Key Takeaways:

Galaxy Digital secures over $175 million for its first exterior enterprise fund, exceeding its $150M goal.The fund targets infrastructure and purposes driving stablecoins, tokenization, and onchain funds.Galaxy’s transfer indicators rising institutional confidence in real-world crypto adoption regardless of market volatility.

Galaxy Digital, one of the vital distinguished gamers within the digital asset house, has formally closed its first externally-backed crypto enterprise fund—Galaxy Ventures Fund I—at greater than $175 million, surpassing its preliminary goal of $150 million. The profitable elevate marks a major milestone as the corporate doubles down on early-stage crypto infrastructure and real-world blockchain purposes, even throughout a subdued fundraising atmosphere throughout the broader crypto {industry}.

Learn Extra: Galaxy Digital acquires crypto custody and asset infrastructure supplier BitGo

Galaxy Ventures Fund I—Positioning for the Subsequent Section of Onchain Progress

The newly launched Galaxy Ventures Fund I (GVF I) will deal with startups which are constructing core elements of the onchain economic system. These embrace sectors akin to:

Stablecoin infrastructureCost railsActual-world asset tokenizationUnderlying blockchain protocols and improvement instruments

Galaxy goals to again founders on the earliest levels—pre-seed to Collection A—and assist scale initiatives by its broad crypto-native ecosystem.

From Stability Sheet to Institutional Capital

Previous to GVF I, Galaxy had been deploying capital into crypto startups straight from its stability sheet since 2018. This primary-time inclusion of exterior restricted companions (LPs) exhibits a strategic pivot: shifting from inside enterprise operations to a extra structured, institutionalized enterprise fund mannequin.

The agency attracted a numerous group of backers, together with international institutional buyers, household workplaces, and strategic digital asset corporations. Notably, Galaxy stays an anchor investor within the fund, holding each normal associate and restricted associate positions.

This construction permits Galaxy to keep up excessive conviction in its investments whereas increasing its attain by leveraging outdoors capital.

What Startups Is Galaxy Backing?

Galaxy Ventures’ portfolio already consists of over 120 corporations, combining each legacy balance-sheet investments and the brand new GVF I fund.

Among the standout names embrace:

Monad: A high-performance Layer-1 blockchain designed to compete with Solana and Aptos on velocity and scalability.Ethena: Issuer of an artificial stablecoin providing yield-bearing options, aiming to unravel volatility with out conventional fiat backing.Arch Lending: A DeFi protocol centered on credit score markets and real-world asset lending.Plume, Rain, and RedotPay: Platforms centered on integrating digital asset funds and monetary infrastructure throughout borders.

These investments present a transparent deal with foundational applied sciences with real-world use instances, reasonably than speculative initiatives. Galaxy is putting its bets on blockchain merchandise that supply utility, compliance readiness, and institutional compatibility.

Learn Extra: Galaxy Digital Obtains FCA License, Paving Path for UK Derivatives Buying and selling

Why This Fundraise Issues Now

The profitable shut of GVF I comes at a time when crypto enterprise capital has considerably contracted. In keeping with knowledge from Galaxy Analysis, Q1 2025 marked one of many lowest funding intervals for crypto startups within the final three years, with just a few breakout raises.

That makes this $175 million elevate all of the extra spectacular.

Confidence in Onchain Finance and Tokenization

Galaxy executives say the fund is aimed squarely on the subsequent wave of crypto adoption, which revolves round tangible, regulated purposes.

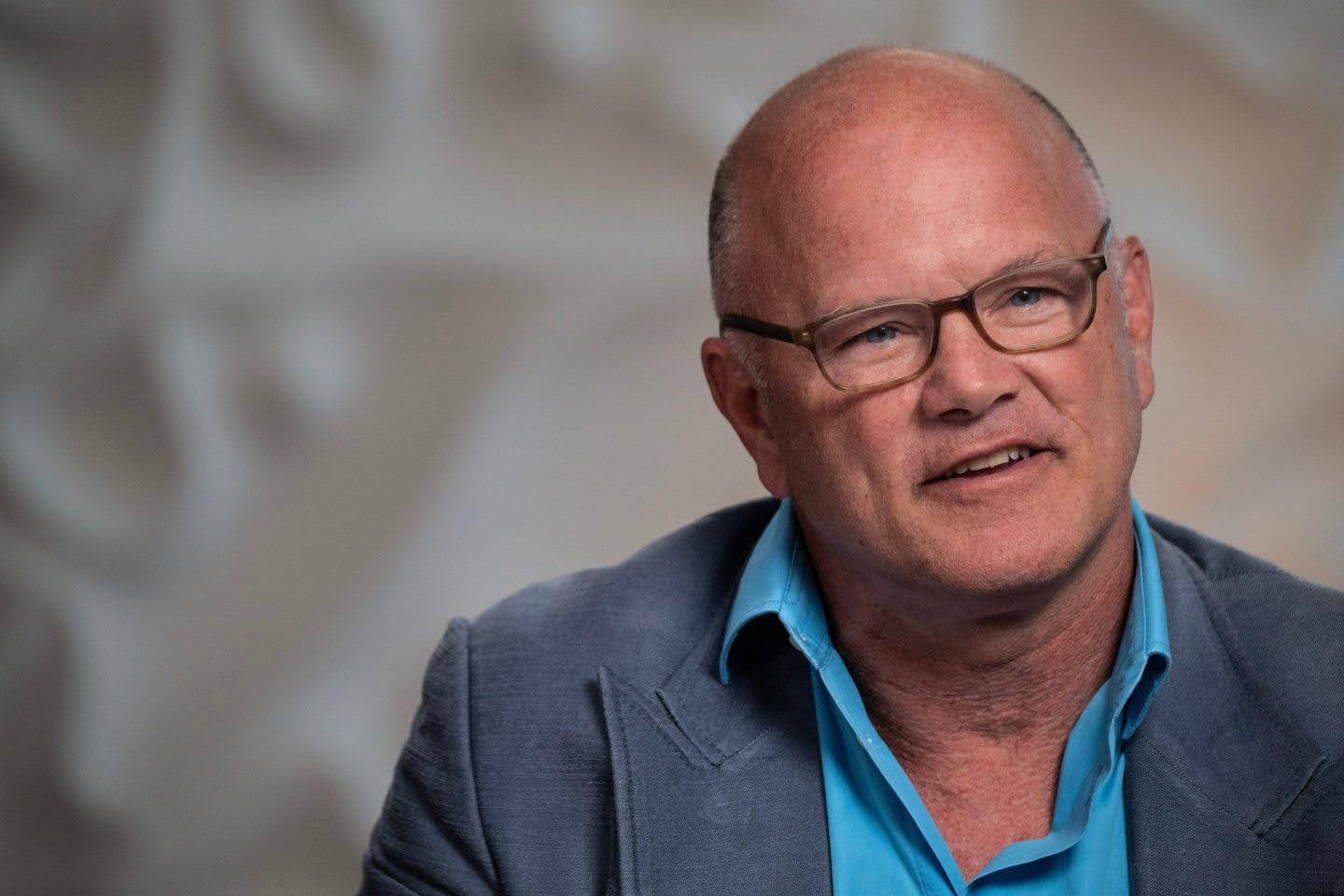

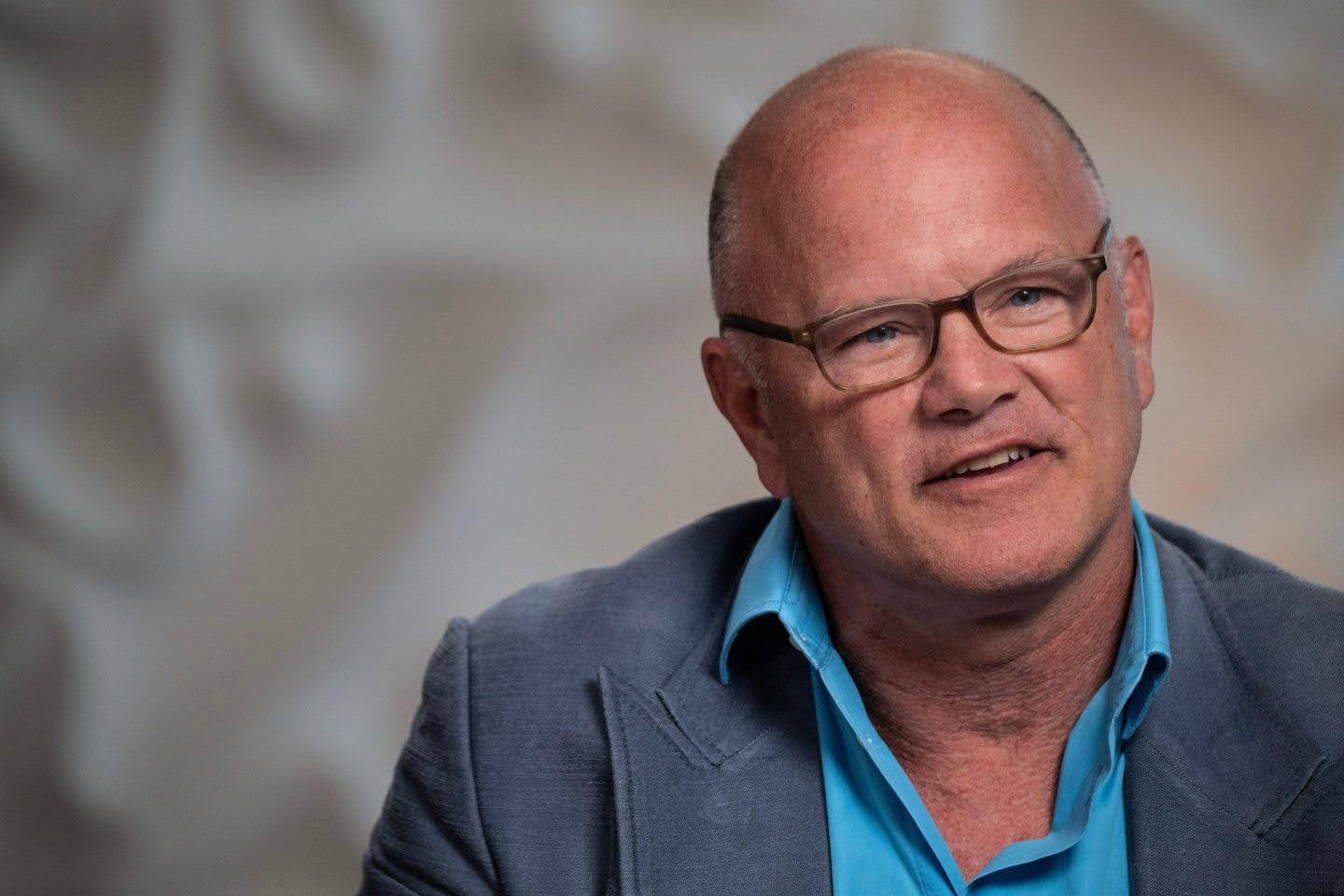

“Blockchain infrastructure is poised to revolutionize international monetary markets. We’re seeing accelerating adoption from each establishments and retail, significantly in funds and capital markets,” stated Mike Giampapa, Normal Companion at Galaxy Ventures.

Giampapa emphasised that GVF I’s technique displays a shift within the broader market: away from speculative property, and towards initiatives that supply fast worth by environment friendly, compliant monetary merchandise.

Galaxy’s Strategic Edge within the Crypto Ecosystem

Galaxy isn’t simply deploying capital—it’s offering startups entry to a broad ecosystem. With greater than 550 staff throughout digital asset buying and selling, lending, staking and custody, the agency gives deep operational assist.

Portfolio corporations profit from:

Technical help through the Ventures Platform staffConnectivity to Galaxy’s buying and selling desks, infrastructure arms, and associate networksStrategic steerage from executives like Mike Novogratz, a seasoned investor with deep Wall Road and crypto roots

This sort of hands-on assist is what separates Galaxy from conventional VC corporations passively supplying capital, however no industry-native backing.

In reality, Novogratz highlighted this benefit within the announcement:

“Closing above goal in one of many hardest crypto fundraising climates exhibits how our staff brings a novel edge to the desk. We’re dedicated to supporting startups constructing real-world use instances shaping the subsequent period of crypto.”

Institutional Demand Is Again—Quietly However Steadily

Whereas mainstream headlines typically deal with crypto’s volatility, behind the scenes, there’s a quiet resurgence of institutional curiosity.

Galaxy’s enterprise elevate additionally comes as trailing indicators of actual capital re-entering the market –accordioning in cautiously, and no less than as a lot out the opposite facet – are lastly starting to emerge:

In 2025, BlackRock, Constancy, and Franklin Templeton rolled out or expanded tokenized funds.Volumes of stablecoins on networks like Ethereum and Tron exceeded $1.3 trillion in Q1 2025, indicating a requirement for programmable {dollars}.Conventional banks akin to HSBC and Commonplace Chartered are piloting onchain settlement rails and tokenized gold merchandise.

GVF I places Galaxy on the middle of this evolution, complementing Web3 to conventional finance connections between prospects, companions, and builders by offers involving the fund.