Per a report from Bloomberg, the world’s largest asset supervisor, BlackRock, achieved a brand new milestone in its crypto roadmap. The corporate has been engaged on new methods to combine with blockchain expertise and thus has partnered with different monetary establishments.

BlackRock Takes One other Step In The Crypto House

In response to the report, BlackRock accomplished a transaction on the derivatives market utilizing Onyx, the blockchain platform developed by JP Morgan. The transaction “used tokenized collateral,” or digital variations of shares from one of many asset supervisor’s funds.

The asset supervisor used these tokens to settle a transaction with Barcles in an over-the-counter (OTC) commerce. These operations happen between two events, and the main points concerning the value, order dimension, and different particulars stay hidden from the general public.

Tom McGrath, Deputy Chief Working Officer of the Money Administration Group at BlackRock, mentioned:

Cash market funds play an necessary position in offering liquidity to traders in instances of excessive market volatility. The tokenization of cash market fund shares as collateral in clearing and margining transactions would dramatically cut back the operational friction in assembly margin calls when segments of the market face acute margin pressures.

The report signifies that this transaction represents a vital contribution to the amount of Onyx. The blockchain developed by the banking establishment nonetheless data a “tiny” buying and selling quantity in comparison with JP Morgan’s legacy platform.

Furthermore, the transaction was settled “instantaneously” between the events. A spokesperson for JP Morgan advised Bloomberg that the operation might open a brand new world of potentialities for legacy monetary establishments by permitting them to liberate capital and enhance effectivity throughout totally different markets.

Ed Bond, Head of Buying and selling Providers at JP Morgan, said:

Establishments on the community can use a wider scope of belongings to fulfill any collateral necessities they’ve on the again of buying and selling.

Crypto: An Various To The Greenback?

The legacy monetary sectors have been in search of methods to combine blockchain expertise, Bloomberg claims, for over a decade. The expertise can cut back prices, pace up transactions, and enhance buying and selling quantity.

Specifically, BlackRock has grow to be an aggressive participant within the crypto house. The asset supervisor holds a stake within the main Bitcoin miners publicly traded within the US whereas pushing for the approval of the nation’s first spot Bitcoin exchange-traded fund (ETF) and in search of methods to realize a stronger foothold within the nascent sector.

The initiative extends to high executives within the asset supervisor firm. Its CEO, Larry Fink, referred to as Bitcoin an “worldwide asset class” with the potential to grow to be a substitute for the US greenback.

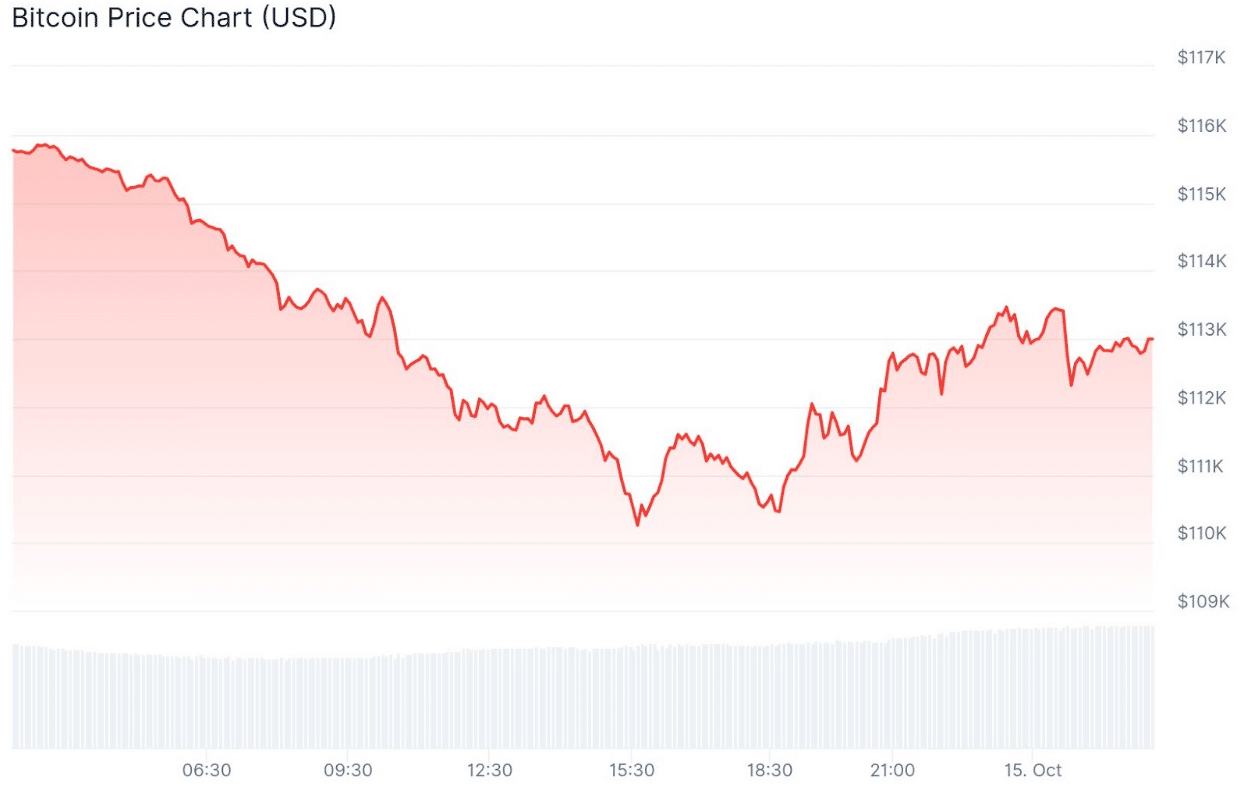

As of this writing, Bitcoin (BTC) trades at $27,050 with a 2% loss within the final 24 hours.

Cowl picture from Unsplash, chart from Tradingview