As DeFi has advanced just lately, the battle for dominance within the derivatives area has intensified. With the surge in on-chain perpetual buying and selling, platforms like dYdX, Aevo, and GMX have carved out niches—however none have reshaped the market as aggressively as Hyperliquid. Since its mainnet debut in 2023 and the launch of HyperEVM in early 2025, Hyperliquid has emerged as the brand new commonplace for on-chain efficiency, transparency, and consumer alignment.

Architectural Variations: The Battle Between Pace and Decentralization

Hyperliquid operates a customized Layer-1 blockchain, designed from scratch for high-frequency buying and selling. At its core is the HyperBFT, a Byzantine Fault Tolerant PoS consensus mechanism enabling sub-second block finality and ~100,000 TPS throughput. Mixed with its native HyperCore and HyperEVM, it delivers absolutely on-chain execution for all trades, orders, and liquidations.

With its customized L1 able to ~100k+ orders per second, it considerably outpaces rivals. For context, most decentralized perps protocols can deal with on the order of just a few thousand operations per second or much less. For instance, GMX (an AMM-based perps DEX on Arbitrum) and Vertex (orderbook on Arbitrum) are constrained by Ethereum L2 speeds – they will course of maybe ~2,000 orders per second at greatest.

Hyperliquid’s purpose-built chain, in distinction, doesn’t should share blockspace or throughput with different dApps, permitting it to scale a lot larger. Even dYdX v4, which launched its personal app-chain on Cosmos blockchain in late 2023, has decrease throughput on paper; dYdX depends on the Cosmos SDK and Tendermint consensus, sometimes yielding block occasions ~1–2 seconds.

Whereas quick, that’s nonetheless slower than Hyperliquid’s sub-second finality, and dYdX’s throughput is restricted by its want for international blockchain consensus on every batch of trades. Hyperliquid’s pipelined HotStuff consensus and optimized networking give it an edge in pure pace. This exhibits in volumes: by This fall 2024, Hyperliquid was already dealing with 5× the buying and selling quantity of its nearest on-chain competitor (dYdX and GMX).

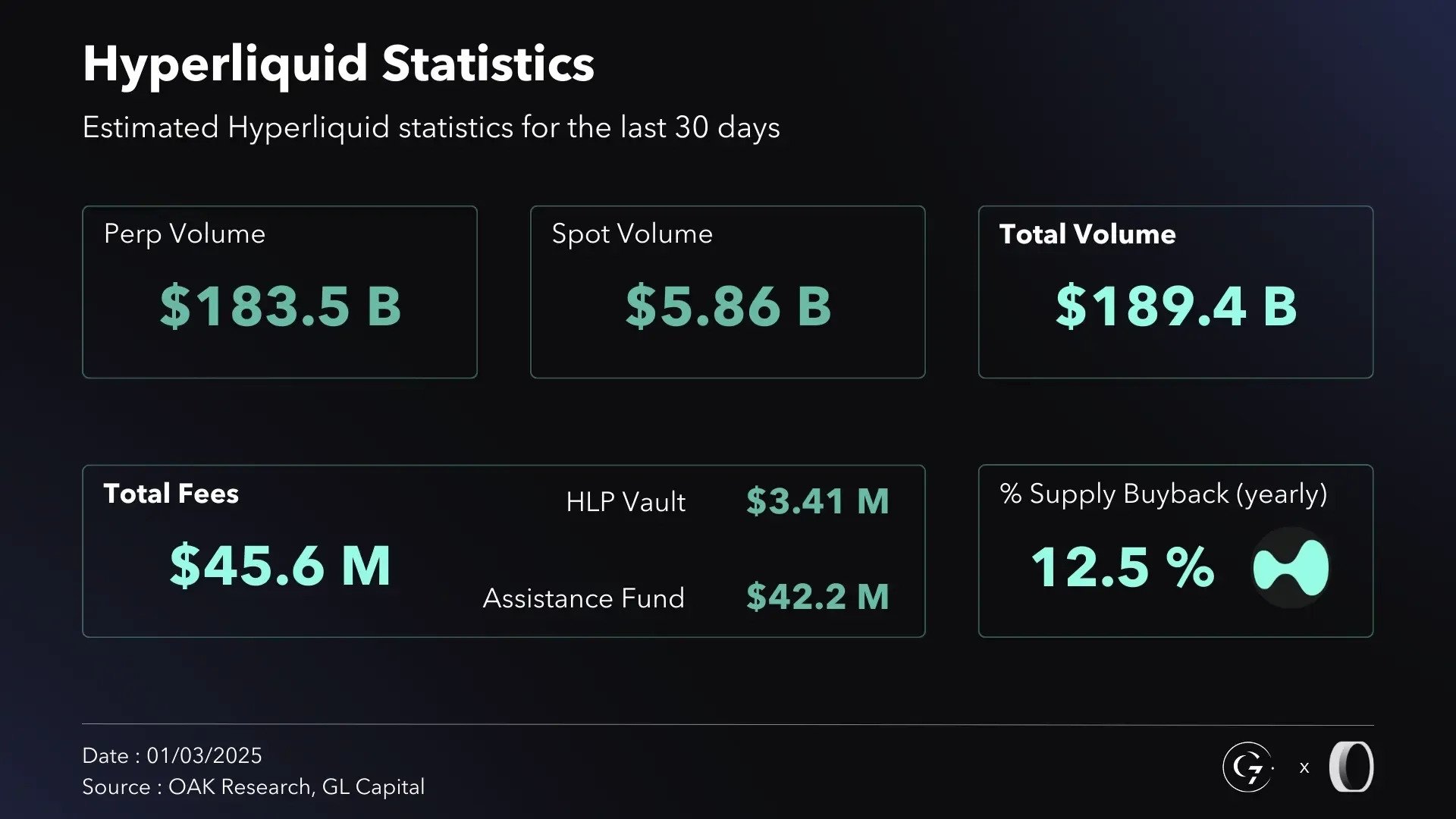

Supply: OAK Analysis & GL Analysis

In December 2024 alone, Hyperliquid facilitated ~$160B of perp buying and selling quantity, whereas dYdX (was once the chief) was far behind in market share. Hyperliquid additionally boasts larger leverage (as much as 50× vs dYdX’s 20× and GMX’s ~50× on main pairs however successfully much less liquid at extremes) and extra markets (130+ vs ~30–40 on dYdX on the time and an analogous vary on GMX/Aevo). Aevo, which is constructed as an Optimism-based L2, additionally targets excessive throughput, however as an optimistic rollup its latency is tied to Ethereum’s tempo and it presently permits as much as 20× leverage.

Briefly, Hyperliquid gives the closest efficiency to a centralized alternate, which has been a decisive benefit in attracting energetic merchants from slower platforms.

For extra: Hyperliquid Deep Dive: Perceive HYPE and HLP Mannequin

Buying and selling Expertise and Liquidity Depth

In the case of buying and selling expertise, Hyperliquid and dYdX each attempt to emulate top-tier CEX platforms. Each exchanges provide skilled net interfaces with TradingView charts, superior order varieties, and options like cross-margining. Hyperliquid’s UI and matching engine ship on the spot order execution and easy order e book updates because of the quick L1 – one thing customers typically discover when coming from different DEXs that really feel laggy.

A serious UX win for Hyperliquid is zero fuel charges on trades. Neither dYdX’s new chain nor Aevo can absolutely match this; on dYdX (Cosmos), customers should maintain some $DYDX or different tokens to pay transaction charges when putting orders. Aevo, being an Optimism rollup, requires ETH for fuel on every transaction, which provides friction and value. GMX customers on Arbitrum additionally pay fuel for every commerce or collateral adjustment, and GMX’s net app is less complicated with fewer order varieties. Hyperliquid’s mannequin of no fuel and low buying and selling charges makes it extraordinarily cost-efficient, particularly for high-frequency methods that submit many orders.

Supply: Hyperliquid SDK Launch – HangukQuant’s Publication

Moreover, Hyperliquid helps options like conditional orders, partial fills, and an API/WebSocket for algorithmic merchants – aligning with what dYdX gives, and going past the essential performance of AMM-based rivals.

One other differentiator is asset assist: Hyperliquid’s versatile itemizing framework (HIP-1 auctions) allowed it to listing a protracted tail of belongings, together with very new tokens, a lot sooner than dYdX.

For instance, throughout memecoin season, Hyperliquid rapidly listed well-liked meme cash on its perp alternate, whereas dYdX and others lagged. Aevo’s distinctive providing is that it additionally gives crypto choices buying and selling, which Hyperliquid presently doesn’t have – so Aevo appeals to choices merchants with merchandise like crypto choices vaults. Nevertheless, within the perpetuals area, Hyperliquid’s expertise is extensively considered extra polished and “smoother for smaller markets and various belongings”.

Each Hyperliquid and dYdX have comparable charting and analytics, however Hyperliquid’s built-in vaults add a social investing dimension (copy buying and selling by way of vaults) that dYdX and Aevo lack. Alternatively, some learners would possibly discover Hyperliquid’s interface and options advanced, whereas a platform like GMX is comparatively simple. Nonetheless, for any skilled dealer, Hyperliquid delivers the richest function set in a DEX – primarily matching a Binance or Bybit in performance, which has been a crucial differentiator.

Product Scope: Past Perps

Whereas all 4 protocols started working as perp DEXs, their evolution has differed from every others:

Hyperliquid has added many different options corresponding to spot buying and selling, staking vaults, and permissionless token listings (by way of HIP-2 auctions as superior).dYdX stays perp-only.Aevo has expanded to choices, structured merchandise, and vault methods, positioning itself as a DeFi choices suite.GMX continues to concentrate on perps however launched V2 with improved pool mechanics.

In conclusion, we will see that Hyperliquid and Aevo are diversifying quick. Hyperliquid’s mixture of spot, perps, and vaults positions it as probably the most full DeFi buying and selling suite.

Composability and Developer Ecosystem

With the launch of HyperEVM, builders can now deploy good contracts immediately on Hyperliquid alternate, utilizing current Solidity code and accessing native buying and selling options by way of HyperCore. Tasks can:

Compose with stay buying and selling information (e.g., liquidations, value feeds, API)Launch vaults, automation instruments, and structured merchandiseEarn income by builder codes, which share protocol charges

Thus far, ~170 initiatives have been deployed, and TVL has grown to $1.7B by mid-2025 in keeping with some reviews. This probably counts consumer collateral (USDC deposits) on the platform. VanEck’s December evaluation famous Hyperliquid amassed ~$2.2B in TVL inside 15 months, far above GMX’s ~$600M over an analogous interval. That signifies an enormous inflow of liquidity suppliers and merchants trusting the platform with funds. Consumer development has additionally been distinctive – Hyperliquid greater than doubled its consumer base after the HYPE airdrop, onboarding over 170,000 new customers virtually in a single day.

The common $HYPE airdrop is now value $109,568. https://t.co/YGcl27Nko0

— Riley 🏴☠️ (@interchainriley) June 26, 2025

In contrast:

dYdX has restricted EVM compatibility and a smaller ecosystem. dYdX, which dominated the area in 2021–2022, noticed its volumes stagnate or decline because it transitioned chains – and Hyperliquid swooped in.Aevo helps composability inside its rollup however lacks Hyperliquid’s native liquidity engine.GMX, the opposite large participant, nonetheless boasts giant TVL in its GLP pool and is well-liked for zero-price-impact swaps, however it primarily attracts a unique phase (decrease frequency, extra passive LP incomes by way of GLP)

Hyperliquid leads in on-chain composability, incentivized builder packages, and integration flexibility.

Tokenomics and Consumer Alignment

The HYPE token serves a number of roles:

Gasoline token for HyperEVMGovernance by way of HIP proposalsValidator staking for community safetyBuying and selling payment reductions (as much as 40%)Collateral and speculative asset on Hyperliquid

Importantly, Hyperliquid issued HYPE with no VC allocations. The 2024 airdrop distributed 31% of provide to customers, whereas 38.8% is reserved for emissions. This design eliminates enterprise overhang and fosters natural group development.

ProtocolVC AllocationFee RebatesReal YieldGovernanceToken UtilityHyperliquidNoneAs much as 40%Sure (by way of HLP)SureGasoline, staking, low costdYdXExcessiveNoneNoSureGovernance solelyAevoAverageSurePartialSurePrice reductionsGMXLowMinorSure (by way of GLP)SureStaking, governance

Market Share and Metrics July 2025

MetricHyperliquiddYdXAevoGMXEvery day Perp Quantity$8–12B+~$1.5B~$300M~$700MTVL~$1.7B~$420M~$160M~$630MPerp Market Share~70%~9%~2–3%~5%Distinctive Customers400K+150K+<50K~100K

Hyperliquid has absorbed a lion’s share of the decentralized perps market, aided by:

Actual-time executionAbsolutely on-chain transparencyVault-generated yieldDeep spot + perp liquidity

No different DEX presently matches Hyperliquid in quantity, retention, or ecosystem velocity.

Remaining Ideas: Why Hyperliquid Leads in 2025

Hyperliquid isn’t simply one other derivatives DEX—it’s a high-performance Layer 1 platform that has redefined what’s doable for on-chain buying and selling. It merges:

The pace and precision of centralized buying and sellingThe transparency and equity of DeFiA community-first mannequin with out VCs

Whereas dYdX and Aevo provide robust options for area of interest merchants or ecosystems (Cosmos, choices), and GMX continues to serve passive LPs, Hyperliquid stands alone because the main protocol in scale, innovation, and alignment.

As of mid-2025, it’s not solely dominating quantity but in addition constructing a sticky, composable DeFi stack—with HYPE on the heart.

For merchants, builders, and long-term buyers alike, Hyperliquid represents probably the most compelling on-chain buying and selling platform of the yr.