Discussing when and the way to promote Bitcoin might be controversial, however in case you’re planning to take earnings this cycle, it’s important to do it strategically. Whereas holding Bitcoin indefinitely is an possibility for some, many buyers intention to seize positive factors, cowl dwelling bills, or reinvest at decrease costs. Historic developments present that Bitcoin typically experiences drawdowns of 70-80%, offering alternatives to reaccumulate at decreased valuations.

For a extra in-depth look into this subject, try a current YouTube video right here: Confirmed Technique To Promote The Bitcoin Worth Peak

Why Promoting Isn’t At all times Taboo

Whereas some, like Michael Saylor, advocate by no means promoting Bitcoin, this stance doesn’t at all times go well with particular person buyers. For these not managing billions, taking partial earnings can supply flexibility and peace of thoughts. If Bitcoin peaks at, say, $250,000 and faces a reasonably conservative 60% correction, it will revisit $100,000, creating an opportunity to reenter at decrease ranges than we’ve already seen.

The objective isn’t to promote all the things however to strategically scale out of positions, maximizing returns and managing dangers. Attaining this requires pragmatic, data-driven choices, not emotional reactions. However once more, in case you by no means wish to promote, then don’t! Do no matter works finest for you.

Key Timing Instruments

This Lively Deal with Sentiment Indicator (AASI) compares modifications in community exercise to Bitcoin’s value motion. It measures deviations between value (orange line) and community exercise, proven by inexperienced and crimson deviation bands.

View Dwell Chart 🔍

For instance, in the course of the 2021 bull run, alerts emerged when the value change exceeded the crimson band. Promote alerts appeared at $40,000, $52,000, $58,000, and $63,000. Every supplied a chance to scale out because the market overheated.

The Worry and Greed Index is a straightforward but efficient sentiment software that quantifies market euphoria or panic. Values above 90 recommend excessive greed, typically previous corrections, equivalent to in 2021, when Bitcoin rallied from $3,000 to $14,000, the index hit 95, signaling a neighborhood peak.

View Dwell Chart 🔍

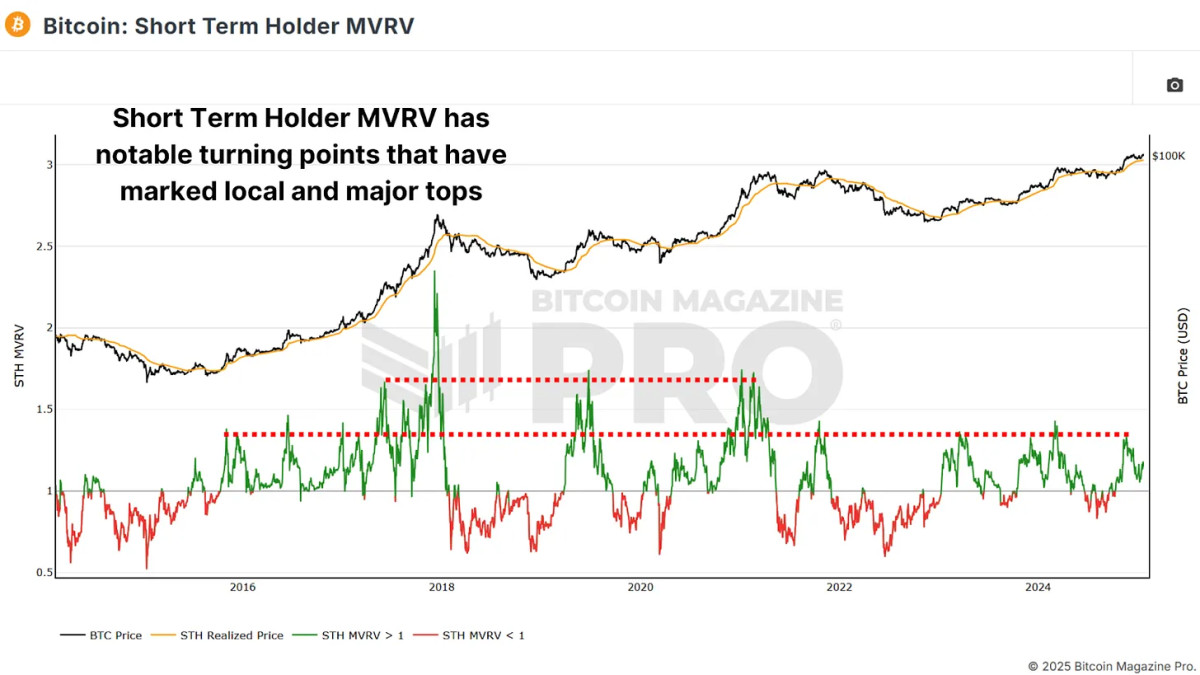

The Quick-Time period Holder MVRV measures the typical unrealized revenue or lack of new market members by evaluating their value foundation to present costs. Round 33% revenue ranges typically mark reversals and native intracycle peaks, and when unrealized earnings exceed round 66%, markets are sometimes overheated and could also be near main cycle peaks.

View Dwell Chart 🔍

Associated: Bitcoin Deep Dive Knowledge Evaluation & On-Chain Roundup

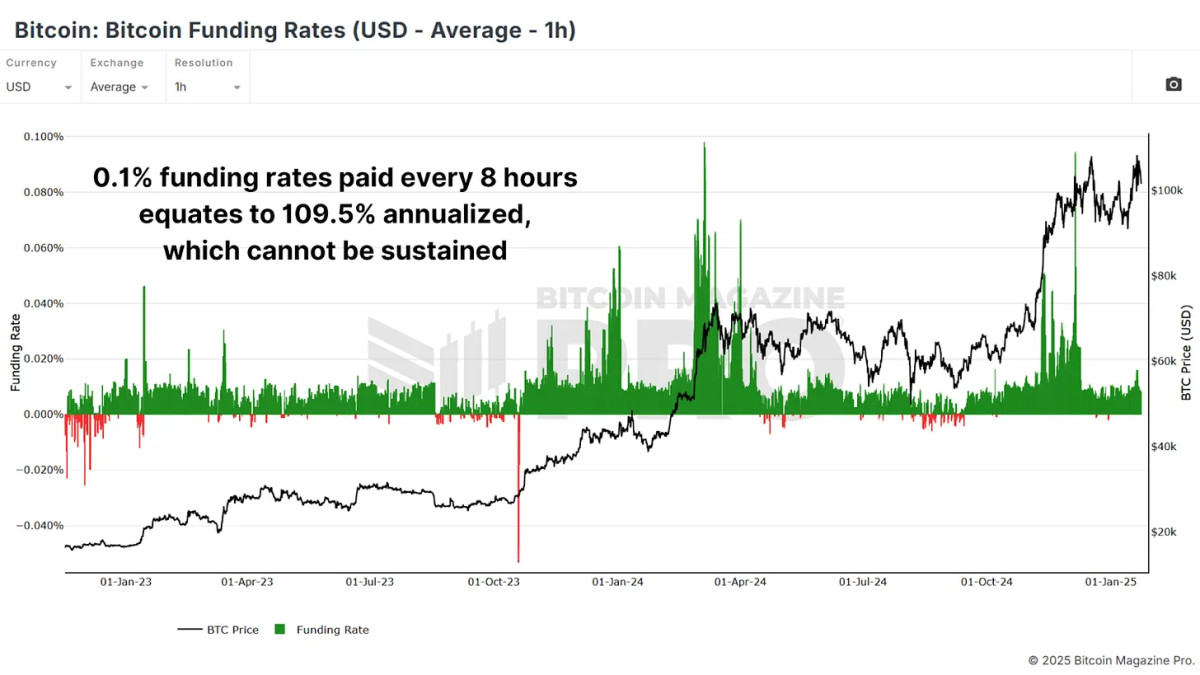

The Bitcoin Funding Charges mirror the premiums merchants pay to take care of leverage positions in futures markets. Extraordinarily excessive funding charges recommend extreme bullishness, typically previous corrections. Like most metrics, we are able to see that counter-trading a very euphoric majority often gives an edge.

View Dwell Chart 🔍

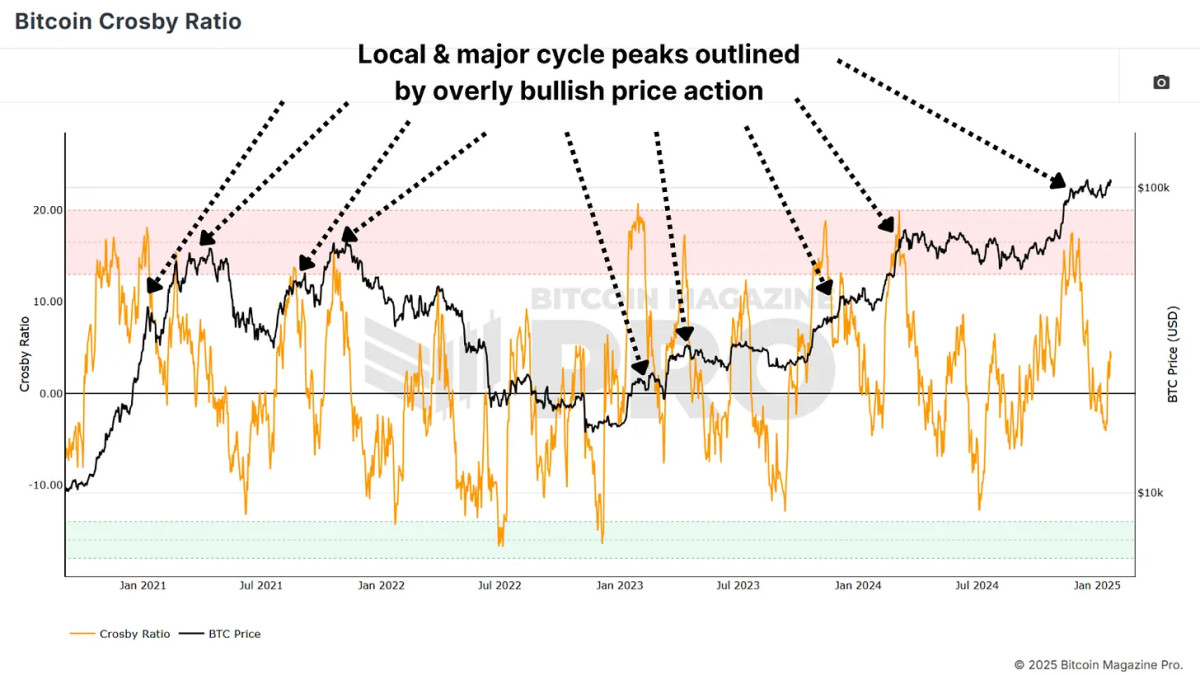

The Crosby Ratio is a momentum-based indicator that highlights overheated circumstances. When the ratio enters the crimson zone on the day by day chart, and even decrease timeframes in case you use our TradingView model of the indicator, market turning factors have sometimes occurred. When these alerts happen in confluence with different top-marking metrics, it solidifies the likelihood of a larger-scale prediction.

View Dwell Chart 🔍

Conclusion

Timing the precise prime is just about unattainable, and no single metric or technique is foolproof. Mix a number of indicators for confluence and keep away from promoting your whole place without delay. As a substitute, scale out in increments as key indicators sign overheated circumstances, and take into account setting trailing stops tied to key ranges or a share of value motion to seize extra positive factors if value rallies even greater.

For extra detailed Bitcoin evaluation and to entry superior options like stay charts, customized indicator alerts, and in-depth trade stories, try Bitcoin Journal Professional.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding choices.