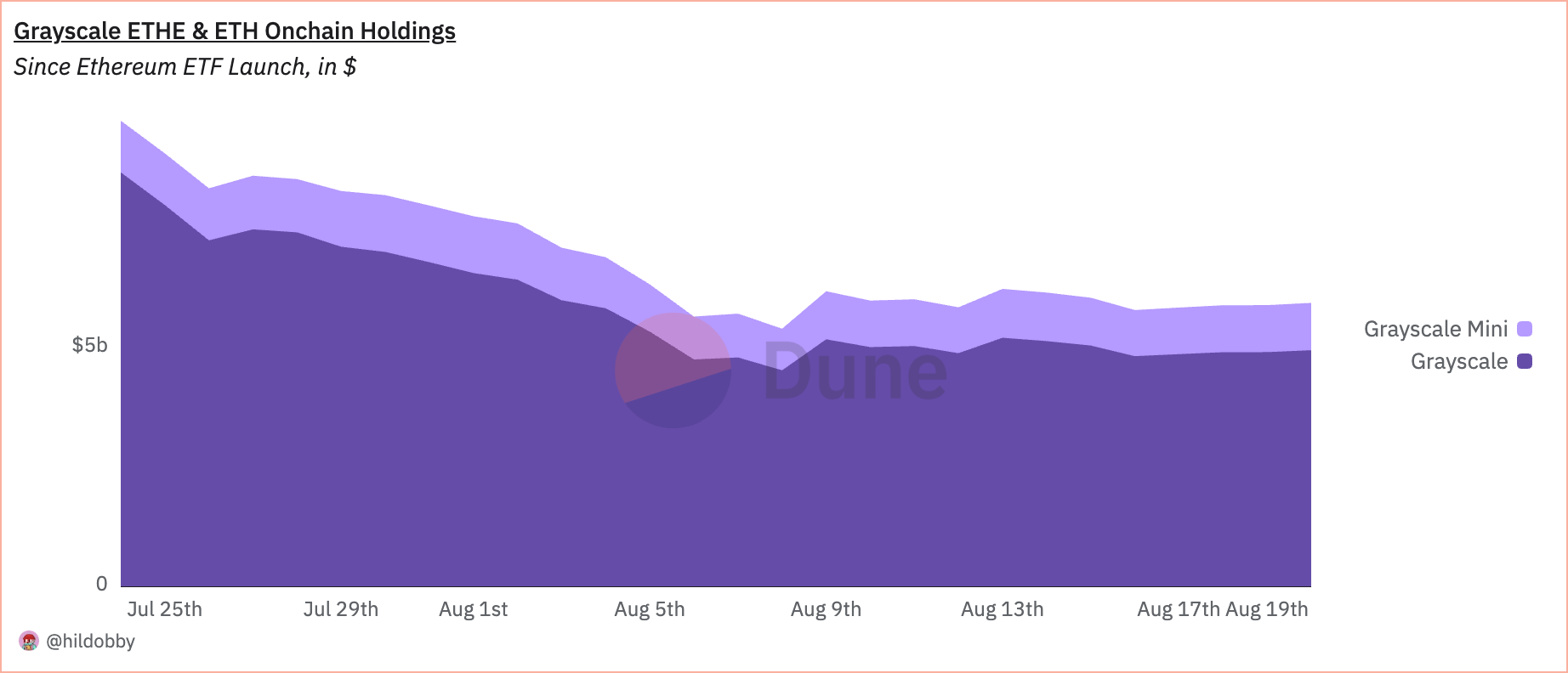

The launch of spot Ethereum ETFs has but to stay as much as the market’s preliminary optimism, as mirrored of their efficiency over the previous few weeks.

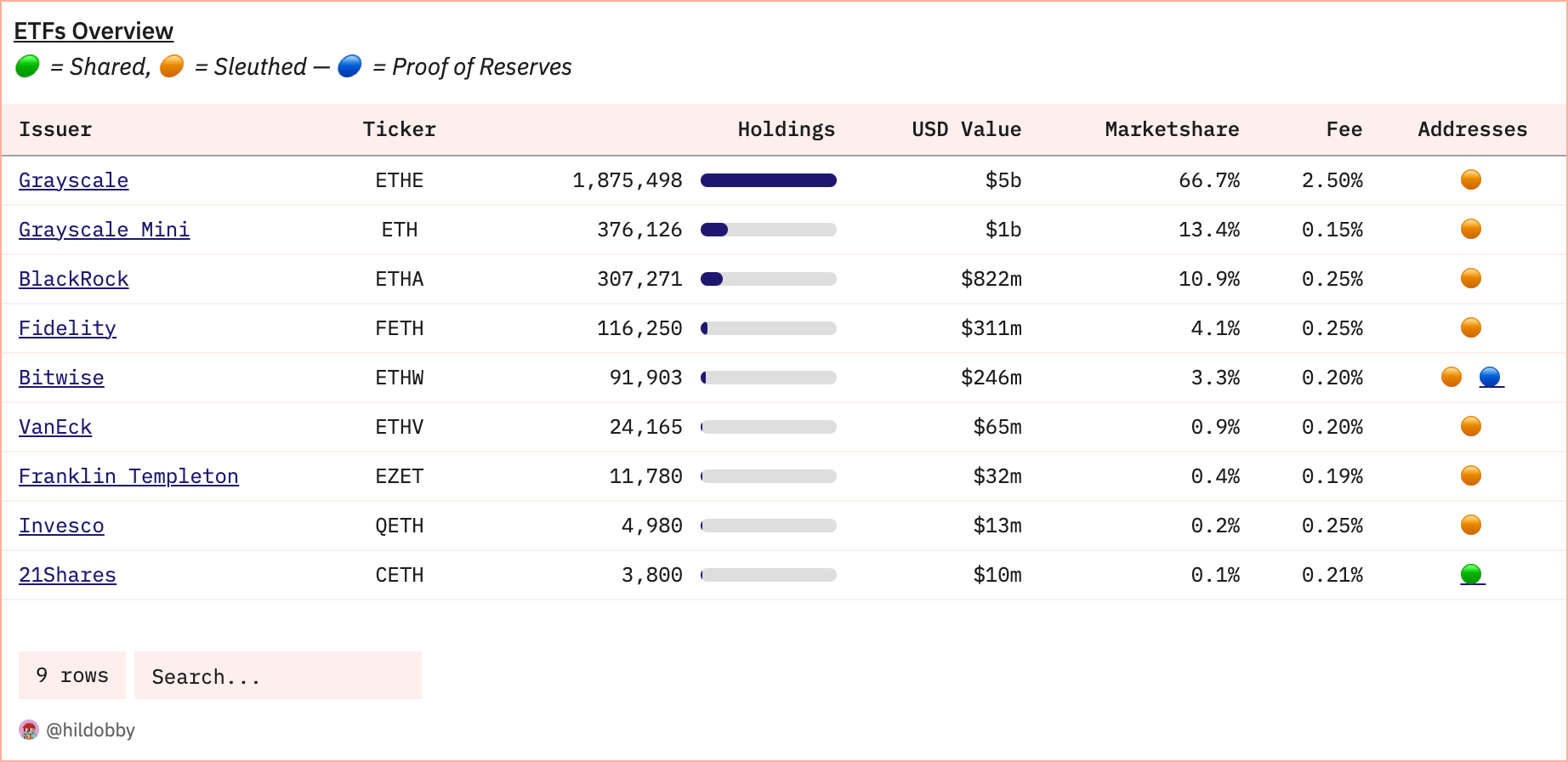

The Ethereum ETFs’ whole on-chain holdings at present stand at roughly 2.81 million ETH, valued at round $7.33 billion, which accounts for about 2.3% of Ethereum’s whole provide.

Regardless of these vital holdings, the online flows since launch have been destructive, with a complete outflow of 136,700 ETH.

The outflows are primarily attributable to Grayscale’s ETHE, which recorded a withdrawal of $487.88 million on the primary buying and selling day alone. Different Ethereum ETFs have seen constant inflows, however these haven’t been enough to offset the drag from ETHE.

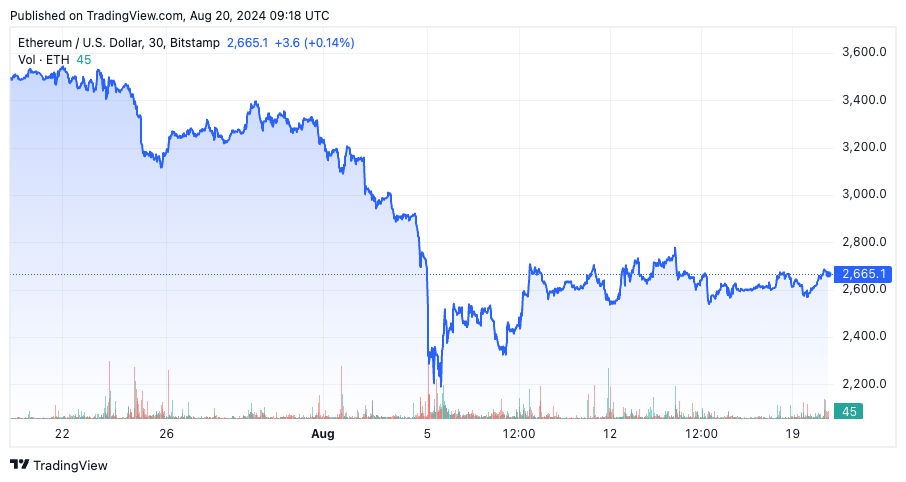

The market’s response to those outflows has been mirrored in Ethereum’s worth, which has struggled to keep up momentum post-launch. After an preliminary rise in anticipation of the ETF launches, Ethereum’s worth dropped considerably, hitting a low of $2,338 on Aug. 7.

Though there was some restoration since then, with costs hovering round $2,600, the general sentiment stays cautious. The broader market downturn has compounded this uncertainty, resulting in a scarcity of clear upward momentum for Ethereum.

Including to the complexity, the Ethereum futures market has proven a marked enhance in leverage ratios, signaling heightened risk-taking amongst merchants. This spike in leverage means that whereas some traders are betting on short-term worth actions, the broader sentiment stays unstable. The market’s response to those leveraged positions might additional exacerbate worth fluctuations, notably if destructive sentiment continues to dominate.

Regardless of these challenges, there may be nonetheless a big institutional curiosity in Ethereum-based monetary merchandise. BlackRock’s iShares Ethereum Belief (ETHA) has persistently attracted a number of the highest inflows amongst Ethereum ETFs, signaling that not all gamers are bearish on Ethereum’s long-term prospects.

Furthermore, the general marketplace for Ethereum ETFs has proven some constructive motion, with occasional days of web inflows, notably as outflows from ETHE have begun to gradual. This has led some analysts to invest that the worst of the outflows could also be over, doubtlessly setting the stage for a restoration in each ETF flows and Ethereum’s worth.

The present state of Ethereum ETFs exhibits that the market remains to be discovering its footing amid broader volatility and particular challenges associated to Grayscale’s ETHE.

Whereas the preliminary efficiency has been underwhelming in comparison with spot Bitcoin ETFs, the slowing outflows from ETHE and continued institutional curiosity counsel that there could also be room for optimism within the medium to long run.

Nonetheless, for now, Ethereum and its ETFs stay in a precarious place, with its future efficiency doubtless tied carefully to broader market tendencies and the actions of main institutional gamers.

The submit Grayscale outflows overshadow Ethereum ETF inflows appeared first on CryptoSlate.