Gas Bullish Momentum

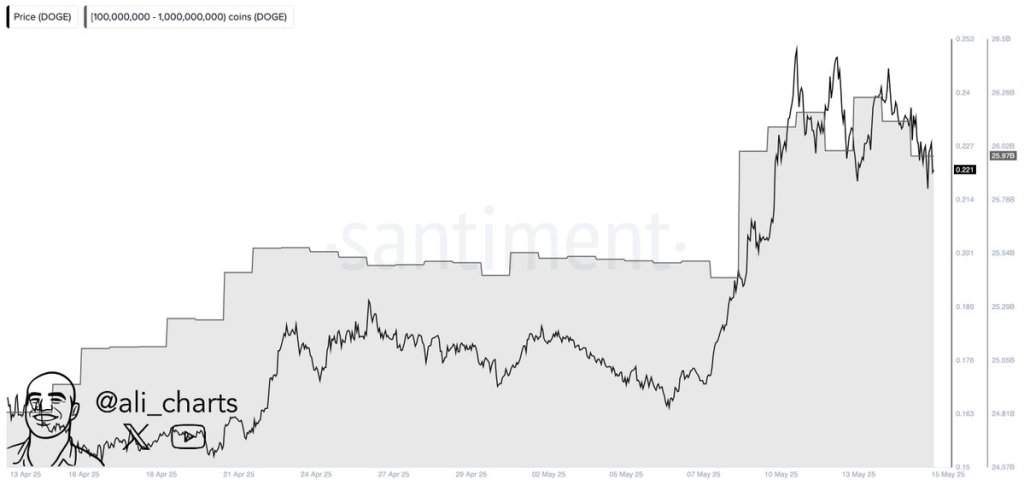

Martinez factors to the section of wallets holding between 100 million and 1 billion DOGE – the cohort typically described as “mid-tier whales.” Their mixed stability stood at roughly 24.6 billion DOGE on April 13 however had climbed to simply beneath 26.0 billion DOGE by Could 13, in response to the gray space within the whale accumulation chart.

The distinction of about 1.4 billion DOGE – value a bit over $300 million at prevailing spot costs – confirms that enormous holders have absorbed important provide even because the token rallied. On the time of the snapshot the cohort managed 25.97 billion DOGE, though the worth already peaked at roughly 26.5 billion DOGE on Could 10.

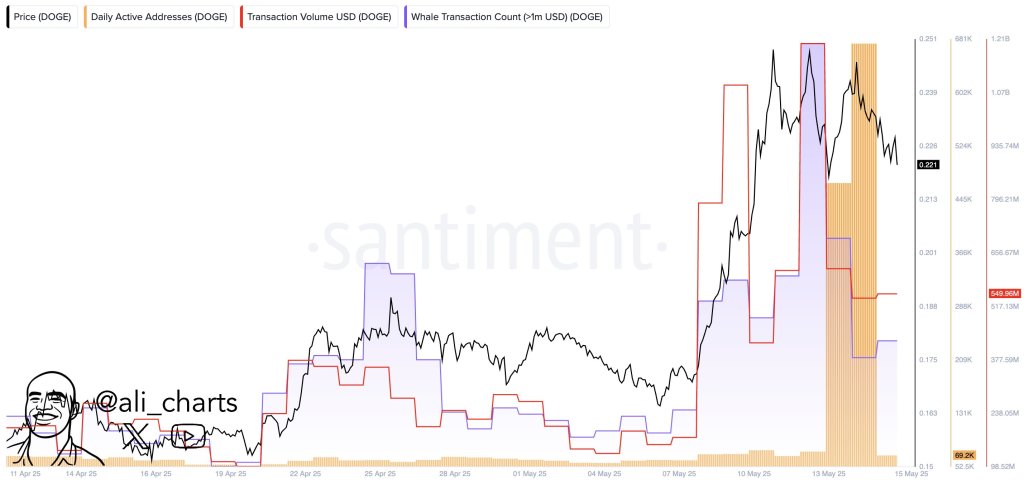

Community exercise seems to be following the cash. A second Santiment dashboard reveals day by day lively addresses vaulting from the low five-figure space in mid-April to peaks north of 680,000 on Could 12-13, earlier than easing to 69,200 on the Could print 15.

Transaction quantity in US greenback phrases has mirrored the surge, spiking to $1.21 billion and nonetheless holding an elevated $549.96 million on the newest studying. Maybe most telling for market depth, the depend of particular person transfers value greater than$1 million – plotted in purple on Martinez’s chart – ballooned throughout the identical window, underscoring that the exercise surge is being pushed in no small half by large-ticket trades reasonably than retail churn.

DOGE Costs Faces Key Resistance

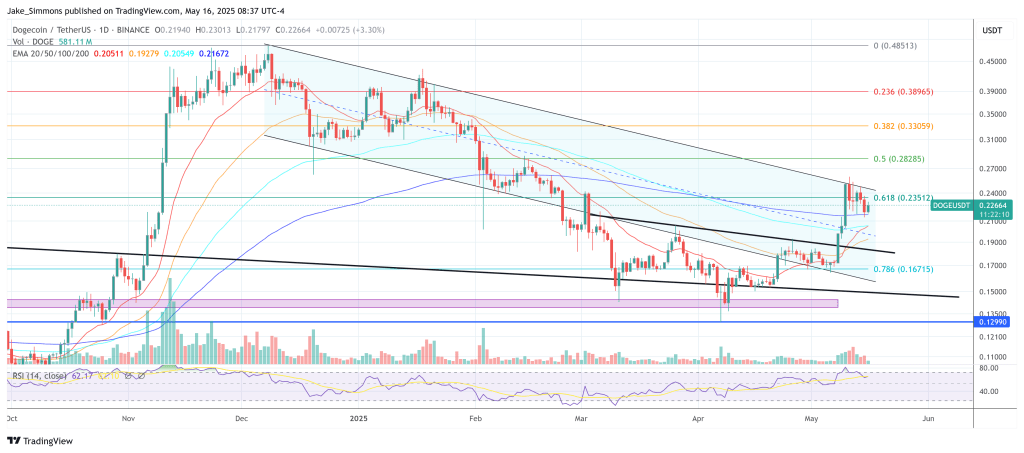

Whereas the tape of flows seems constructive, the value chart argues that the market stays at a crucial juncture. On the three-day candle chart shared by Martinez, DOGE is buying and selling at $0.2277 and urgent right into a provide wall that caps the band between roughly $0.24 and $0.26.

The horizontal zone – shaded in gray – was sturdy help all through December 2024 and have become resistance after the mid-February breakdown. It has since produced a number of clear rejections, every marked by Martinez’s downward arrows. One other breach try earlier this week pierced the band intraday however did not settle above it, leaving the extent intact.

Ought to patrons pressure a decisive shut above $0.2600 on a day foundation, the chart reveals a vacuum as much as the psychological $0.3000 deal with, a transfer Martinez argues “might spark a brand new bull run.” Conversely, failure to clear the ceiling dangers a swing again towards the mid-$0.1700 space the place the April basing construction started.

Taken collectively, the on-chain accumulation, the bounce in giant transactions and the swell in deal with exercise give basic backing to the bid beneath DOGE. Whether or not that demand can overpower the well-defined $0.24-$0.26 barricade will decide if the current accumulation marks the opening salvo of a bigger upside marketing campaign or merely one other range-bound flurry. For now, the whales have made their wager; the market is ready to see if value will observe.

At press time, DOGE traded at $0.22.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.