The Synthetic Superintelligence Alliance, as soon as hailed as crypto’s flagship AI collaboration, is now unraveling below the load of inner battle and competing pursuits.

Shaped to unify Fetch.ai, SingularityNET, and Ocean Protocol right into a shared ecosystem, the alliance promised to speed up decentralized AI growth via token and governance alignment.

However what started as a imaginative and prescient of synergy has devolved into public disputes over management, transparency, and token administration.

These tensions have now spilled into the courtroom, with Fetch main a category motion that might check not solely the alliance’s future but in addition the very notion of DAO autonomy.

Why is Fetch taking authorized motion towards Ocean Protocol?

Fetch and three token holders have filed a category motion within the Southern District of New York alleging Ocean Protocol and its founders misled the neighborhood in regards to the autonomy of OceanDAO.

The grievance, “Fetch Compute, Inc., et al. v. Bruce Pon, et al., case no. 1:25-cv-9210,” was filed Nov. 4, 2025, and names Ocean Protocol Basis Ltd., Ocean Expeditions Ltd., OceanDAO, and Ocean co-founders Bruce Pon, Trent McConaghy, and Christina Pon as defendants.

Plaintiffs declare that Ocean misrepresented that tons of of hundreds of thousands of OCEAN “neighborhood” tokens can be reserved for DAO rewards, however as a substitute transformed and bought these tokens after becoming a member of the Synthetic Superintelligence Alliance, thereby miserable the worth of FET and undermining the DAO’s said governance mannequin.

In line with the grievance, the alleged scheme centered on the standing of roughly 700 million OCEAN neighborhood tokens.

Plaintiffs declare that these tokens have been initially pledged for autonomous, rules-based distribution to contributors through good contracts as Ocean transitioned to a DAO mannequin, however have been subsequently reclassified in apply and faraway from neighborhood management.

The submitting argues that Ocean transferred the OceanDAO property to a Cayman Islands entity, Ocean Expeditions, in late June, transformed OCEAN to FET starting in early July, liquidated a big portion of the ensuing FET on centralized venues, and withdrew from the ASI Alliance in October.

Ok&L Gates accomplice Ed Dartley, counsel to Fetch.ai and the plaintiff class, mentioned in a press release shared with CryptoSlate that

“Ocean misled the token neighborhood and its merger companions… to imagine that 600 million Ocean tokens have been reserved for neighborhood rewards.”

He added that the defendants “reaped hundreds of thousands of {dollars} that ought to have gone to the neighborhood.”

Ocean Protocol Basis is contesting the claims. In a press release to CryptoSlate, Preston Byrne, Managing Companion of Byrne & Storm, who represents Ocean Protocol Basis, mentioned:

“It is a very unusual lawsuit that appears designed for consumption on social media moderately than destined for achievement in a courtroom. OPF can be responding to this lawsuit vigorously sooner or later.”

In a press release shared with CryptoSlate, Dr. Ben Goertzel, CEO of SingularityNET and co-founder of the ASI Alliance, mentioned:

“Whereas I’ve been very unpleasantly shocked by a few of the current actions of Ocean Protocol within the context of their departure from the ASI Alliance, I might moderately depart the authorized facet within the arms of the legal professionals.

I might identical to to reiterate that whereas Ocean has chosen to go their very own method, the Alliance continues to maneuver ahead powerfully towards decentralized AGI and superintelligence, with new advances day by day.”

Plaintiffs element a timeline that tracks the ASI token merger and Ocean’s eventual departure.

In line with the submitting, plaintiffs assert claims of fraud, civil conspiracy, violations of New York Common Enterprise Regulation, breach of contract, breach of the implied covenant, and promissory estoppel, and so they search class certification, damages, and equitable reduction, together with rescission and disgorgement.

The grievance frames the case round whether or not a purportedly decentralized DAO was, actually, managed by a small group that might transfer neighborhood property with out the approval of token holders, and whether or not Ocean’s public supplies, weblog posts, and “imaginative and prescient” paperwork created a binding covenant relating to how neighborhood tokens can be used.

They allege that Ocean joined the alliance on the idea that neighborhood tokens would stay restricted for rewards, whereas the FET and AGIX communities voted to proceed.

Afterward, the grievance states that Ocean created Ocean Expeditions on June 27, 2025, transferred OceanDAO property to that entity, started changing OCEAN to FET round July 1, 2025, and later exited the ASI Alliance on October 8–9, 2025.

The submitting quantifies the flows as greater than 661 million OCEAN transformed into roughly 286.46 million FET, adopted by gross sales of roughly 263 million FET into the market, equal to greater than 10 % of the circulating provide on the time, leading to worth stress on FET throughout and after Ocean’s withdrawal.

For readers monitoring the on-chain and structural mechanics, the grievance claims Ocean had beforehand revoked contract management and described OceanDAO as “absolutely decentralized and autonomous,” with neighborhood tokens to be disbursed by good contract to individuals in information farming and different incentive packages.

Plaintiffs argue that these commitments have been central to merger-vote approvals and to token holders’ selections to carry, convert, or purchase tokens throughout the ASI transition, and that any undisclosed change in command of the neighborhood token wallets can be materials to market habits and governance expectations.

The submitting additionally asserts market construction impacts. Plaintiffs allege that changing after which promoting neighborhood tokens created a persistent overhang, weakening confidence in DAO governance and impairing the alliance’s means to draw contributors and maintain incentives.

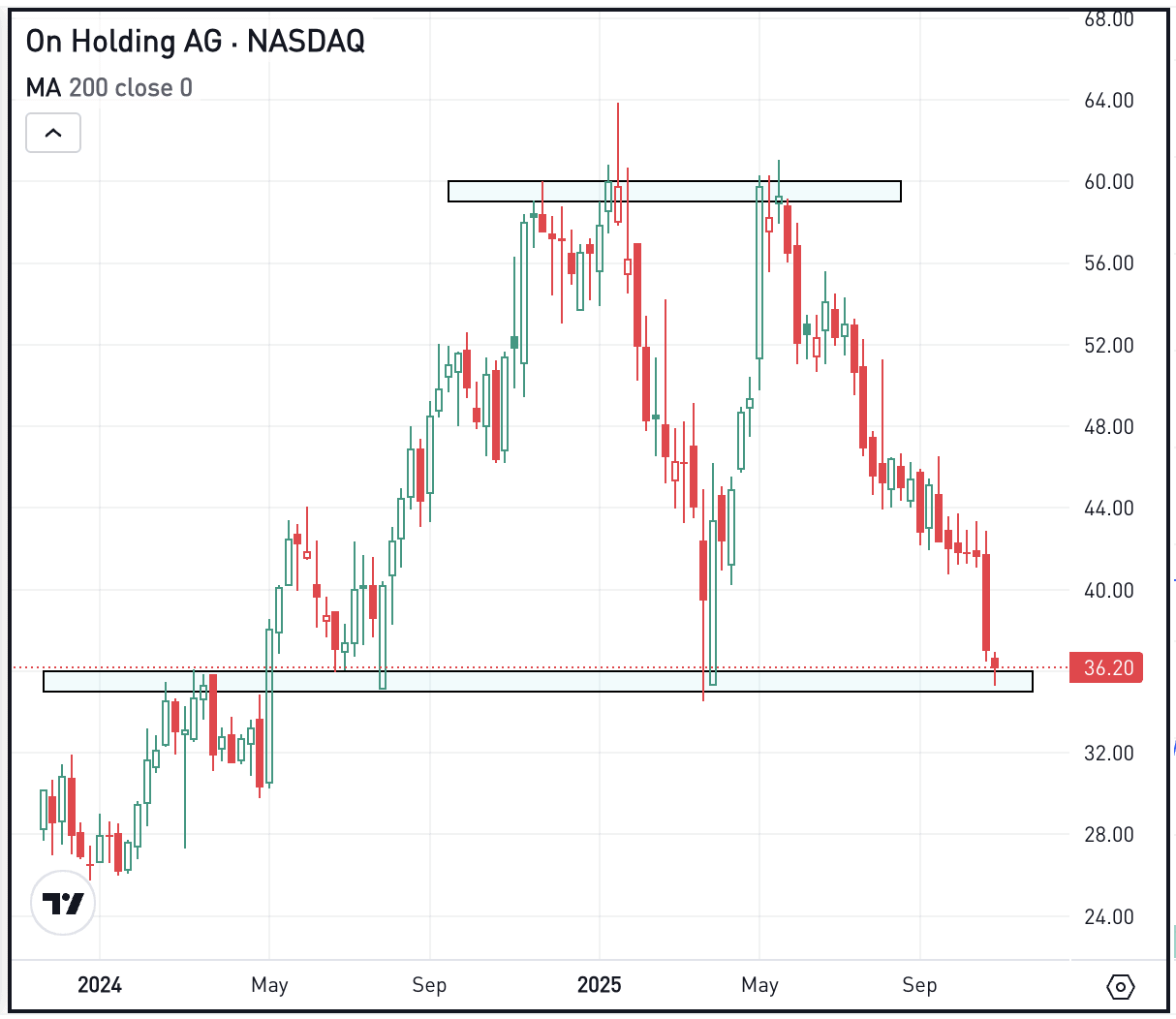

The grievance cites worth ranges across the exit window and ties the drawdown to Ocean’s actions and bulletins, whereas noting the size of the tokens at situation in relation to the float.

The idea of hurt combines direct token worth results with a lack of the motivation pool that the neighborhood anticipated to fund information and mannequin contributions over time.

For an at-a-glance view of the dispute as pleaded:

EventDetailDate / AmountCase filingSDNY class motion, case no. 1:25-cv-9210Nov. 4, 2025Community token poolDesignated OCEAN neighborhood tokens≈700,000,000 OCEANEntity changeOcean Expeditions shaped, OceanDAO property movedJune 27–30, 2025ConversionsOCEAN transformed to FET661,218,319 OCEAN → 286,456,967.46 FETAlleged salesFET bought into market≈263,000,000 FETAlliance exitOcean leaves ASI AllianceOct. 8–9, 2025

The case lands in a interval of mounting regulatory and civil scrutiny for token initiatives that describe themselves as decentralized whereas sustaining foundation-controlled multisig constructions. U.S. companies and courts have handled DAOs as unincorporated associations when human controllers are identifiable.

Latest issues have targeted on who can authorize treasury strikes, how proposals are accredited, and whether or not token holder votes are binding in apply. The SDNY discussion board provides discovery and movement apply that may probe the hole between technical decentralization claims and operational management, particularly the place a big “neighborhood” allocation is alleged to have been spent, transformed, or redirected.

Key subsequent steps to observe are an look by protection counsel, any movement to dismiss difficult the contract and shopper safety claims, and requests for preliminary reduction tied to manage of token holdings referenced within the submitting.

Plaintiffs additionally plead for equitable treatments that might have an effect on custodied balances or on-chain addresses if granted. Any parallel governance adjustments, signer disclosures, escrow preparations, or return mechanisms introduced by the events would reshape the reside controversy even because the litigation proceeds.

Ocean’s response will decide whether or not this dispute proceeds on to motions apply or towards a negotiated framework for dealing with the tokens at situation.

Plaintiffs have framed the case round DAO accountability and the reliance of token holders on the DAO. The protection has framed it as a social media narrative.

The grievance now presents that battle earlier than a federal choose in New York.