Be a part of Our Telegram channel to remain updated on breaking information protection

The US Federal Reserve is getting ready to hitch the “revolution in funds” and convey crypto “from the fringes” of finance into the mainstream.

That’s in accordance with Governor Christopher Waller, who mentioned on the Fed’s Funds Innovation Convention in Washington on Oct. 21 that the central financial institution will grant stablecoin issuers and fintech companies entry to its fee system by means of proposed “skinny” grasp accounts.

The transfer underscores a dramatic shift within the Fed’s method to digital property and decentralized finance. Waller mentioned applied sciences like stablecoins, tokenized property, and AI are “not on the fringes however more and more woven into the material of the fee and monetary methods.”

“Funds innovation strikes quick, and the Federal Reserve must sustain,” he mentioned. “We intend to be an energetic a part of that revolution.”

Fed Intends To Be Half Of The “Know-how-Pushed” Revolution In Funds

Addressing a room filled with trade leaders, together with Chainlink CEO Sergey Nazarov, Coinbase CFO Alesia Haas, Circle President Heath Tarbert, and a number of other Fed officers, Waller mentioned the decentralized finance (DeFi) neighborhood is not “considered with suspicion and scorn.”

Unimaginable management at present from Governor Chris Waller on the thought of a “skinny” Fed Account particularly for funds use instances for eligible establishments.

It will allow an entire host of alternatives to additional the US because the chief in funds and stablecoins. pic.twitter.com/QTIfYnRsfx

— Nathan McCauley ⚓ (@nathanmccauley) October 21, 2025

“Reasonably, at present, you’re welcomed to the dialog on the way forward for funds in the USA and on our dwelling area—one thing that might have been unimaginable just a few years in the past,” he mentioned. “As you all know, we’re effectively right into a technology-driven revolution in funds.”

Fed To Provide Streamlined Accounts For Stablecoin And Fintech Suppliers

Governor Waller mentioned that he has instructed Fed employees to discover what he calls a “fee account,” that will likely be aimed toward offering extra assist “to these actively remodeling the fee system.”

These accounts could be a lighter model of a masters account, and will likely be focused at companies that don’t essentially want all the “bells and whistles of a grasp account, or entry to the complete suite of Federal Reserve monetary providers.”

He mentioned that the so-called ”skinny” fee accounts could be out there to “legally eligible entities” that might want to observe the central financial institution’s Pointers for Evaluating Accounts and Providers Requests.

Establishments receiving these accounts would face particular operational restrictions which are designed to restrict Fed stability sheet publicity.

Along with that, the accounts wouldn’t earn curiosity on deposited balances. They may additionally carry necessary stability caps to regulate their dimension.

He then went on to say that the “skinny” grasp accounts would exclude low cost window borrowing and sure Fed funds providers the place the central financial institution can’t adequately management overdraft dangers.

“The concept is to tailor the providers of those new accounts to the wants of those companies and the dangers they current to the Federal Reserve Banks and the fee system,” Waller defined throughout his speech,” he mentioned throughout his speech.

“Accordingly, and importantly, these lower-risk fee accounts would have a streamlined timeline for assessment,” he added.

The Fed’s opening as much as the stablecoin sector follows months after US President Donald Trump signed the GENIUS Act into regulation in July.

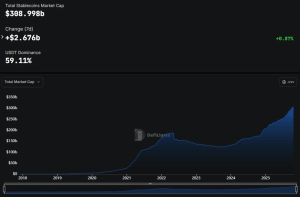

That is the primary regulatory framework on the federal stage that establishes the necessities for stablecoin companies seeking to concern their tokens within the US. The stablecoin market cap has since damaged above $300 billion for the primary time.

Stablecoin market cap (Supply: DefiLlama)

New “Skinny” Grasp Accounts May Profit Ripple, Kraken, Circle, And Custodia Financial institution

The brand new “Skinny” grasp accounts may speed up the approval course of for crypto-native companies resembling Ripple, Kraken and Custodia Financial institution, who’re all pursuing Fed grasp accounts by means of prolonged authorized processes.

One motive the method has been so prolonged is as a result of conventional finance banks have additionally pushed again towards the purposes.

Ripple’s CEO, whereas talking at DC Fintech Week earlier this month, commented on the pushback and referred to as the banks “hypocritical” for saying that the crypto sector needs to be held to the identical commonplace whereas not being given entry to infrastructure like Fed grasp accounts.

It may additionally profit different companies that function within the digital asset house who’re making an attempt to realize entry to the Fed’s funds infrastructure.

One in all them is USD Coin (USDC) issuer Circle, who has utilized for a nationwide banking/belief constitution. That is typically seen as a prerequisite for full Fed account entry.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection

![[LIVE] Crypto News Today, October 23 – Crypto Markets Hold Steady With BTC at $109K as Traders Await CPI Data and Trump–Xi Talks: Next Crypto to Explode? [LIVE] Crypto News Today, October 23 – Crypto Markets Hold Steady With BTC at $109K as Traders Await CPI Data and Trump–Xi Talks: Next Crypto to Explode?](https://www.ajoobz.com/wp-content/themes/jnews/assets/img/jeg-empty.png)