The journey of XRP towards mainstream recognition is not theoretical, as companies throughout totally different industries start testing and adopting it in their monetary operations. Due to this, the asset could play a a lot greater function in world digital cash within the years forward.

Institutional Catalysts For XRP: Gemini’s Card & JPM’s Outlook

This week, Gemini launched a giant teaser in New York Metropolis. The corporate put up an enormous wraparound billboard exhibiting an XRP-branded Mastercard. On the cardboard was the date August 25, 2025, and the phrases “Issued by WebBank.” Gemini additionally posted the image on X with the caption “Put together your luggage.” The signal and the submit counsel {that a} main launch is coming. Many individuals consider this date might be important for XRP, as a result of it could mark the beginning of a brand new product that connects the asset instantly with the worldwide Mastercard community.

Crypto commentator John Squire shortly reacted to the information. He stated mass adoption “is coming quick” and added that the date “may change the whole lot.” The thought of an XRP card is thrilling as a result of it may let folks make funds utilizing XRP or convert their belongings into common cash throughout a purchase order.

One other improvement got here from JP Morgan because the financial institution launched a report known as “Sizing up the XRP ETP Alternative.” In keeping with a submit shared on X by SMQKE, JP Morgan’s report means that XRP may generate $4.3 to $8.4 billion in its first 12 months following the launch of an exchange-traded product. The financial institution additionally identified that the digital asset could be very low-cost to make use of, with every transaction costing solely about $0.0004, which is much lower than Ethereum or Bitcoin.

International Funds Enlargement: Europe & Japan

Ripple’s progress in Europe and the U.Okay. can also be getting consideration as the corporate’s system now suits with upgrades within the area’s fee networks. The SEPA Instantaneous Credit score Switch scheme completes euro funds in underneath ten seconds, and its adoption is rising. Within the U.Okay., the Quicker Funds Service (FPS) is already transferring trillions of kilos every year, and the Financial institution of England is modernizing its Actual-Time Gross Settlement (RTGS) system to attach with new world requirements.

The fintech firm is collaborating with companions like OpenPayd to combine these techniques with Ripple’s On-Demand Liquidity (ODL) answer, which implies XRP might be utilized as a bridge to facilitate swift cross-border transactions.

In Asia, Ripple is getting ready to launch its Ripple USD (RLUSD) stablecoin in Japan throughout the first quarter of 2026. The rollout will occur by means of SBI VC Commerce, which is a part of SBI Holdings, a well known Japanese monetary firm. RLUSD is backed by U.S. greenback deposits, Treasury securities, and different money belongings, with month-to-month audits to indicate transparency.

As of August, RLUSD already had a market cap of $666 million, making it the eighth-largest stablecoin on this planet. Ripple’s entry into Japan comes because the nation will get able to approve its first official stablecoins, making this transfer very well timed. The launch follows the corporate’s approval in Dubai earlier this 12 months and provides one other area the place RLUSD can function.

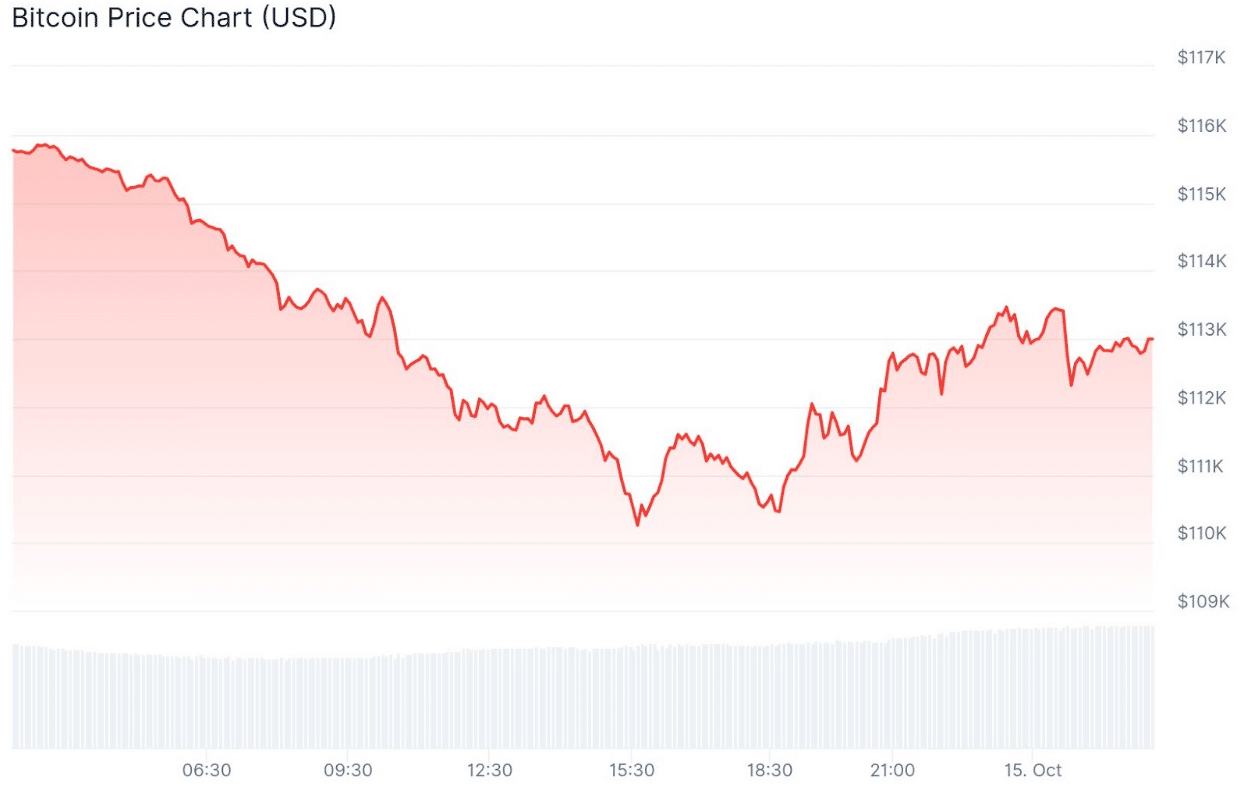

Featured picture from Dall.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.