The Each day Breakdown takes a better have a look at just a few macro parts, like GDP and PCE. Solana is making an attempt to realize steam by way of a breakout.

Earlier than we dive in, let’s be sure you’re set to obtain The Each day Breakdown every morning. To maintain getting our each day insights, all it is advisable to do is log in to your eToro account.

What’s Occurring?

The second GDP revision for Q2 will probably be launched this morning.

Final month, the preliminary studying got here in at 3%, nicely above expectations for two.5%, as commerce balances — which damage Q1 GDP — rebounded final quarter. Whereas Q2 is displaying a pleasant rebound, the primary half is shaping as much as present disappointing development. Let’s see what right now’s revised numbers replicate.

Tomorrow’s PCE report can also be in focus.

Keep in mind, the PCE report is the Fed’s most popular inflation report — and particularly, core PCE. June and July each noticed an uptick in inflation and economists are predicting a 3rd straight month of upper inflation, with year-over-year expectations calling for two.9%.

In-line outcomes aren’t essentially good because it confirms a 3rd straight month of upper inflation because the Fed is making an attempt to place for a charge reduce subsequent month. Nevertheless, an in-line end result retains the established order — i.e. a charge reduce subsequent month — and that’s prone to hold issues calm on Wall Avenue.

Under expectations and Wall Avenue bulls will cheer the outcomes, as confidence in charge cuts will probably develop. Nevertheless, if PCE is available in scorching — like 3.0% or increased — and the temper would possibly bitter a bit.

Wish to obtain these insights straight to your inbox?

Enroll right here

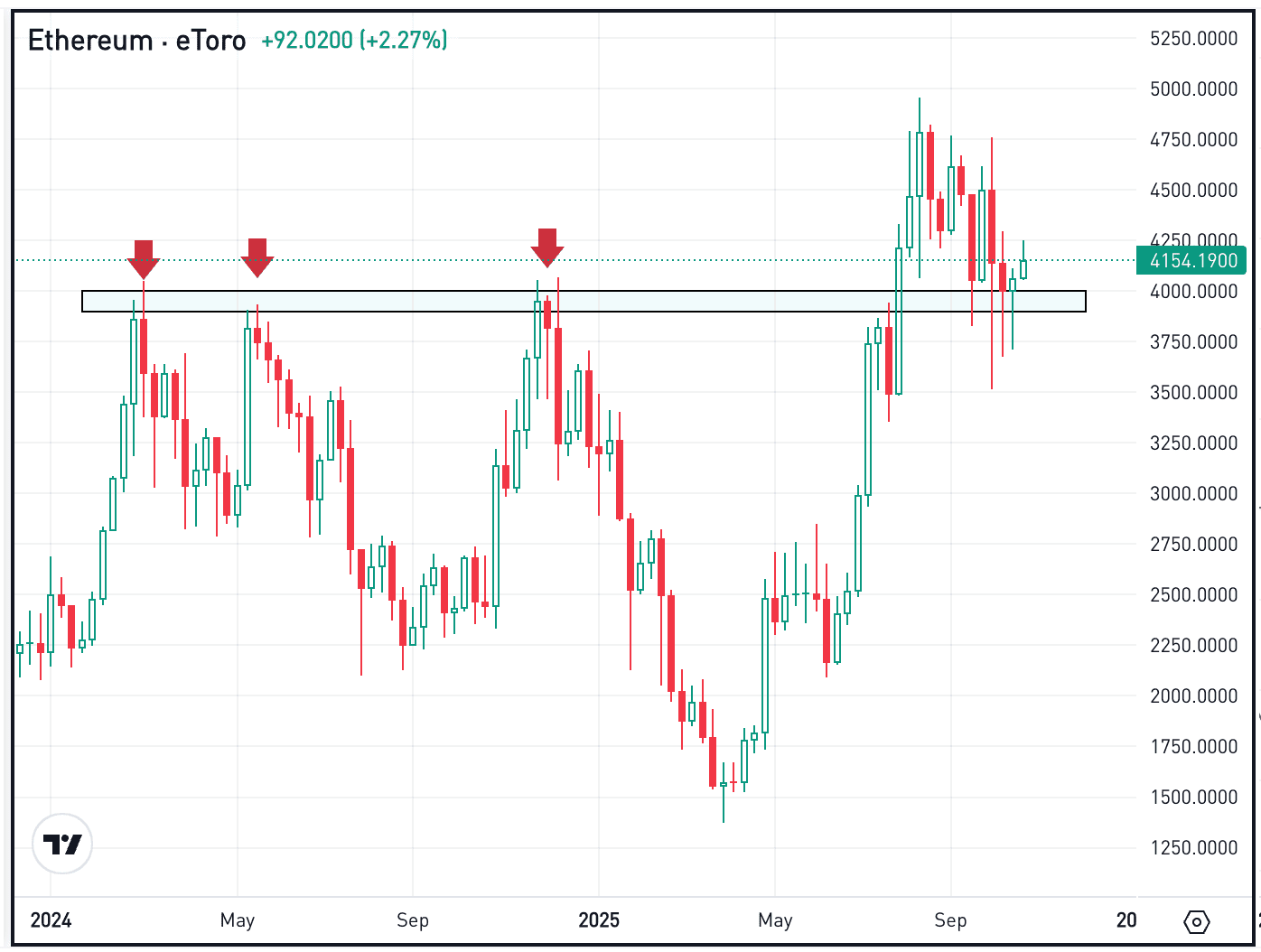

The Setup — Solana

Ethereum has been stealing the highlight amid its run to report highs, whereas a number of consideration is on Bitcoin because it sits close to a key help space. However what about Solana? It’s engaged on its fourth straight weekly acquire and has climbed in six of the final seven weeks. In that span, it’s up greater than 35%. Plus, it simply hit a six-month excessive because it has now rallied greater than 13% within the final three days.

Discover the sequence of increased lows (inexperienced arrows) since Solana bottomed in June. Additionally discover how SOL has seemingly ran out of stream within the $200 to $210 space (blue field). If it may acquire momentum over this zone, bulls will hope for extra upside potential. Keep in mind, SOL hit $295 in January. Nevertheless, if the $200 to $210 space acts as resistance, we might see a pullback.

As for different cryptoassets making some waves, Dogecoin, Berachain, Livepeer, and Polkadot are shifting this morning. To discover extra, take a look at our Uncover web page.

What Wall Avenue’s Watching

SNOW

Shares of Snowflake are flying increased this morning, up greater than 13% in pre-market buying and selling after the corporate beat on earnings and income expectations. What’s extra, steering was sufficient to impress buyers. Its 52-week excessive comes into play at $229.57, which was hit in July. Will SNOW make new one-year highs? Take a look at the charts for SNOW.

NVDA

Alongside a top- and bottom-line beat, Nvidia additionally issued a stable income outlook for subsequent quarter. Nevertheless, datacenter gross sales — which was 88% of Nvidia’s income — missed expectations, whereas enterprise from China stays considerably of a query mark. Administration settled a few of these issues on the convention name, however will that be sufficient for buyers shifting ahead? Shares initially offered off on the outcomes, however are actually down simply barely in pre-market buying and selling. Dig into Nvidia’s fundamentals.

Disclaimer:

Please be aware that attributable to market volatility, a few of the costs could have already been reached and situations performed out.