Whether or not you’re younger, mid-career, or taking part in the again 9, Roth IRAs will be an essential instrument to your monetary objectives. 4 case research beneath will illustrate how by combining Roth IRAs with bitcoin, it can save you for retirement, optimize to your private tax scenario throughout retirement, and depart your bitcoin for the subsequent era.

These are hypothetical case research primarily based on our experiences, not actual individuals. They’re supposed that will help you higher perceive how bitcoin Roth IRAs can match into many forms of retirement plans. Therefore, they’re for academic functions—it is best to talk about all private conditions with a monetary, tax, or authorized skilled.

Sally the tremendous stacker: Saving for retirementRod is retirement prepared: Coming into retirementLarry needs to depart a legacy: Inheritance“Why Would I?” Wayne: Causes to not Roth

1. Sally the tremendous stacker: Saving for retirement

Sally is in her early 30s and has fallen down the bitcoin rabbit gap. Sally views bitcoin as the most effective financial savings expertise given at present’s present macroeconomic backdrop and bitcoin’s mounted provide of 21 million and is dedicated to a disciplined accumulation technique.

She’s on the lookout for a method to save her hard-earned cash with out struggling debasement over time. In the end, she wish to use her financial savings for main objectives: a dream trip, a home, beginning a household, and perhaps retiring sometime. However retirement is a distant aim, and she or he thinks the US may undergo some important adjustments earlier than she’s able to cool down.

Why would she even hassle with the fiat-based American retirement system? The principles, limits, penalties, and potential adjustments aren’t value it. Simply hold your head down and stack sats, proper? Not so quick, Sally.

Significance of tax-free development

Like most bitcoiners, Sally is stacking bitcoin with cash that has already been taxed. Her payroll taxes are withheld on payday, and she or he is paid the remaining U.S. {dollars} into her checking account. She then sends cash to an alternate and purchases bitcoin. That is the standard manner most individuals stack sats—post-tax.

Nonetheless, simply because the bitcoin is bought post-tax doesn’t imply it received’t be taxed once more. Non-retirement bitcoin earnings are taxed as a capital acquire when bought. Over her years of stacking, she might want to hold monitor of her price foundation and deduct that quantity from the gross proceeds when promoting.

It’s a easy components: (ultimate commerce) minus (what you paid) equals (what you made). What you make is taxed as capital good points.

Enter the Roth IRA

That is the place a Roth IRA financial savings car provides worth. If Sally have been to contribute to a bitcoin Roth IRA, contributions would nonetheless be made post-tax—similar as earlier than. However the important thing distinction is that certified Roth IRA distributions are tax-free. She solely pays tax as soon as, not twice.

The potential implications of tax-free bitcoin are large. If the greenback worth of bitcoin exponentially will increase as Sally expects, then lowering her potential tax burden turns into more and more rewarding.

Let’s assume she begins saving $6,000 per yr at age 30 till she reaches age 65, and bitcoin grows at 6% annualized (be happy to plug in your personal assumptions). At age 65, she can have accrued $822,330. And if she needed to pay an estimated 20% capital good points tax, it might quantity to a invoice over $117,000.

On this situation, a Roth IRA saves her greater than $117,000. The Roth turns into a car to supercharge future buying energy with out altering her present taxation. Not having to pay tax on future good points has an exponential influence over time.

Not simply retirement: Withdrawing contributions

4 years into maximizing her bitcoin Roth IRA contributions, Sally has contributed $24,000 (4 years of $6,000 max) and skilled a fast improve in bitcoin value—a typical expertise for a lot of bitcoiners. Let’s assume a hypothetical steadiness of $100,000. To have a good time and reward herself, she has deliberate a Miami trip. Nonetheless, she will be able to’t resolve if she ought to promote her non-retirement bitcoin and pay good points tax or take it from her retirement account and pay penalties.

With penalty-free entry to Roth contributions, Sally can take as much as $24,000 (her whole contributions) out of her Roth with out incurring penalty or tax. On this imaginary situation, let’s say she finally ends up pulling $10,000 from the Roth for her Miami trip.

Extra methods to maximise a Roth

If Sally meets somebody in Miami, she may pull $10,000 extra from the Roth for an elopement marriage ceremony. And the home with the picket fence? The Roth permits for some flexibility in that, too: Roth IRAs enable for as much as $10,000 of earnings to be withdrawn penalty-free if used for a first-time dwelling buy. With $4,000 of contributions left and a further $10,000 in earnings for the first-time dwelling buy, Sally may mix forces together with her equally-wise new partner—who was additionally contributing to a Roth—and compile $24,000 for a down cost.

After the tax- and penalty-free spending spree has subsided, she and her partner can proceed to usually contribute once more, saving for the subsequent massive aim, and in the end for retirement.

Key takeaways

The Roth account has extra flexibility than simply saving for the basic age 59 ½ retirement situation. Tax-free development is a robust instrument to develop wealth over time and must be strongly thought of for any retirement plan. You’ll be able to pull contributions tax- and penalty-free at any time, and earnings are tax-free at retirement age. Sure circumstances even will let you pull earnings out of your Roth with out a penalty.

2. Rod is retirement prepared: Coming into retirement

Rod has been diligently getting ready for retirement. He’s mentally there, however financially not able to take the leap. Nonetheless, bitcoin has change into an more and more essential place in his portfolio. What began as a hedge (1-2%) has change into a core element (+10%). He holds some bitcoin instantly however has extra publicity via bitcoin-adjacent property (GBTC, MicroStrategy, mining shares, and many others.).

He’s not able to go all-in on bitcoin as a result of, though he believes in its significance, the volatility conflicts together with his need for monetary stability throughout retirement. He has labored exhausting to earn his nest egg and would hate for it to vanish—particularly to taxes. Inside the subsequent 5-10 years, he’ll transition out of his profession and dwell off his 401k, funding account, actual property fairness/revenue, and bitcoin. Any social safety or pension are only a bonus.

Brackets and buckets

Rod must dive into his monetary scenario and see how his tax brackets will look. What’s going to they seem like the Monday morning after he retires? What’s going to they seem like after the pension or social safety begin? What about when the 401k required minimal distributions begin at age 72? Figuring out the place the cash is coming from, when it happens, and the way it’s taxed are important parts to retiring—and staying retired.

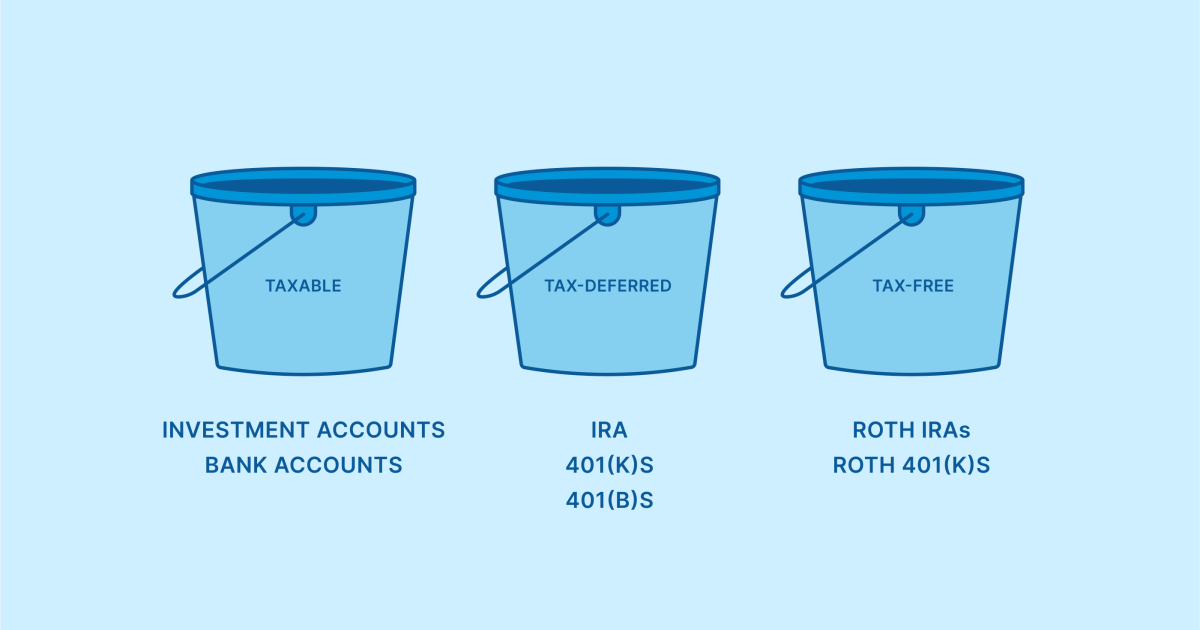

To make a plan, Rod wants to consider every account kind as being in a unique “tax bucket”. His taxable property are taxed upon sale, and his tax-deferred accounts are taxed when he takes revenue from them. The Roth offers one other bucket: tax-free revenue. If Rod have been so as to add a Roth IRA, he may pull from totally different buckets relying on the plan and the necessity.

For instance, Rod can pull from the Roth in excessive tax years and hold his bracket from climbing too rapidly. He can pull from taxable or Conventional IRAs in low tax years and speed up that revenue at a decrease marginal charge. Extra refined methods may embrace conversions, delaying revenue, gifting taxable property, and many others. The important thing level: Roth permits for diversification in “tax buckets” to optimize your tax bracket in retirement.

When Rod provides this tax-free bucket to his image, he decides to fill it with excessive threat/reward property like bitcoin. If the expansion is tax-free, then it is smart for it to develop as a lot as attainable. He decides to promote his mining shares, GBTC, and MSTR and convert that money right into a bitcoin IRA (ideally one the place he controls entry to the keys).

Key takeaways

What did your bracket seem like this yr? No, not the March Insanity one. The un-fun IRS one. All retirees should contemplate their anticipated tax bracket all through retirement, and tax bracket administration is a science and an artwork. Specifics range from individual to individual, however the principle idea applies: The extra diversified your “tax buckets,” the extra flexibility and optionality you’ll have in any tax setting.

3. Larry needs to depart a legacy: Inheritance

Larry has been having fun with his time together with his spouse and grandchildren. He had a profitable profession and worthwhile investments which have sustained his life-style via retirement. Now, he thinks rather more in regards to the subsequent era and the challenges and struggles they are going to face. He needs to guard these he cares about and depart the world a greater place.

At first, bitcoin didn’t make sense to him. He thought it was simply one other get-rich-quick scheme. However given the state of the world at present and institutional monetary foolishness happening, he’s now open to seeing its long-term potential. Larry’s primary aim is to depart bitcoin for the children and grandkids. He thinks it may change into significant for his or her future when he’s not with them.

Inheritance and property issues

When Larry units up a Roth IRA, he doesn’t ever should take Required Minimal Distributions from that account. He can depart the property there to develop tax-free for the long run—excellent for bitcoin. Larry can simply add or modify beneficiaries to that IRA at any time, and beneficiaries will obtain the Roth revenue tax-free upon his passing. He can accomplish his aim of passing bitcoin to his family members. (Property taxes should apply, Roth IRAs solely keep away from revenue tax.)

Changing to a Roth IRA

Larry was already retired when the Roth IRA got here out in 1997, so he doesn’t have an current Roth, and also you want earned revenue to contribute. However despite the fact that he can’t add cash instantly to 1, he can contemplate a Roth conversion.

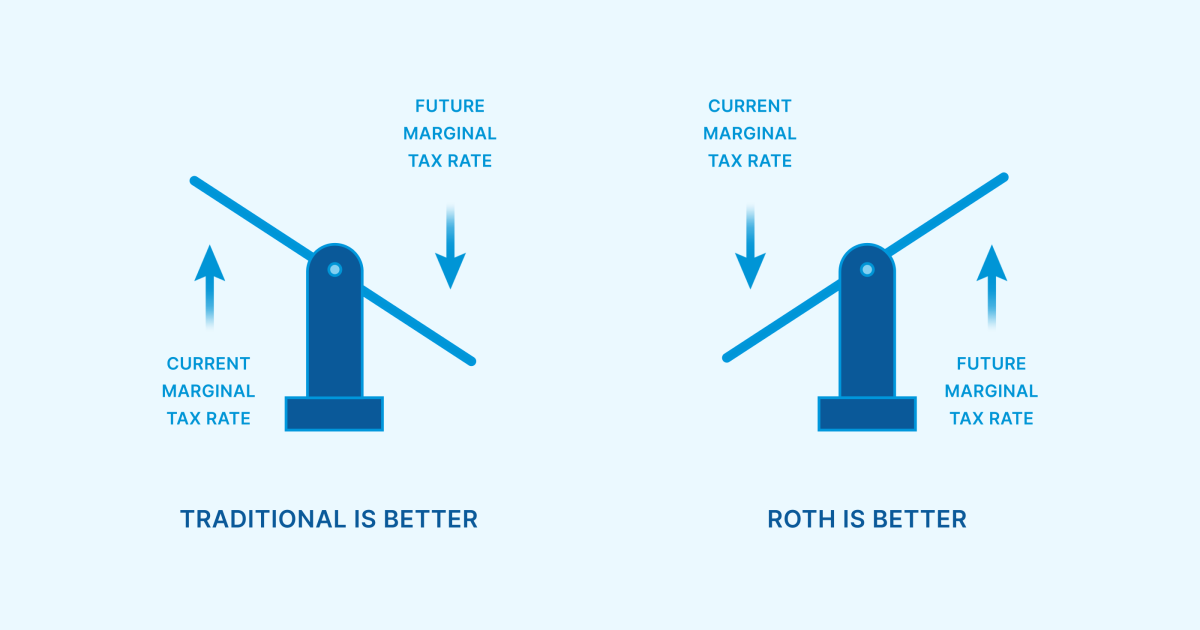

He can take pre-tax 401k/IRA funds and convert them to Roth, permitting him to pay the tax now and switch it right into a tax-free car for future generations. As as to if it is a good concept to your beneficiaries, the mathematics is pretty easy: should you count on your tax charge to be decrease than your beneficiaries’ tax charge, then the Roth would make extra sense.

Key takeaways

Larry has optionality. If the mathematics is smart, he may flip a portion of his portfolio right into a bitcoin Roth IRA and depart the asset for future generations. It’s value noting that holding your personal keys in an Unchained IRA requires that you simply additionally do correct inheritance planning.

4. “Why Would I?” Wayne: Causes to not Roth

Wayne is in his peak incomes years and making actually good cash at his fiat job. He lives a easy life having fun with numerous time open air, and expects to not want a lot revenue after he retires. He has many hobbies, considered one of which is mining bitcoin with a number of machines from his dwelling. It’s not a large-scale operation, only a interest, however he would contemplate mining bitcoin together with his retirement account if that have been an possibility. In the end, he plans to depart all property he owns to charities that he cares about.

Brackets and buckets pt. 2

Revisiting the brackets and buckets dialogue from above, Wayne’s present revenue (excessive bracket) is far higher than his anticipated future revenue wants (low bracket). If he have been to transform any of his current retirement property to Roth, he can be paying the next charge than if he had simply waited to drag it in retirement. From this angle, it could be wiser to maintain the property in a Conventional pre-tax account and never convert to Roth.

Dying and taxes…

You realize the saying: nothing is for certain in life however demise and taxes. If that’s true, we are able to definitely add “demise taxes” to the checklist. “Dying tax” in all probability wasn’t too common in opinion analysis research, so “property tax” is the politically appropriate time period nowadays. In 2022, the property tax kicks in round $12 million of internet value ($24 million for married {couples}). Over time, increasingly bitcoiners might want to contemplate this threshold because it turns into related to their scenario.

As Wayne considers a Roth IRA, he ought to observe Roth IRAs don’t keep away from the property tax, solely the revenue tax. Wayne plans to depart all property to charity. Property left to certified non-profit entities would keep away from each property and revenue tax. In his case, there isn’t any profit to the Roth over his present construction from a taxation-at-death standpoint. If it goes to charity, it avoids the demise tax—a silver lining to say the least.

Mining in a Roth?

Now, let’s re-introduce Wayne’s bitcoin mining interest. Mining bitcoin inside an IRA is technically attainable however extremely suggested in opposition to for the common investor. He ought to concentrate on the tax nightmare typically concerned and seek the advice of a tax advisor relating to UBIT (Unrelated Enterprise Earnings Tax) inside IRA accounts. Moreover, if Wayne needs to carry his mined bitcoin with out revealing private info to a monetary establishment, Roth IRAs merely aren’t an possibility.

Key takeaways

When contemplating a monetary technique, no single instrument works for each particular person’s scenario. Elements equivalent to tax bracket, internet value, and charitable intent are all related issues when evaluating a Roth IRA. Mining doesn’t are typically well-suited for bitcoin IRAs due to UBIT. Because of these components, a Roth IRA is probably not the proper route for Wayne.

Wrapping up

Hopefully, you’ve seen how versatile, versatile, and impactful the Roth IRA car will be when mixed with the most effective financial savings expertise ever found: bitcoin. You’ve seen circumstances that will positively and negatively have an effect on the suitability of a bitcoin Roth IRA to your monetary image.

When contemplating bitcoin in a Roth IRA, it is best to at all times contemplate who’s controlling the keys. There are tangible variations between the various approaches to bitcoin IRAs, and there’s no cause to let an alternate hack or mistake jeopardize your wealth. The Unchained IRA lets you safe your monetary future by holding your personal non-public keys to your bitcoin.

Whether or not you’re planning for retirement, coming into retirement, or planning your inheritance, the Unchained IRA workforce may help. To study extra, join an upcoming Retirement and Inheritance webinar or enter your electronic mail beneath to enroll in our e-newsletter.

This text is supplied for academic functions solely, and can’t be relied upon as tax or funding recommendation. Unchained makes no representations relating to the tax penalties or funding suitability of any construction described herein, and all such questions must be directed to a tax or monetary advisor of your selection. Jessy Gilger was an Unchained worker on the time this put up was written, however he now works for Unchained’s affiliate firm, Sound Advisory.

Initially revealed on Unchained.com.

Unchained Capital is the official US Collaborative Custody companion of Bitcoin Journal and an integral sponsor of associated content material revealed via Bitcoin Journal. For extra info on providers provided, custody merchandise, and the connection between Unchained and Bitcoin Journal, please go to our web site.