How will AI assist drive fintech innovation? How can digital transformation energy larger monetary inclusion? The place is the sensible cash investing in fintech? What would be the Subsequent Massive Factor in monetary companies?

FinovateFall wrapped up simply days in the past – and far of the three days of fintech demoes, keynote addresses, and panel discussions was devoted to offering solutions to those questions.

Right here we’ll replicate of these responses and spotlight a number of the key takeaways from our mainstage fintech consultants, our modern demoing corporations, and Finovate attendees themselves.

What we realized from the consultants

Our invitation-only, Leaders+ session held the night earlier than the convention started featured quite a lot of insights on the current and way forward for fintech. The lead-off tackle on main fintech themes set a tone for our invitees that foreshadowed a lot of what the remainder of our attendees would see and listen to as soon as FinovateFall obtained underway the next morning.

Analyst and skilled Alex Johnson of Fintech Takes offered one of many extra stunning insights of the evening in his keynote on prime tendencies in banking and fintech. Johnson prompt that the comparatively unglamorous areas of the trade might develop into the “Coming Sights” by way of fintech innovation over the close to time period. A lot of the fintech revolution thus far, Johnson defined, concerned fixing shopper issues – a lot of them bearing an uncanny resemblance to the issues of the corporate founder’s themselves.

As innovation on this area runs its course, alternatives in different, uncared for areas can emerge. Johnson inspired invitees to keep watch over “the boring stuff” like funds infrastructure and the B2B world when gauging the general stage of innovation and alternative within the fintech and monetary companies trade.

Johnson additionally noticed that we should always proceed to see fintech deployed to unravel issues that aren’t essentially thought-about to be monetary issues. Our personal Finovate analysis crew has famous the elevated information circulation from corporations seeking to assist small companies survive provide chain financing challenges. It was heartening to listen to Johnson use the instance of fintechs offering financing to SMEs caught in provide chain snafus in that a part of his presentation.

The opposite main subject of dialog in our Leaders+ session was AI and the metaverse. This was one other dialogue that prolonged over the steadiness of FinovateFall. The jury should be out on the influence of the metaverse in banking. However the potential of AI in fintech and monetary companies appears clear.

From larger personalization of companies to extra environment friendly, safer, and extra modern monetary merchandise, banking and monetary companies are prepared to search out roles for AI.

Begin with Generative AI. One commonality between keynote audio system on AI was to match the adoption price of a Generative AI answer like ChatGPT to the adoption price of earlier standard applied sciences from the previous. Suppose every part from Napster to LinkedIn to TikTok. GenerativeAI was clearly in a category of its personal. This sentiment – that AI is right here to remain – was echoed in nearly each dialogue of the know-how – from Leaders+ and keynote speaker Tomas Chamorro-Premuzic to Analyst All-Star Tiffani Montez of Insider Intelligence. At one level, even David Letterman’s basic skewering of the Web in an interview with Invoice Gates again in 1995 (“Does radio ring a bell?”) was deployed to remind our FinovateFall viewers that we’ve underestimated innovation earlier than.

What we realized from the innovators

There isn’t any higher method to really feel the heart beat of fintech innovation than by attending the Demo Days at a Finovate occasion. And there’s no higher distillation of what route fintech innovation goes than the businesses that take dwelling Finovate Better of Present awards.

FinovateFall was no exception. Of the six corporations that gained Better of Present final week, we noticed three corporations demo options in areas that observers lengthy have mentioned are ripe for innovation. Chimney demoed an answer for owners that gave them actionable recommendation on their dwelling’s worth and fairness, their borrowing energy, and the provision of related pre-qualified presents. Belief & Will demonstrated know-how that streamlines and simplifies property planning and settlement with lawyer permitted, legally legitimate paperwork. Wysh, an innovator within the insurance coverage area, demoed a deposit answer that gives micro-life insurance coverage protection of as much as 10% of the account holders steadiness.

Better of Present profitable corporations like eSelf.ai confirmed fintech to be on the chopping fringe of enabling applied sciences like AI, as effectively. The Israel-based firm, whose founder helped launch three-time Finovate Better of Present winner Voca.ai, demoed eSelf.ai’s AI-powered shopper interplay answer that gives human-like dialog and engagement. Mahalo Banking, headquartered in Michigan and in addition profitable Better of Present in its Finovate debut final week, demonstrated fintech’s dedication to variety and inclusivity. The corporate leverages modern know-how to ship on-line and cellular banking options for credit score unions that assist them serve neurodiverse clients with visible, cognitive, and different challenges.

And the return of Debbie to the Better of Present winner’s circle is a reminder that options that reply to the fundamentals of monetary wellness – saving and lowering debt – stay crucial parts of the fintech ecosystem. Having gained Better of Present in its Finovate debut final fall, Debbie was again with new instruments to assist customers handle debt, together with a bank card refinancing market for credit score unions.

The place we go from right here

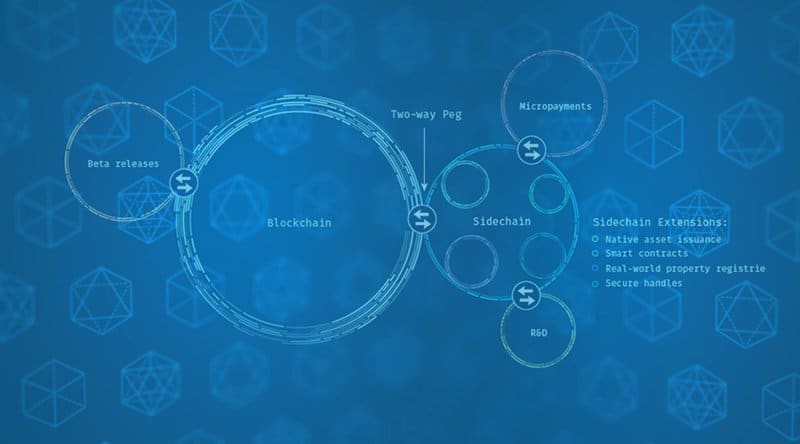

There have been a number of canines that didn’t bark – at the very least not as loudly as they as soon as did. Cryptocurrency and digital belongings, for instance, didn’t draw as a lot consideration this 12 months as they’ve in earlier years. We’ve seen extra from mortgagetech, as effectively. It’s exhausting to not marvel what the influence of upper rates of interest can have on this trade and different consumer-facing, interest-rate delicate sectors and companies from lending to Purchase Now Pay Later.

Therein lies the chance. The issues could appear extra intractable and the options not as attractive as they was once. However the eagerness of founders and monetary establishments to embrace each new applied sciences like digitization, automation, and AI – in addition to new causes like monetary inclusion and sustainability – is a powerful signal for the way forward for our trade.