US-based cryptocurrency trade, Gemini has formally launched operations in France after securing a Digital Asset Service Supplier (VASP) registration earlier this 12 months.

Based by the Winklevoss twins, Gemini’s enlargement coincides with the European Union’s complete Markets in Crypto-Belongings (MiCA) regulatory framework, set to take full impact later this 12 months

Gemini crypto trade expands into France after being granted VASP license https://t.co/QYr1hMfBGl

— The Block (Meet Us at Emergence) (@TheBlock__) November 19, 2024

The enlargement aligns with France’s supportive regulatory surroundings and rising adoption of digital property, striving to be hub for crypto innovation.

France As Strategic Market For Gemini

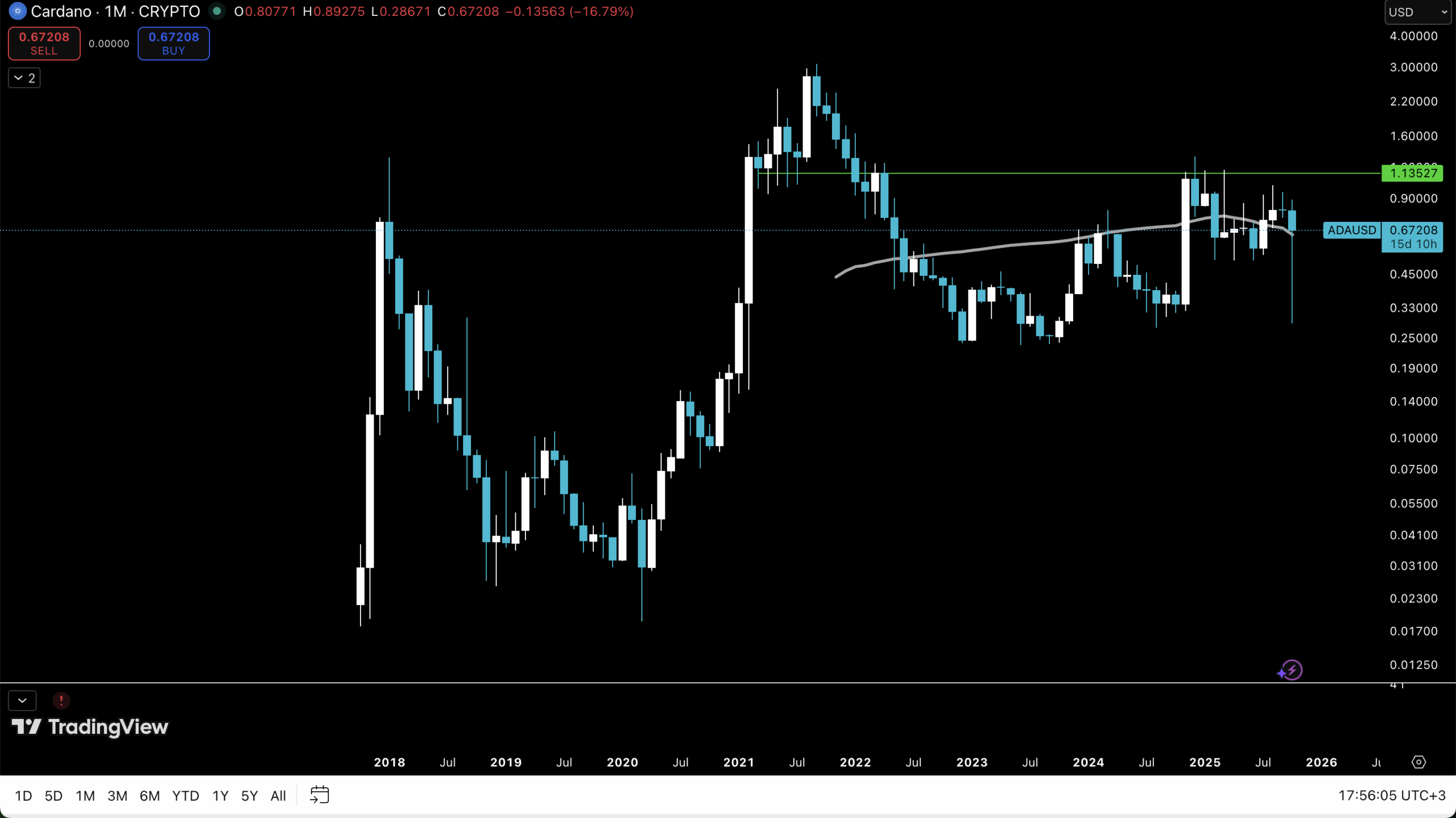

France ranks among the many most pro-crypto nations in Gemini’s 2024 World State of Crypto report. The entry into the French market highlights the nation’s rising prominence within the world cryptocurrency panorama.

The report signifies a 2% enhance in crypto possession in France since 2022, with 18% of the inhabitants now holding digital property—making it one of many fastest-growing markets post-crypto winter.

The European boss of @Gemini particulars their arrival in France in @TheBigWhale_

“We imagine that attaining a number one place within the French market is achievable inside 12 to 18 months”

Free entry article https://t.co/TcZTscdOp8

— Grégory Raymond

(@gregory_raymond) November 19, 2024

By capitalizing on this momentum, Gemini goals to bridge the hole between institutional-grade crypto options and retail adoption in France.

Emphasizing on the importance of the launch Gillian Lynch, Gemini’s CEO for U.Okay. and Europe stated “Our analysis into the French market exhibits Gemini’s rising curiosity in digital property.

Additional including, “Together with a sturdy regulatory framework, the enlargement presents a singular alternative to introduce our platform to the buying and selling group and lengthen our presence within the European market over the approaching months.”

EXPLORE: France To Block Entry To Polymarket After Surge In Crypto Betting On US Election

Leveraging MiCA And Native Market Traits

With the implementation of the EU’s MiCA rules within the close to future, the launch in France may nicely be strategically timed as MiCA goals to streamline operations for crypto companies throughout the 27-nation buying and selling bloc.

As soon as totally applied, MiCA will enable firms authorised in a single member state to function throughout the EU, decreasing regulatory hurdles and fostering cross-border innovation.

The trade will provide native customers entry to over 70 digital property with cost choices together with Euros, British kilos, Debit playing cards and Apple Pay.

The proactive regulatory stance of France, coupled with the broader MiCA framework, has lowered the share of French crypto customers citing regulatory considerations—from 37% on the top of the bear market two years in the past to 32% at the moment.

This decline displays the rising belief in crypto’s legitimacy throughout the nation, paving the best way for additional adoption and innovation.

It’s important to notice that 62% of respondents from France think about cryptocurrency to be a long-term funding, and 46% reported buying their preliminary cryptocurrency throughout the final three to 5 years.

Moreover, 49% of people who’ve beforehand owned cryptocurrency indicated that they’re prone to re-enter the market within the coming 12 months, whereas 28% expressed their intention to allocate 5% of their funding portfolios to cryptocurrency.

Constructing Sturdy Crypto Ecosystem In France

France’s supportive surroundings for crypto companies shouldn’t be solely attracting firms like Gemini however can also be fostering the event of a sturdy ecosystem.

The nation is dwelling to a fairly a couple of influential crypto initiatives together with Ledger, a number one {hardware} pockets producer and DeFi platform Morpho.

By aligning its operations with native regulatory requirements and client preferences, the trade is about to play a pivotal function in shaping the way forward for digital property within the area.

“We imagine in empowering people by crypto, and our enlargement into France marks a big milestone in our mission to make crypto accessible to everybody,” Gillian Lynch highlighted.

As France continues to steer in crypto adoption and regulatory readability, Gemini’s enlargement will be seen as a benchmark for different companies seeking to faucet into the European market.

The submit Gemini Crypto Change Expands To France Following VASP License Approval appeared first on .